Updated: January 31, 2025

Gone are the days when cash ruled as the primary mode of exchange, making it essential to understand how to create a payment app that meets modern digital transaction needs. Today, payment app development has become a cornerstone of modern financial technology, enabling seamless, secure, and instant payments.

From P2P payment app development for peer-to-peer transfers to mobile payment app development for e-commerce and retail, digital payment platforms are transforming the way we handle money.

In this comprehensive guide, we’ll cover everything you need to know about payment app development – from essential features to technology stacks, monetization models, challenges, and real-world examples – ensuring your app stands out in this competitive market. It’s your go-to resource for online payment transfer app development.

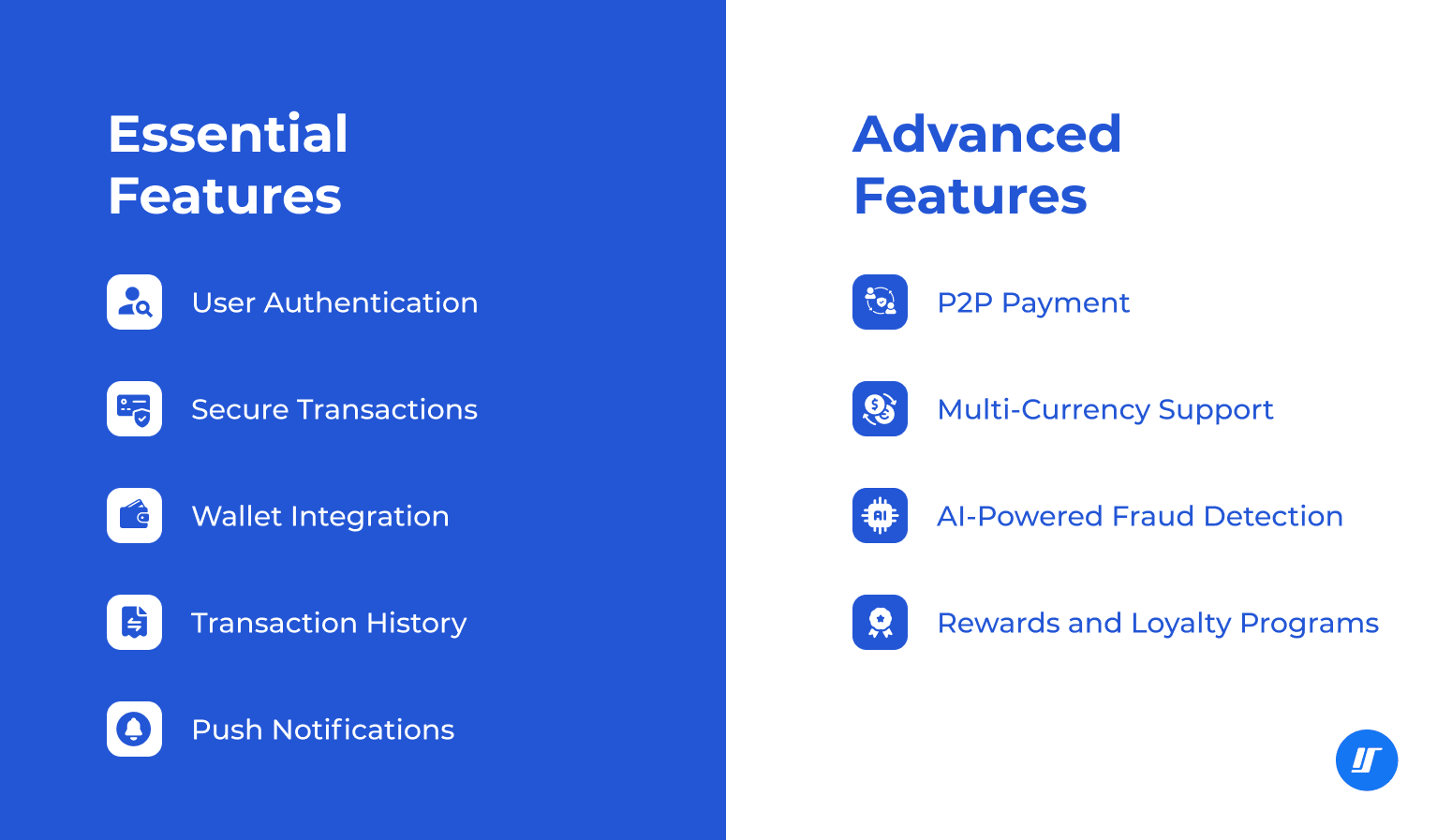

Key Features of a Successful Payment App

The backbone of any payment app development process is its features. A payment app must balance functionality, security, and user experience to gain a competitive edge. These can be categorized into essential and advanced features.

Essential Features

A secure and user-friendly payment app needs key features to protect users and enhance convenience. User authentication, including OTPs, biometrics, and multi-factor authentication, ensures only authorized access. Secure transactions with encryption and fraud detection safeguard financial data, while wallet integration makes managing and transferring funds easy.

Transaction history provides transparency with detailed records, and push notifications keep users updated on payments, balances, and important alerts in real time – essential for a seamless mobile payment app experience, especially in P2P payment app development, where real-time updates and trust are crucial.

Advanced Features

To improve functionality, security, and user experience, modern payment apps incorporate advanced features that streamline transactions, enhance global accessibility, and protect against fraud.

These innovations not only make payments more convenient but also strengthen compliance and build user trust.

- P2P Payment. Enables fast, secure peer-to-peer transactions for seamless money transfers.

- Multi-Currency Support. Allows users to transact in different currencies, expanding global reach.

- AI-Powered Fraud Detection. Uses AI to identify suspicious activity and prevent fraud.

- Rewards and Loyalty Programs. Boosts engagement with cashback, points, and discount incentives.

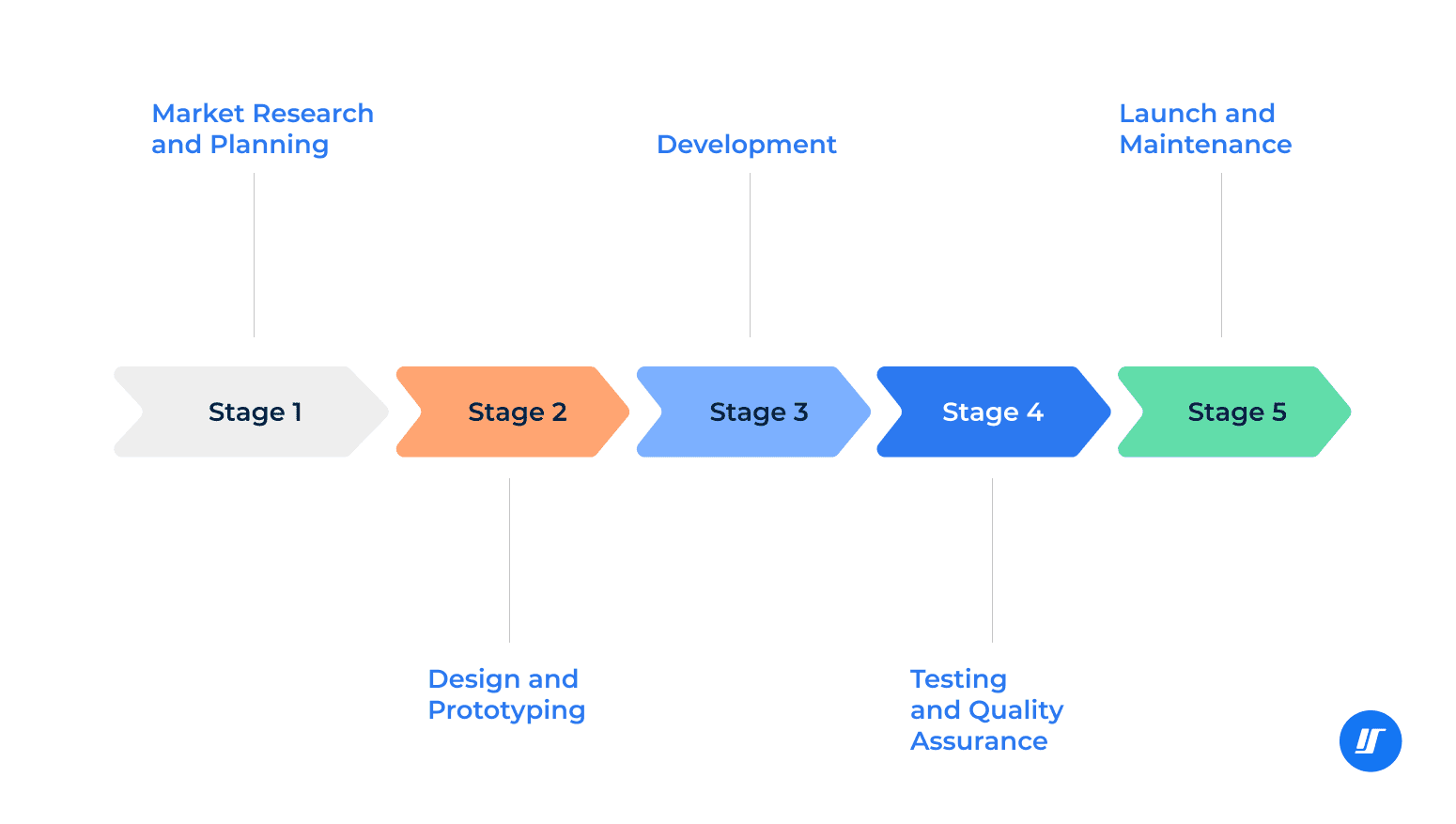

The Payment App Development Process

Creating a successful payment app involves a structured approach. Let’s explore the five key stages of the payment app development process:

Market Research and Planning

- Identify the target audience and understand their pain points. Whether you’re focusing on small businesses, enterprises, or individual users, your app must address specific needs.

- Analyze competitors offering P2P payment app development solutions, such as Venmo and PayPal, to identify gaps and opportunities.

- Define your app’s unique value proposition and key features, such as secure transactions or advanced fraud detection.

Design and Prototyping

Start with wireframes to create a visual representation of the app’s user interface. Focus on user-friendly design principles, ensuring smooth navigation and intuitive controls. For example, a streamlined onboarding process can significantly improve user retention.

Development

Choose a tech stack that aligns with your app’s goals:

- Backend: Node.js, Python, or Ruby for scalable and efficient server-side operations.

- Frontend: React Native, Flutter, or Swift for a seamless user experience.

- APIs: Integrate third-party APIs for payment gateways to handle transactions securely.

- Build core functionalities such as authentication, wallet integration, and payment processing.

Testing and Quality Assurance

Rigorous testing is essential to eliminate bugs and ensure security. Simulate various use cases to identify vulnerabilities. Ensure compliance with regulations like PCI DSS and GDPR through detailed testing procedures.

Launch and Maintenance

Deploy your app on relevant platforms (iOS, Android, or web) and promote it through marketing campaigns.

Continuously update the app based on user feedback, incorporating new features and fixing bugs.

Technology and Compliance Considerations

To build a payment app that is secure, scalable, and user-friendly, it’s essential to meet the demands of today’s users while ensuring compliance with regulations. This not only keeps your app operating within legal boundaries but also inspires trust among your users.

A strong technical framework and adherence to standards are key to excelling in online payment transfer app development. Make sure your app meets every requirement↗. Here’s an in-depth look at how to address technology and compliance considerations effectively:

Technology Stack

Backend Development

The backend is the powerhouse of your app, managing essential functions like transaction processing, data storage, and API communications. To ensure scalability and reliability, developers often use Node.js, Python, or Ruby – all known for handling high transaction volumes without performance issues. Node.js excels at real-time updates, making it ideal for instant payment confirmations. Python is highly versatile and well-suited for building secure, data-driven applications. Ruby offers high availability and flexibility, minimizing downtime and keeping operations smooth, even during peak usage.

Choosing the right backend technology ensures your app runs efficiently as your user base grows, especially in mobile payment app development, where scalability and security are critical.

Frontend Development

The frontend is the face of your app, shaping how users interact and engage with it. To create a smooth, responsive experience, developers rely on frameworks like React Native, Flutter, and Swift. React Native allows for cross-platform development, enabling a single app to run seamlessly on both iOS and Android.

Flutter stands out for its fast rendering and expressive UI, making it ideal for high-performance, visually rich apps. Swift, Apple’s powerful programming language, ensures a smooth, native-like experience for iOS users.

By leveraging these technologies, you can build an intuitive, fast, and engaging app that works flawlessly across devices and platforms, ensuring a seamless experience in payment app development.

Compliance

Compliance is critical for any payment app, ensuring legal operation and building user trust while minimizing risks like fines or reputational damage. Strong security measures help protect sensitive data through encryption, secure communication, and strict access controls. Privacy laws also require transparency in data collection, user opt-out options, and secure handling of personal information.

Key compliance measures include:

- Payment Card Industry Data Security Standard

- General Data Protection Regulation

- California Consumer Privacy Act

- Anti-Money Laundering Regulations

- Know Your Customer Requirements

- Strong Customer Authentication

- Electronic Fund Transfer Act

Since payment and data regulations vary by region, it’s essential to stay compliant with local laws wherever your app operates. Some countries enforce data localization rules, requiring user data to be stored within their borders. Keeping up with evolving regulations not only reduces compliance risks but also strengthens your mobile payment app development efforts by ensuring security and responsible operations.

Security Measures

Protecting payment apps requires a multi-layered approach to keep user data and transactions secure. Regular security assessments catch vulnerabilities before they become threats, and tokenization ensures intercepted payment data remains useless to attackers.

Real-time monitoring with automated alerts enables quick responses to suspicious activity, while role-based access controls limit exposure to sensitive data, ensuring only the right people have access – both critical for payment app development and especially for P2P payment app development, where secure transactions and user trust are paramount.

Implementing these measures protects user data, prevents fraud, and builds long-term trust. Protect your transactions↗. A proactive security strategy also keeps apps compliant with industry regulations and ahead of evolving threats.

Common Challenges and How to Overcome Them

Developing a payment app comes with unique challenges that require careful planning and execution to address effectively. Here’s a detailed look at these challenges and actionable solutions to overcome them:

Ensuring App Security

Challenge

Security is the cornerstone of any payment app, as app users entrust your platform with sensitive personal and financial information. Breaches, fraud, and data leaks can not only harm users but also destroy your app’s reputation and trustworthiness.

This is especially critical in P2P payment app development, where seamless and secure money transfers are a top priority. Without robust security measures, unauthorized transactions, identity theft, and financial fraud can pose significant risks.

Solution

To safeguard payment app transactions, implementing end-to-end encryption ensures that sensitive data remains protected during money transfers. Securing APIs with strong authentication protocols, such as OAuth and biometric verification, prevents unauthorized access.

AI-powered fraud detection and real-time monitoring help identify suspicious activities early, mitigating potential threats before they escalate. Additionally, multi-factor authentication enhances user verification, adding an extra layer of security.

For P2P payment apps, integrating tokenization further reduces exposure to card details, keeping transactions secure. Regular security audits, compliance with industry regulations (such as PCI DSS), and timely updates help maintain the integrity of the app.

By prioritizing security, you can build trust with your app users and ensure a seamless and protected payment experience.

Building Scalability

Challenge

As your user base grows, your payment app must handle increased transaction volumes without delays, crashes, or performance issues. Poor scalability can lead to slow money transfers, failed transactions, and a frustrating user experience, ultimately limiting your app’s potential for growth.

This challenge is even more critical in P2P payment app development, where seamless peer-to-peer transactions must be processed instantly and securely. Without a robust infrastructure, payment processing delays can erode user trust and drive customers to competitors.

Solution

A cloud-based infrastructure with auto-scaling capabilities ensures that your payment app can handle surges in transaction volumes without compromising speed or reliability.

Load balancing distributes requests efficiently, preventing server overloads and keeping money transfers seamless. Optimized databases, such as NoSQL or partitioned SQL databases, enhance data retrieval speeds, ensuring real-time transaction processing.

For P2P payment apps, leveraging microservices architecture enables independent scaling of critical components, such as user authentication, payment gateways, and fraud detection systems. Implementing caching strategies and asynchronous processing ensures that transaction confirmations happen swiftly, even during peak usage hours.

Regular stress testing and performance monitoring help identify weak points before they impact users. By proactively optimizing scalability, your peer-to-peer payment solution can provide a frictionless experience, retain users, and support long-term growth in a competitive market.

Maintaining User Trust

Challenge

Trust is a critical factor in retaining users, especially in a payment app, where financial security and seamless transactions are paramount. If your app appears unreliable, lacks transparency, or experiences frequent issues, users will quickly lose confidence and switch to competitors.

This is even more crucial for P2P payment apps, where real-time transaction history and instant confirmations play a key role in user satisfaction. Without a clear and trustworthy system, your target audience may hesitate to use your platform for digital wallet transactions and everyday payments.

Solution

Providing users with a detailed transaction history ensures transparency, allowing them to track payments, refunds, and transfers with ease. Real-time notifications for successful payments, failed transactions, or security alerts keep users informed and reassured about their financial activities.

For P2P payment apps, instant processing and confirmation of transfers build confidence in the platform. Secure authentication methods, such as biometric login and multi-factor authentication, further enhance trust by protecting user accounts and digital wallet balances.

Additionally, implementing clear and easy-to-understand privacy policies reassures users about how their data is handled, addressing any concerns they may have.

A dedicated and responsive 24/7 customer support system, including live chat and AI-driven assistance, helps resolve user issues promptly. Proactive security updates and performance improvements demonstrate reliability, ensuring your target audience remains engaged and confident in your payment app.

By prioritizing transparency, security, and seamless support, you can foster long-term trust and loyalty among users.

Achieving Smooth UX

Challenge

A seamless, user-friendly interface is crucial for retaining users in a payment app. Complex navigation, poor design, or slow performance can frustrate users, leading to abandonment. In P2P payment apps, smooth transactions and easy access to payment gateways are essential for user satisfaction.

Solution

An intuitive, clutter-free design enhances usability, making it easier for users to navigate the payment app and complete transactions without confusion. Conducting usability testing ensures that the app meets user expectations and eliminates friction points.

Features like one-click payments, clear action buttons, and seamless integration with payment gateways contribute to a smooth and efficient experience. For P2P payment apps, prioritizing speed is key. Optimizing load times and streamlining transaction flows help users send and receive payments instantly.

Implementing smart autofill for payment details, personalized dashboards, and clear transaction tracking further enhances usability. Accessibility features, such as voice commands and screen reader compatibility, make the app more inclusive for a broader audience.

Regular performance updates and user feedback-driven improvements ensure continuous enhancement of the UX. By combining intuitive design with efficient payment gateways, your app can provide a frictionless, engaging experience that keeps users satisfied and loyal.

Navigating Regulatory Compliance

Challenge

Compliance with global and regional regulations is a complex but essential aspect of P2P payment app development. Failing to meet legal requirements can lead to hefty penalties, app shutdowns, or loss of user trust.

Regulations governing financial transactions, data privacy, and fraud prevention vary by region, making it critical for businesses looking to create a money transfer app to stay up to date with evolving compliance standards. Whether handling Know Your Customer, Anti-Money Laundering regulations, or GDPR, non-compliance can severely impact the app’s operations and credibility.

Solution

Engaging legal experts ensures your P2P payment app complies with key financial regulations, including secure authentication for users who transfer funds.

Implementing KYC and AML checks prevents fraudulent activities while adhering to global standards. End-to-end encryption and tokenization safeguard user data, reducing the risk of breaches and regulatory fines.

Regular compliance audits help identify and address potential risks before they escalate. Clear communication of security policies builds user confidence, ensuring they understand how their data and transactions are protected.

By prioritizing compliance from the start, businesses looking to create a money transfer app can mitigate legal risks, enhance security, and establish long-term trust with users.

Monetization Models for Payment Apps

A well-designed payment app not only serves users efficiently but also generates consistent revenue for its creators. Here’s an in-depth look at the most effective monetization strategies, complete with examples and considerations for implementation:

Transaction Fees

Transaction fees are a key revenue source for payment apps, typically charged as a percentage or flat fee to users, merchants, or both. User fees, like those on PayPal and Venmo, apply to services such as instant bank transfers, often around 1%.

Merchant fees are common on platforms like Square and Stripe, where businesses pay a percentage of each sale. Some apps also use flat fees, charging a set amount per transaction, especially for smaller payments.

Considerations

- Keep transaction fees competitive to attract users while ensuring profitability.

- Offer discounts or fee waivers for high-volume users or merchants to build loyalty.

- Clearly communicate fees upfront to avoid user frustration.

Subscription Plans

Subscription-based monetization provides users with premium features for a monthly or yearly fee, catering to those who want more convenience and functionality.

Benefits may include faster transfers and priority processing, higher transaction limits for individuals and businesses, advanced analytics and reporting for merchants, and enhanced security features like stronger fraud protection.

Considerations

- Ensure the premium features provide clear value over the free version.

- Offer a free trial to entice users to explore premium features.

- Tiered subscription plans can cater to different user groups and budgets.

In-App Ads

In-app advertising drives revenue by integrating ads seamlessly into the user experience, making it a great fit for apps with high engagement. Banner ads stay visible at the top or bottom of the screen without being intrusive, while interstitial ads appear during natural pauses, like after a transaction.

Sponsored content lets brands offer targeted deals within the app, and rewarded ads give users perks – such as waived fees or cashback – in exchange for watching ads.

Considerations

- Ensure ads are relevant to the user base to maximize engagement.

- Avoid overloading the app with ads, as this can negatively impact the user experience.

- Use targeted advertising to appeal to specific user segments based on behavior or preferences.

Freemium Models

The freemium model provides basic app features for free while offering premium upgrades for added convenience and functionality, making it a great way to attract users while driving revenue. Free features typically include basic payment and transfer capabilities, limited transaction limits, and essential fraud protection.

Upgrading unlocks perks like multi-currency transactions, recurring payments, and detailed financial insights, along with customizable dashboards for merchants. Premium users may also benefit from priority customer support and enhanced security features for a more seamless experience.

Considerations

- Strike a balance between free and premium offerings to avoid alienating free users while motivating upgrades.

- Use clear and persuasive messaging to showcase the value of premium features.

- Periodically introduce limited-time offers to encourage users to explore premium options.

Real-World Examples

To better understand what makes a payment app stand out, let’s take a closer look at three leading examples: Venmo, PayPal, and Square. Each of these platforms has carved out a unique niche by addressing specific user needs, leveraging innovative features, and creating exceptional user experiences.

Venmo

Venmo has become synonymous with peer-to-peer payments, particularly among younger users, thanks to its social features and easy-to-use interface.

Key Strengths

- Venmo isn’t just a payment app – it’s a social experience. Users can add emojis, notes, and comments to transactions, turning simple payments into fun, shareable moments.

- It allows users to quickly split bills, pay friends, or send money for everyday activities, such as rent or dining out.

- The app integrates seamlessly with bank accounts and debit cards, offering users flexibility in how they send and receive money.

Why It Works

Venmo makes payments social, boosting engagement and setting it apart from other apps. Its intuitive design ensures quick, seamless transactions, while its focus on millennials and Gen Z keeps it modern and in sync with their digital lifestyles.

PayPal

PayPal is one of the earliest pioneers in payment app development, evolving from an online payment processor into a globally recognized brand with millions of users across businesses and individuals.

Key Strengths

- PayPal supports a wide range of payment types, including P2P transfers, e-commerce transactions, and even in-store payments through QR codes.

- The platform’s global reach allows users to send and receive money in multiple currencies, making it a go-to solution for international transactions.

- With its robust fraud protection measures, PayPal has earned a reputation for security and reliability, making it a trusted choice for users and merchants alike.

Why It Works

PayPal’s strong reputation for security and reliability has made it one of the most trusted names in digital payments. Its wide acceptance among online retailers, freelancers, and service providers cements its presence in e-commerce. With feature-rich tools like invoicing and subscription management, PayPal caters to both individuals and businesses. Its ability to scale while prioritizing security keeps it a leader in the digital payments space.

Square

Square has become the go-to payment platform for small businesses, revolutionizing how merchants accept payments and manage their operations.

Key Strengths

- Square combines mobile and physical payment solutions, allowing merchants to process card payments through their mobile devices using a card reader.

- The company’s point-of-sale system includes tools for inventory management, sales tracking, and customer engagement, making it an all-in-one solution for small businesses.

- Square also supports online stores, enabling businesses to integrate both physical and digital sales channels seamlessly.

Why It Works

Square makes payments easy for small businesses with affordable, scalable solutions that require no technical expertise. Its seamless blend of physical and digital tools, like Square Reader and Square Terminal, has transformed how businesses operate.

Our Expertise in Payment App Development

At Intellectsoft, we specialize in creating custom financial solutions, including payment P2P app development and secure transaction systems. One of our standout projects was the development of a stock trading platform, where we demonstrated our ability to integrate advanced payment functionalities seamlessly.

For this project, we built a comprehensive stock trading platform that included robust features such as real-time analytics, wallet integration, and secure payment processing. By focusing on user-centric design and security compliance, we delivered a solution that empowered users to trade stocks confidently and efficiently.

Key Highlights

Wallet Integration

The platform featured a built-in digital wallet, enabling users to securely deposit, withdraw, and manage funds without third-party services. With real-time balance updates and automated transaction tracking, traders enjoyed a smooth, transparent payment process.

Real-Time Data and Analytics

Delivering real-time market insights, the platform helped users make informed trading decisions. Advanced charting tools and predictive analytics allowed traders to track price movements, spot trends, and receive automated alerts, giving them a competitive edge.

Advanced Security Features

To safeguard user funds and sensitive data, we implemented multi-factor authentication, end-to-end encryption, and fraud detection algorithms. These security measures ensured only authorized access, preventing fraud and maintaining the highest level of cybersecurity.

Scalability

Designed to handle high transaction volumes, the platform leveraged cloud-based infrastructure and load balancing to ensure fast response times and seamless performance during peak trading hours. As user demand increased, the system automatically scaled to maintain efficiency without disruption.

This project underscores Intellectsoft’s expertise in delivering high-performing financial platforms tailored to client needs. Whether it’s payment P2P app development or full-scale financial ecosystems, our team combines technical innovation and user-centric design to create solutions that stand out in the competitive FinTech landscape.

Secure & Scalable Mobile Payment App & P2P Payment App Development

Whether you’re exploring online payment transfer app development or building a platform for P2P and multi-currency transactions, partnering with experienced developers ensures your app is scalable, secure, and successful. Ensure your payment app is compliant and fraud-proof↗. Now is the time to transform your vision into reality and deliver a standout payment solution.

Subscribe to updates

Source link