The demand for custom mobile banking app development is at an all-time high as businesses strive to meet evolving consumer expectations. Customers now expect seamless, secure, and feature-rich banking experiences that allow them to manage their finances anytime, anywhere.

For banks, fintech startups, and enterprises, developing a robust retail online banking app is more than a trend – it’s a strategic move toward digital transformation, customer engagement, and business growth. Whether you’re a small to medium-sized bank digitizing services or a fintech startup entering the banking space, a well-designed mobile banking solution can set you apart from the competition.

This guide will walk you through the banking app development process, covering key features, development steps, challenges, emerging technologies, and real-world examples of successful banking apps. Start building today↗

What Is Mobile Banking App Development?

Mobile banking app development is the process of designing, building, and deploying digital platforms that allow users to perform financial transactions securely using their smartphones.

These applications have transformed banking by enabling customers to access essential financial services anytime, anywhere, without needing to visit a physical branch. A well-designed retail online banking app provides functionalities such as:

- Account management – Viewing balances, transaction history, and statements.

- Payments and transfers – Sending money, paying bills, and setting up direct deposits.

- Financial planning tools – Budgeting, savings, and investment tracking.

- Customer support – AI-powered chatbots and live assistance.

The Growing Importance of Mobile Banking

The adoption of mobile banking solutions has skyrocketed over the past decade, with consumers demanding fast, secure, and feature-rich applications. According to industry reports:

- Over 55% of Americans now prefer using mobile banking apps over visiting bank branches.

- Global mobile banking transactions are expected to reach $36,75 trillion by 2029.

- Banks that fail to digitize their services risk losing customers to more agile fintech competitors.

Why Does Mobile Banking Matter?

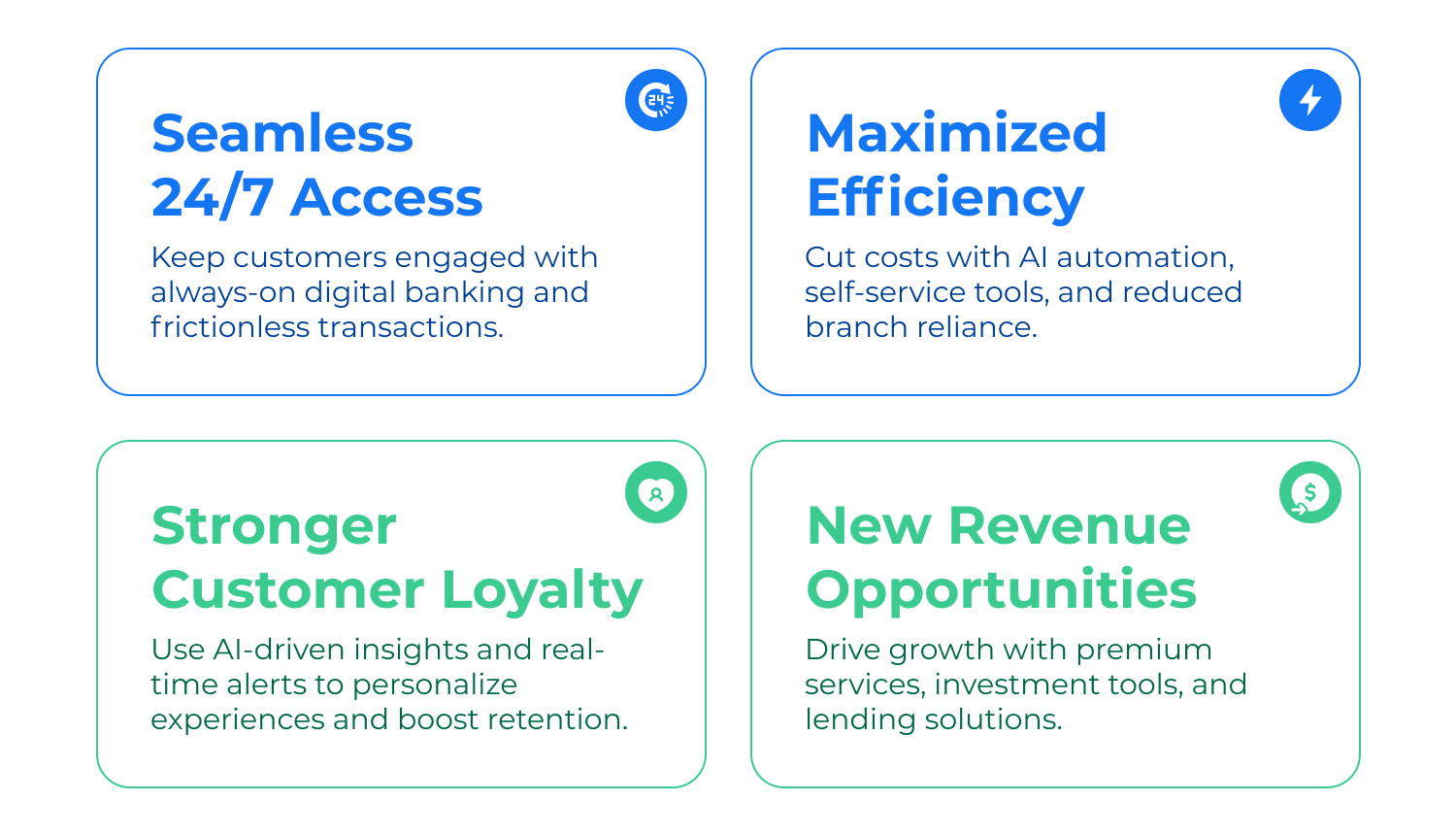

Mobile banking is more than just a convenience – it’s a strategic business advantage. Here’s why banks, fintech startups, and enterprises should prioritize banking app development:

Customer Convenience

- Enables 24/7 access to banking services without physical visits.

- Users can transfer funds, pay bills, and monitor spending on the go.

- Integration with digital wallets for faster payments.

Cost Efficiency

- Reduces reliance on physical branches, lowering operational expenses.

- Automates banking processes, cutting down on customer service costs.

- AI-powered virtual assistants handle common inquiries, reducing manual workload.

Customer Retention & Engagement

- Personalized banking experiences through AI-driven insights and recommendations.

- Push notifications for real-time transaction alerts and financial tips.

- Loyalty programs and rewards to encourage user engagement.

Revenue Growth & Monetization

- Banks can offer premium subscription plans for advanced financial services.

- In-app investment tools provide new revenue streams.

- Loan origination and credit-building features generate additional profits.

Key Banking App Features

A top mobile banking app balances security, usability, and functionality to deliver a seamless user experience. Below are the essential features that define a high-performing banking app.

Robust Security Measures

Security is a top priority in mobile banking. Customers expect their financial data to be fully protected, and banks must implement strong security measures to prevent fraud and cyber threats. A multi-layered security approach builds trust and ensures safe transactions.

- Biometric Authentication – Secure logins using fingerprint, facial recognition.

- End-to-End Encryption – Protects transactions with AES-256 and SSL encryption.

- Multi-Factor Authentication – Adds extra layers of verification.

- AI-Powered Fraud Detection – Identifies suspicious activity and blocks fraud attempts.

- Secure Session Management – Auto-logout and token-based authentication for added security.

User-Friendly Interface & Navigation

A smooth, intuitive user experience is key to keeping customers engaged. A well-designed banking app should be fast, easy to navigate, and accessible to all users.

- Frictionless Onboarding – Quick sign-up with ID verification.

- Intuitive Dashboard – Instant access to account details and transactions.

- Customization & Accessibility – Dark mode, adjustable fonts, and multi-language support.

Essential Banking Features

The best mobile banking apps make managing money effortless. These must-have features ensure users can handle their finances with speed and convenience.

- Account Management – Check balances, view transaction history, and track spending.

- Fund Transfers & Payments – Instantly send money, make P2P payments, and handle international transfers.

- Bill Payments & Auto-Pay – Set up automatic bill payments and reminders.

- Real-Time Alerts – Get notifications for transactions, failed payments, and security risks.

- Mobile Check Deposits – Deposit checks by scanning them with your phone.

- AI-Powered Finance Tools – Track expenses, automate savings, and monitor investments.

Advanced Features & Integrations

Today’s banking apps go beyond the basics, offering cutting-edge features that enhance security, convenience, and financial control.

- Voice & Chatbot Banking – AI-powered assistants for hands-free banking.

- Blockchain-Based Transactions – Secure, transparent payments with crypto support.

- Open Banking & API Integrations – Connect with financial apps and business tools.

- Cardless ATM Withdrawals – Use QR codes for secure cash withdrawals without a card.

Steps to Develop a Mobile Banking App

Developing a mobile banking app is a multi-stage process that requires strategic planning, the right technology stack, and continuous optimization. A well-executed app enhances customer experience, boosts engagement, and ensures compliance with financial regulations. Below, we’ll explore each critical step in the banking app development process, from ideation to post-launch improvements.

Ideation and Market Research

Every successful custom mobile banking app begins with a clear vision. Before diving into development, businesses must conduct comprehensive research to understand their target audience, competitors, and industry regulations. A thorough discovery phase ensures that the app is not only functional but also aligns with user needs and market demands.

Understanding the Target Audience

A banking app is not a one-size-fits-all solution. It must be tailored to the specific needs of different user segments. For example, traditional banks require a seamless digital extension of their services, while fintech startups need to differentiate themselves with cutting-edge technology and innovative features. Enterprises and retail businesses may require integrated payment solutions and expense management tools.

By analyzing the target audience, businesses can determine what features and services will resonate most. Do users prefer AI-powered budgeting tools? Are they looking for quick international transactions? Understanding these pain points helps in designing a product that delivers real value.

Competitor Analysis and Differentiation

The mobile banking space is highly competitive, with established players like Chime, Revolut, and N26 setting high standards. Analyzing successful competitors can reveal gaps in the market, allowing businesses to offer unique selling points.

Key areas to study include:

- User experience – How intuitive is the competitor’s interface?

- Feature set – Are there missing functionalities that your app can offer?

- Security protocols – What measures are being used to prevent fraud?

- Regulatory compliance – How are competitors ensuring legal adherence?

By identifying strengths and weaknesses in existing solutions, businesses can develop a superior mobile banking experience.

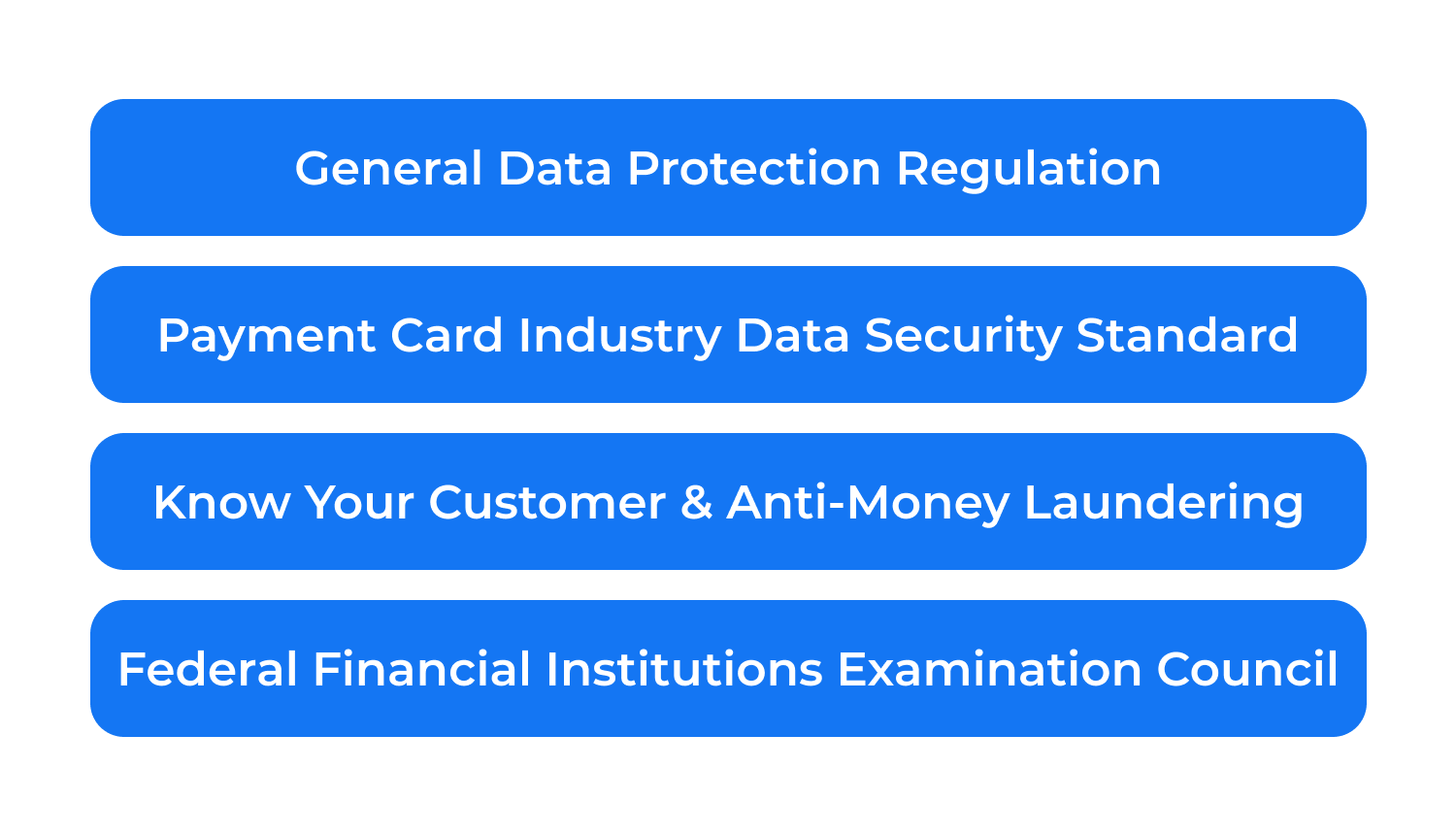

Compliance with Financial Regulations

Since banking apps deal with sensitive financial data, ensuring regulatory compliance is non-negotiable. Businesses must comply with various laws depending on their region, such as GDPR in Europe, PCI DSS for payment security, and KYC/AML for fraud prevention. Failure to comply can result in hefty fines and loss of customer trust.

Collaborating with legal and cybersecurity experts during this phase ensures that compliance is built into the app from the ground up, avoiding costly adjustments later.

Designing for UX/UI

User experience is one of the most important aspects of mobile banking app development. A poorly designed interface can frustrate users and lead to high abandonment rates. Prioritize user-friendly design↗. Customers expect banking apps to be fast, intuitive, and visually appealing, with a seamless flow that makes transactions effortless.

Wireframing and Prototyping

Before diving into full-fledged development, it’s essential to create wireframes and prototypes that outline the app’s structure. Wireframes act as blueprints, showcasing:

- The layout of key features (e.g., account overview, transfers, bill payments).

- User navigation flows, ensuring simple and intuitive interactions.

- Placement of important UI elements, such as CTA buttons and security prompts.

Prototypes take this a step further, offering an interactive demo that allows stakeholders and test users to provide feedback before development begins.

Prioritizing Accessibility and Navigation

A great banking app design should cater to all types of users, including those with disabilities. Accessibility features such as adjustable font sizes, voice navigation, and color contrast settings ensure inclusivity.

Moreover, a minimalistic and clean dashboard should present key banking functions at a glance, reducing cognitive load. Users should be able to navigate between different sections effortlessly, with intelligent recommendations that anticipate their needs.

User Testing for Seamless Experience

Even a beautifully designed app can have usability flaws. That’s why rigorous user testing is necessary to ensure an effortless experience. Conducting A/B testing, heatmaps, and focus groups can reveal pain points and areas for improvement, leading to a more refined design before launch.

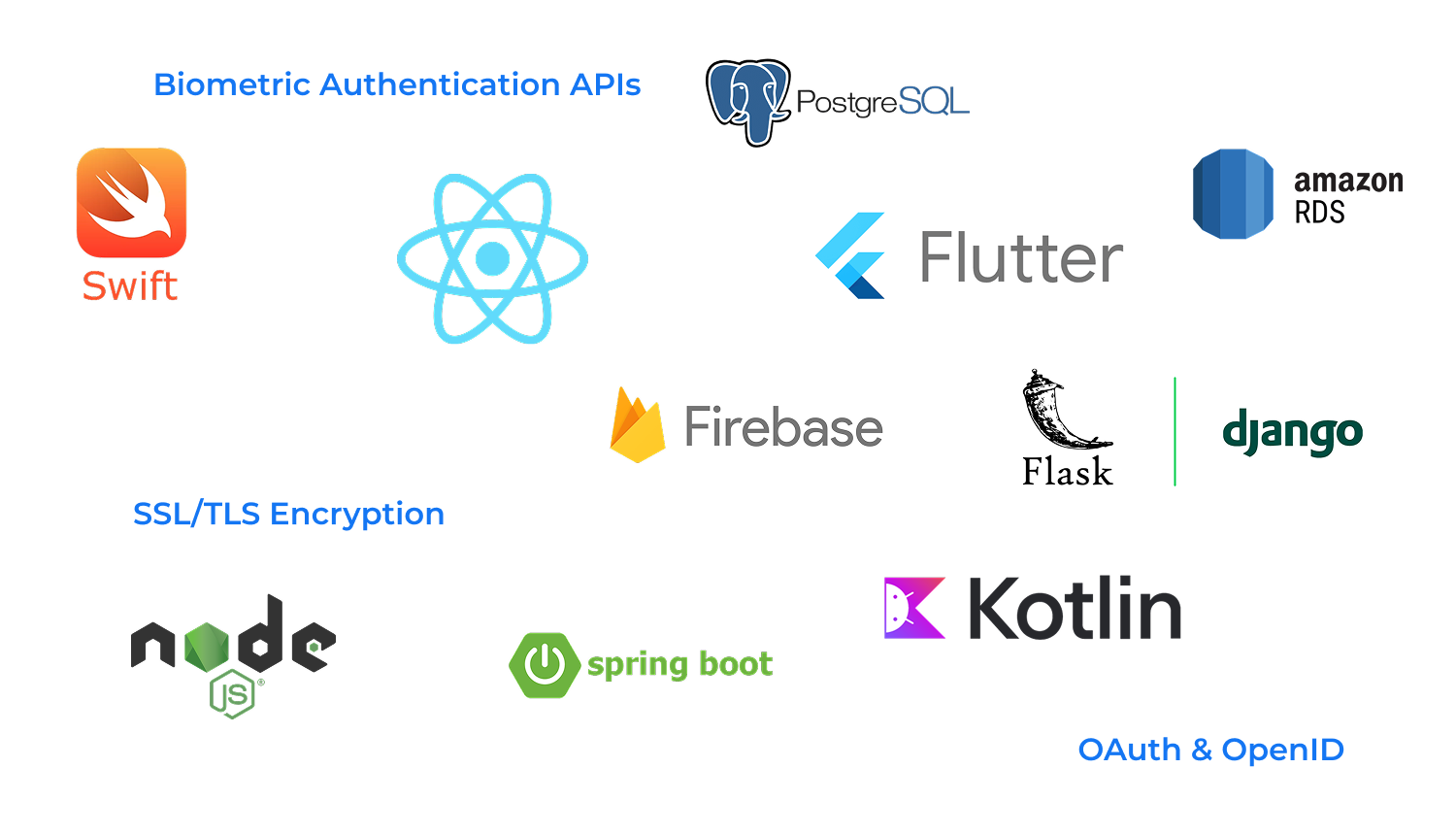

Selecting the Right Tech Stack

The success of a banking app relies heavily on choosing the right technology stack. A well-structured tech stack ensures scalability, security, and fast performance, making it a crucial component of the banking app development process.

Choosing the Right Programming Languages

For native mobile apps, development should be done using:

- Swift for iOS applications, ensuring smooth performance and security.

- Kotlin for Android applications, offering modern programming features.

For cross-platform development, businesses can opt for:

- React Native – A popular choice for developing apps that work on both iOS and Android.

- Flutter – A UI toolkit by Google that allows fast, high-performance banking apps.

Backend & Database Solutions

A robust backend infrastructure ensures that banking transactions are processed securely and efficiently. Common backend choices include:

- Node.js – Ideal for real-time banking operations and APIs.

- Python (Django, Flask) – Excellent for AI-powered financial insights.

- Java (Spring Boot) or .NET (ASP.NET) – Best suited for large-scale enterprise banking applications.

Secure databases such as PostgreSQL, Oracle, Microsoft SQL Server, and Cloud Databases ensure that customer financial data remains safe while maintaining fast response times.

Security & Compliance Tools

- End-to-end encryption (SSL/TLS) secures all communication between users and banks.

- OAuth and OpenID protocols ensure safe authentication.

- Biometric authentication APIs enable Face ID and fingerprint security.

The right technology stack ensures long-term stability, security, and high-speed performance, making it a critical decision in banking app development.

Development and Testing

The actual development phase follows Agile methodologies, allowing for iterative improvements and flexibility.

Agile Development & Continuous Integration

Instead of building everything at once, Agile development breaks the process into sprints, where developers work on small, incremental updates. This allows for rapid testing and feedback implementation, reducing errors before the final launch.

Security Testing: A Priority in Banking Apps

Security testing is not optional in mobile banking. The app must be subjected to:

- Penetration testing to simulate cyber-attacks and test vulnerabilities.

- Automated security scanning to detect weak encryption methods.

- Regulatory compliance checks to ensure GDPR, PCI DSS, and AML compliance.

Beta Testing with Real Users

Before launching, beta testing is conducted with real users to gather feedback. This helps identify any bugs, performance bottlenecks, and usability issues, ensuring a smooth experience at launch.

Deployment and Continuous Updates

Once testing is complete, the app is deployed to Google Play and the Apple App Store. However, this is just the beginning. Ongoing updates and optimizations are necessary to keep up with:

- Security patches to prevent fraud and cyber threats.

- Feature updates based on user feedback and banking trends.

- Performance optimizations to ensure a smooth experience.

Post-Launch Monitoring

Real-time monitoring tools like Google Firebase, AWS CloudWatch, and New Relic track app performance, identifying slow load times or errors before they impact users.

Continuous Customer Support & Enhancements

A dedicated customer support system via chatbots and human agents ensures that users receive help whenever needed. Additionally, AI-powered insights can predict new feature demands, ensuring the banking app stays ahead of the curve.

Building a mobile banking app is a complex but rewarding process. By following these step-by-step guidelines, businesses can create a secure, intuitive, and future-proof banking solution that enhances customer engagement and streamlines financial operations.

Role of Emerging Technologies in Mobile Banking

The mobile banking sector is undergoing a profound transformation, driven by advancements in artificial intelligence, machine learning, and blockchain. These technologies are reshaping the industry by enhancing security, improving customer experience, automating financial management, and streamlining transactions. As financial institutions adapt to a more digital-first approach, leveraging these innovations has become essential to maintaining a competitive edge.

AI & Machine Learning: Enhancing Banking Experiences

AI and ML have revolutionized the banking experience, making services more intuitive, efficient, and secure. These technologies enable financial institutions to offer personalized solutions, detect fraudulent activity in real time, and automate banking operations, ultimately improving customer satisfaction.

AI-Powered Chatbots

AI-driven chatbots have transformed customer support by providing instant, 24/7 assistance without human intervention. Using natural language processing, chatbots can handle account inquiries, and financial advice. Some advanced banking chatbots, like Bank of America’s Erica, even analyze transaction history to provide proactive insights and reminders, improving financial literacy among users.

Smart Budgeting & Expense Tracking

AI-powered financial assistants help users track expenses, analyze spending habits, and set budgets automatically. By assessing transaction patterns, AI suggests ways to save money and sends real-time budget alerts when spending limits are exceeded. Fintech apps like Mint and Revolut use AI to provide users with tailored financial recommendations, making budgeting easier and more intuitive.

Fraud Detection & Risk Prevention

AI and ML play a crucial role in detecting fraudulent activities by identifying unusual transaction patterns and flagging suspicious behavior in real time. Financial institutions like PayPal and Mastercard utilize AI algorithms to assess creditworthiness, prevent identity theft, and minimize fraud risks, significantly reducing the chances of unauthorized transactions and cyber threats.

Blockchain: Ensuring Secure Transactions

Blockchain technology is revolutionizing mobile banking by providing a decentralized, tamper-proof, and transparent financial ecosystem. Its ability to secure transactions, improve identity verification, and eliminate intermediaries makes it a powerful tool for banks and fintech firms.

Tamper-Proof Records

Blockchain ensures that financial transactions are immutable and verifiable, making it nearly impossible for hackers to alter banking records. Platforms like JP Morgan’s Quorum leverage blockchain to secure financial data and minimize fraud risks, giving institutions and customers greater confidence in the integrity of transactions.

Secure P2P Payments

Blockchain enables real-time, low-cost peer-to-peer transactions without requiring intermediaries like banks or payment processors. Cryptocurrencies such as Ripple’s XRP facilitate seamless cross-border payments, significantly reducing transaction fees and processing times compared to traditional banking methods.

Fraud Reduction & Identity Verification

With cyberattacks on the rise, banks are turning to blockchain for secure identity verification. Blockchain-based Know Your Customer and Anti-Money Laundering solutions help financial institutions authenticate users quickly and prevent fraudulent accounts. Solutions like IBM Blockchain for KYC/AML compliance allow banks to store and verify customer data on an immutable ledger, reducing phishing attacks and identity fraud risks.

Cost and Timeline Considerations

Developing a mobile banking app is a complex process that demands careful planning, strong security protocols, and strict regulatory adherence. The overall cost and development timeline depend on several key factors, including the app’s complexity, required features, compliance requirements, technology stack, and team structure. Without a clear roadmap, projects can quickly exceed budgets and face delays.

Key Cost Factors

App Complexity & Features

The scope and functionality of a mobile banking app directly influence its development cost and time-to-market. Banking apps can generally be categorized into three levels:

Basic Apps (MVP)

These offer fundamental banking operations such as account management, fund transfers, and bill payments. They are cost-effective and ideal for banks launching a digital-first strategy.

Mid-Level Apps

Designed with enhanced security and automation, these apps include AI-driven chatbots, real-time transaction alerts, and basic financial analytics. They require additional development time and security measures.

Enterprise-Grade Apps

These high-end applications integrate AI-powered fraud detection, blockchain security, and cryptocurrency transactions.

Regulatory Compliance

Regulatory frameworks heavily influence both app development costs and timelines. Banking and fintech apps must comply with industry-specific regulations such as:

GDPR (General Data Protection Regulation)

Governs user data privacy and security, especially in the European Union.

PCI DSS (Payment Card Industry Data Security Standard)

Ensures secure payment transactions and protection of cardholder data.

KYC/AML (Know Your Customer & Anti-Money Laundering)

Mandates identity verification and fraud prevention protocols.

FFIEC (Federal Financial Institutions Examination Council)

Regulates banking security compliance in the U.S.

Compliance entails regular security audits, penetration testing, legal reviews, and encrypted data storage-all of which contribute to higher development costs. However, failing to comply can result in steep fines, legal action, and loss of customer trust.

Technology Stack & Integrations

The choice of development technologies plays a crucial role in cost, security, and scalability.

Native Development (Swift/Kotlin)

Offers better performance and platform-specific security, but requires separate codebases for iOS and Android, increasing development costs.

Cross-Platform Development (Flutter/React Native)

Reduces time-to-market and costs by enabling a single codebase for both platforms, though it may have limitations in advanced security implementations.

Security & Third-Party Integrations

Implementing SSL encryption and OAuth authentication enhances security while often reducing costs. Adding AI-powered chatbots and blockchain-based security further improves user experience but increases development complexity and expenses.

Development Team & Location

Your choice of development team structure significantly impacts the overall project budget.

In-House Development Teams

Provide greater project control and customization but come with high overhead costs for hiring, salaries, and ongoing maintenance.

Outsourcing

Offers a cost-effective alternative, especially when working with skilled developers in Eastern Europe, Latin America, or Southeast Asia. These regions provide high-quality development at lower costs.

Hybrid Development Models

Combine in-house expertise with outsourced technical teams, allowing companies to maintain strategic oversight while leveraging external talent for specialized development tasks.

Developing a mobile banking app is a long-term investment that requires careful planning, precise execution, and continuous updates. By balancing functionality, security, compliance, and budget, financial institutions and fintech firms can create scalable, user-friendly, and future-proof banking solutions that cater to modern digital consumers.

Development Breakdown

Building a mobile banking app follows a structured process to ensure security, functionality, and a seamless user experience. It starts with discovery and planning, defining key features, and addressing compliance requirements. Then, UX/UI design brings the app to life with wireframes, prototypes, and intuitive user interfaces.

The development phase focuses on building the frontend, backend, and database while implementing strong security measures. Testing follows, covering security audits, compliance checks, and performance optimization, leading to beta testing for real-world feedback and final refinements. After launch on app stores, ongoing maintenance keeps the app updated with new features, security patches, and performance enhancements.

Challenges and How to Overcome Them in Mobile Banking App Development

Developing a custom banking app comes with strict regulatory requirements and rising cybersecurity threats. Financial institutions must ensure compliance while protecting users from fraud, data breaches, and cyberattacks.

Regulatory Compliance

Banking apps must comply with laws like GDPR, PCI DSS, KYC/AML, and CCPA to prevent fraud and protect user data. Failure to meet these standards results in fines, legal action, and reputational damage.

How to Ensure Compliance

- Partner with legal and compliance experts to stay updated on regulations.

- Implement end-to-end encryption, tokenization, and secure cloud storage.

- Use AI-driven compliance tools to monitor regulatory changes and detect violations.

- Conduct regular audits to identify security gaps and maintain legal compliance.

Cybersecurity Threats

Cybercriminals target banking apps through phishing, MITM attacks, ransomware, and API vulnerabilities. Without strong security, apps become vulnerable to data breaches and financial fraud.

How to Strengthen Security

- Multi-layer authentication – Use MFA, biometrics, and OTP verification.

- Penetration testing & audits – Identify and fix security flaws proactively.

- Secure APIs – Implement OAuth 2.0, API gateways, and role-based access controls.

- User education – Provide security tips to prevent phishing and fraud.

By prioritizing compliance, security, and AI-driven fraud detection, banks can build trust, protect data, and prevent costly breaches.

Monetization Strategies for Mobile Banking Apps

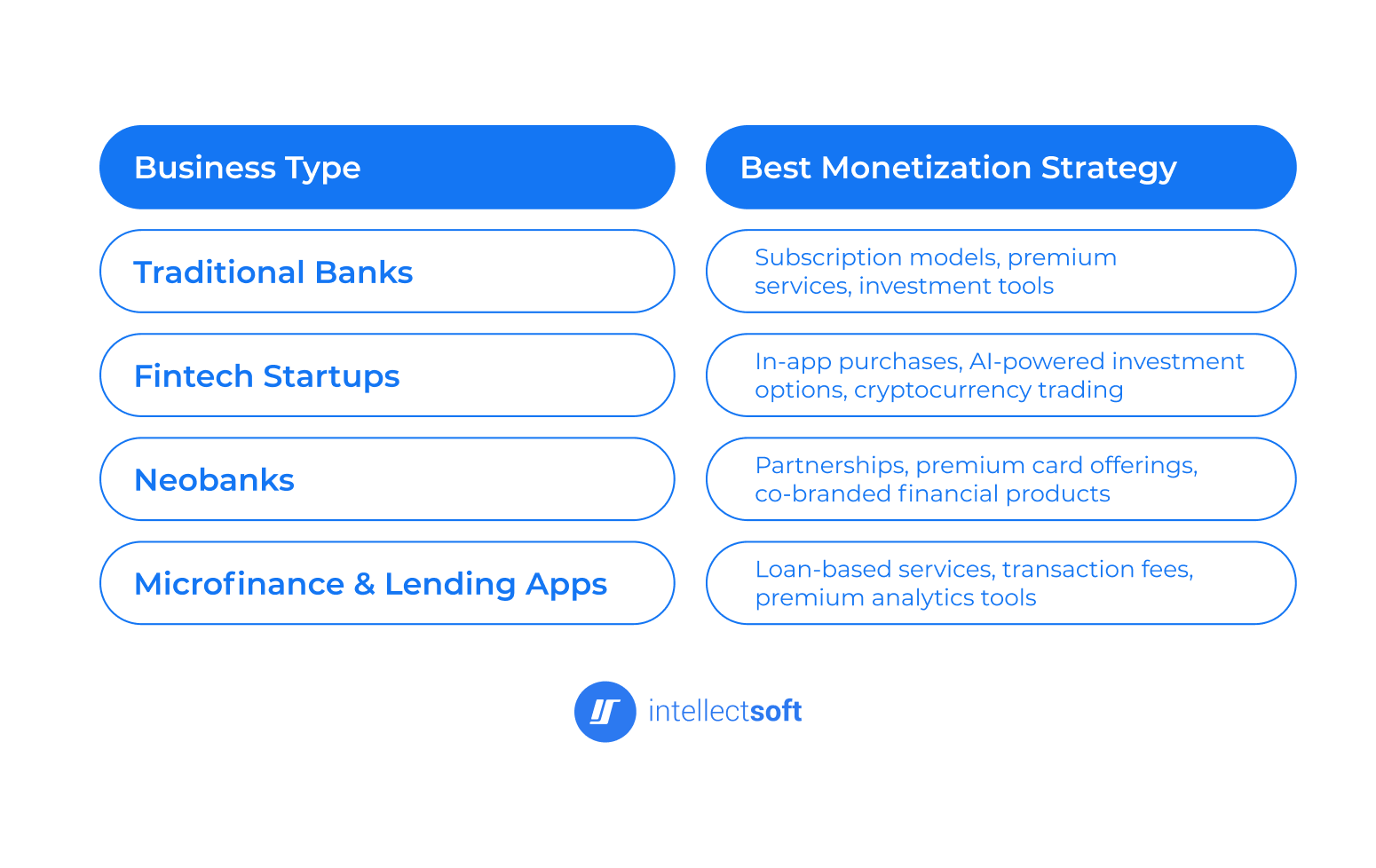

Developing a custom banking app is a major investment, but businesses can generate revenue through subscriptions, in-app purchases, and partnerships. Turn features into revenue↗. While traditional banks rely on interest rates and service fees, digital banking apps have additional monetization opportunities.

Subscription Models: Recurring Revenue

Users pay a monthly or annual fee for premium features like AI-driven financial insights, enhanced security, high-yield savings, cashback programs, and priority support. Popular apps like Revolut, Chime, and N26 use this model.

- Offer free trials to attract users.

- Use tiered pricing for different user needs.

- Bundle financial services for added value.

In-App Purchases: Selling Financial Tools

Users can pay for additional services like stock/crypto trading, credit score monitoring, AI-driven wealth management, and virtual security tools. Apps like Robinhood, Acorns, and Credit Karma successfully implement this model.

- Provide value-driven add-ons.

- Offer pay-as-you-go options.

- Combine free and paid features for wider adoption.

Advertisements & Partnerships: Revenue Through Collaborations

Apps earn commissions through affiliate marketing, personalized financial ads, and retailer partnerships offering cashback, financing, and co-branded cards. Examples include Monzo, Revolut, and Mint.

- Promote financial products via partner banks.

- Use AI-driven, non-intrusive ads.

- Offer cashback and loyalty rewards through retail collaborations.

By combining these strategies, banking apps can maximize revenue while enhancing user experience.

Choosing the Right Monetization Strategy

The ideal monetization approach depends on the target audience, banking model, and competitive positioning. Here’s how different businesses can tailor their strategies:

Monetizing a custom mobile banking app requires careful planning, user-friendly pricing models, and strategic partnerships. By leveraging subscriptions, in-app purchases, and non-intrusive advertising, banks and fintech startups can drive consistent revenue while offering valuable financial services.

Best Examples of Successful Mobile Banking Apps on the Market

Innovative digital banks like Chime, Revolut, and N26 have reshaped banking with fee-free services, AI-driven financial tools, and seamless global transactions. These fintech disruptors prioritize transparency, automation, and customer experience.

Chime: The Fee-Free Digital Bank

Chime operates entirely online, eliminating banking fees and offering smart money management tools. Features include early direct deposits, automated savings, overdraft protection, and fee-free ATM access. Its revenue comes from interchange fees and lending partnerships.

Key Takeaway:

Chime’s success proves that fee-free banking with automation appeals to millennials and underbanked users.

Revolut: The Global Financial Super App

Revolut provides multi-currency accounts, commission-free stock and crypto trading, instant transfers, and AI-powered budgeting. Its revenue stems from subscriptions, trading fees, and interchange fees.

Key Takeaway:

Combining banking, investing, and crypto in one platform offers a versatile, all-in-one financial experience.

N26: AI-Driven Mobile Banking

N26 offers instant account setup, AI-powered financial insights, secure virtual cards, and goal-based savings accounts. It generates revenue from premium plans, interchange fees, and financial partnerships.

Key Takeaway:

AI-driven budgeting and security-focused banking meet growing user demand for smart, digital-first solutions.

Key Lessons from Market Leaders

- Customer-Centric Models Win – Fee-free banking, early deposits, and smart savings enhance user experience.

- AI & Automation Matter – Expense tracking, savings tools, and fraud detection improve financial management.

- Beyond Basic Banking – Offering crypto, stock trading, and multi-currency accounts attracts tech-savvy users.

- Subscription-Based Growth – Premium plans like Revolut Metal and N26 Premium create long-term revenue.

- Security & Compliance Build Trust – Biometric authentication and AI fraud detection ensure user protection.

The Future of Mobile Banking is Here

Developing a custom mobile banking app is essential for banks and fintech startups looking to digitize financial services, enhance engagement, and stay competitive. Consumers expect secure, seamless, and AI-driven banking experiences available anytime, anywhere.

Success requires cutting-edge security, intuitive UX/UI, AI-powered tools, and seamless tech integration while ensuring compliance and fraud prevention. Future-proof your banking app↗. With the right approach, businesses can build scalable, future-proof solutions that drive growth.

At Intellectsoft, we specialize in secure, high-performing banking apps tailored to industry needs. Whether modernizing traditional banking or disrupting fintech, we help create world-class digital experiences.

Ready to innovate? Let’s build your next-gen banking app.

Subscribe to updates

Source link