We’ve done banking the same for many years, and traditional institutions have had a stranglehold on fintech startups who aim to disrupt the financial landscape and offer much-needed innovation.

Open Banking and its open API framework are starting to break down these old walls and pave the way for fintech to finally take root in mainstream banking.

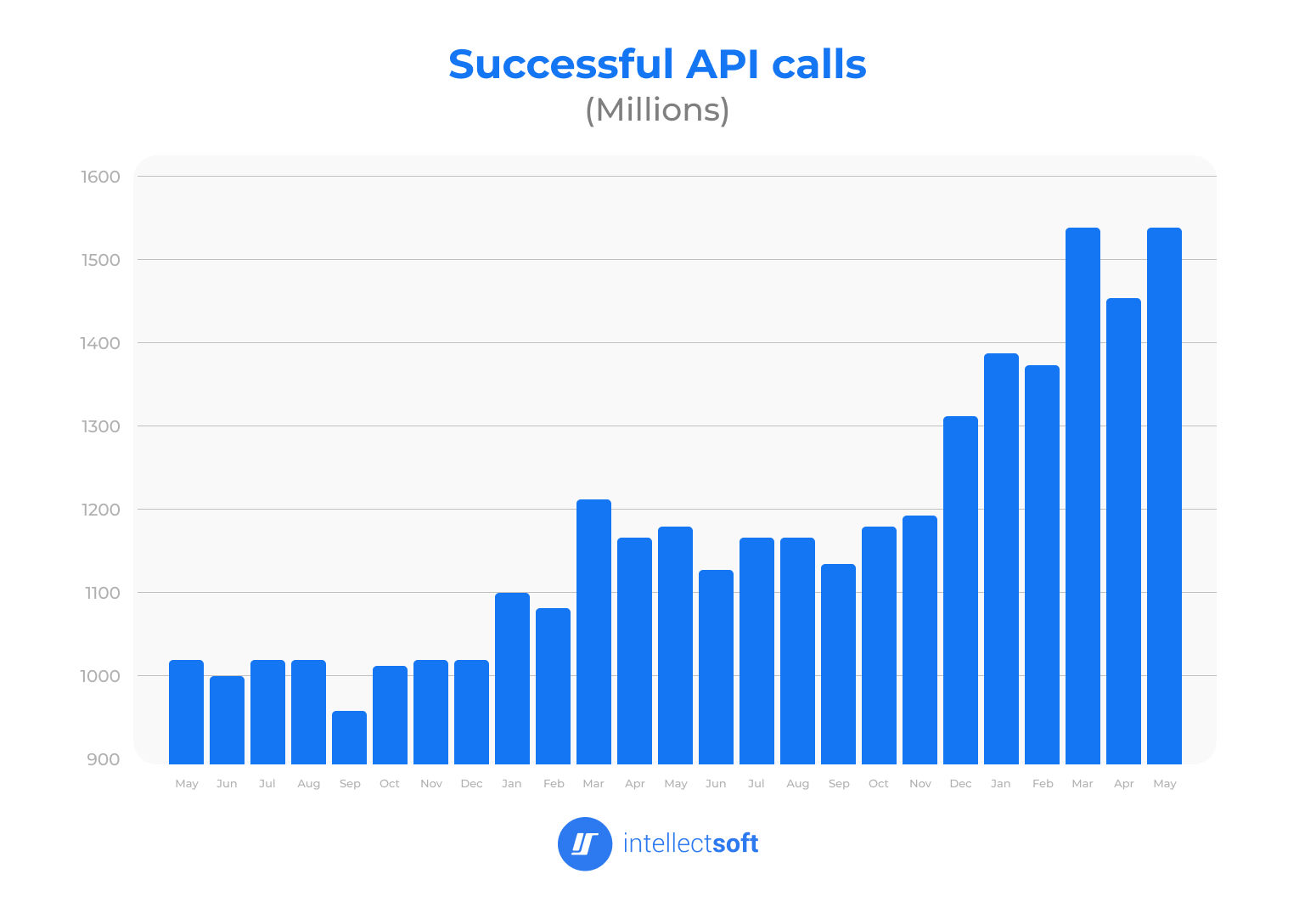

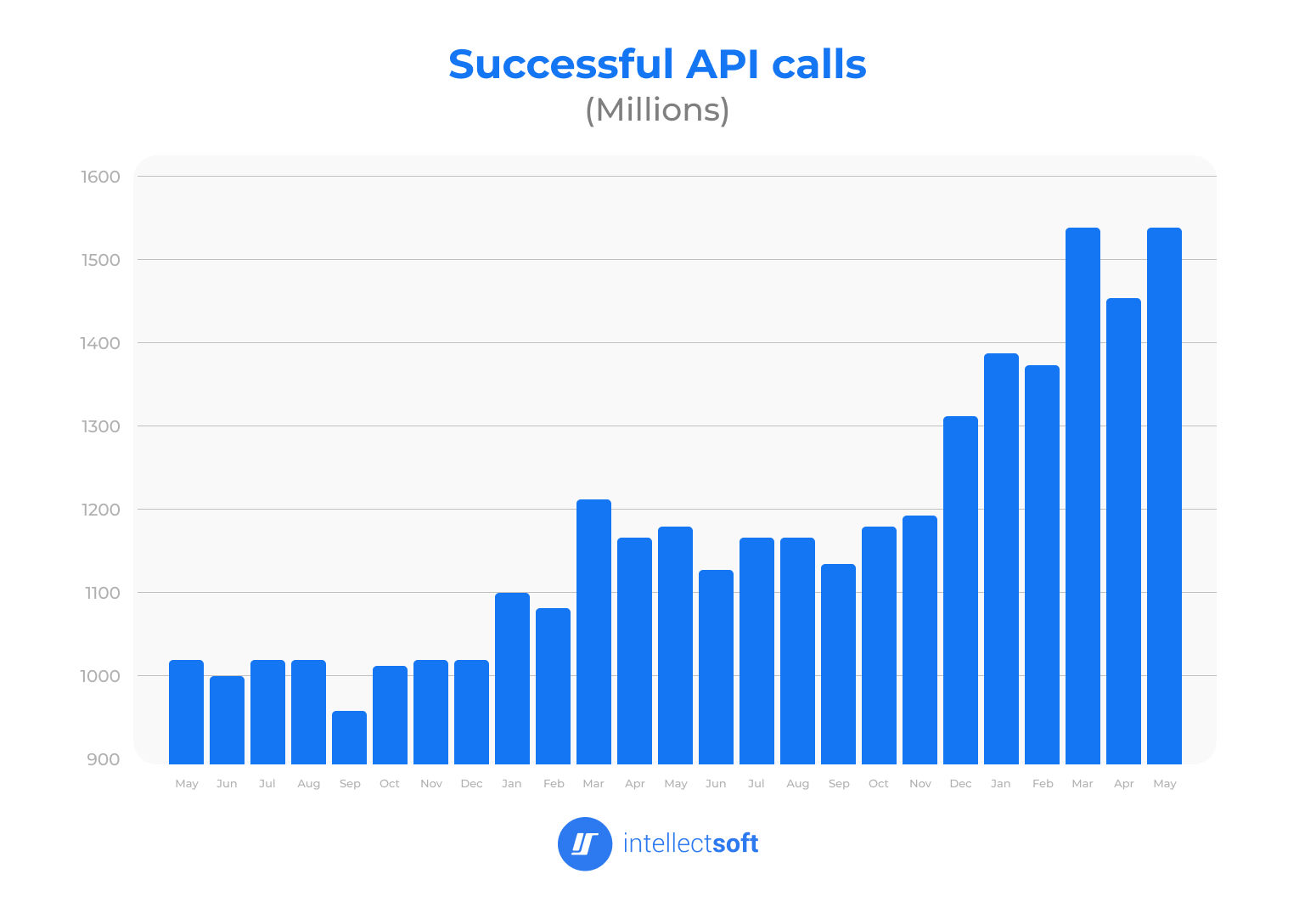

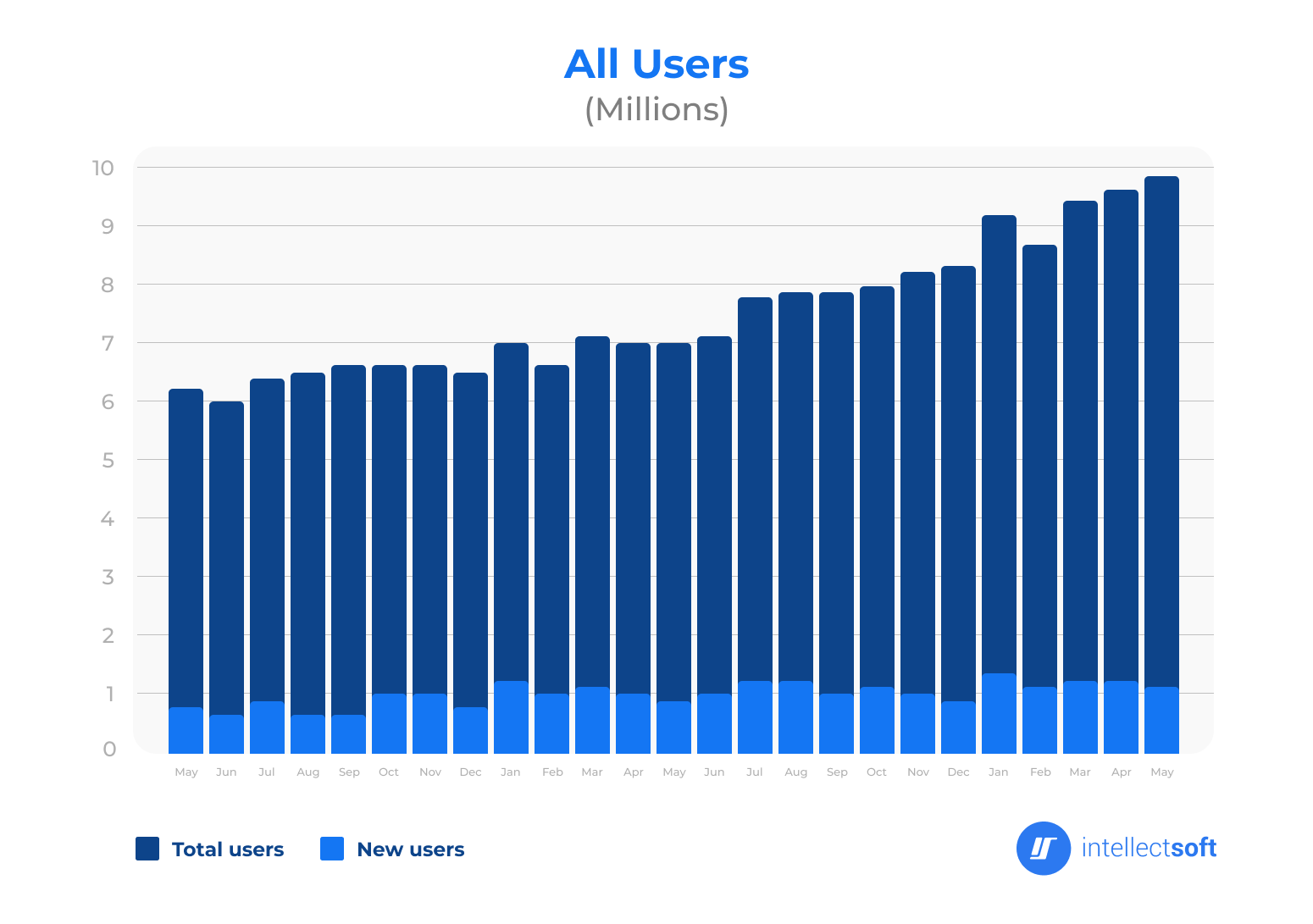

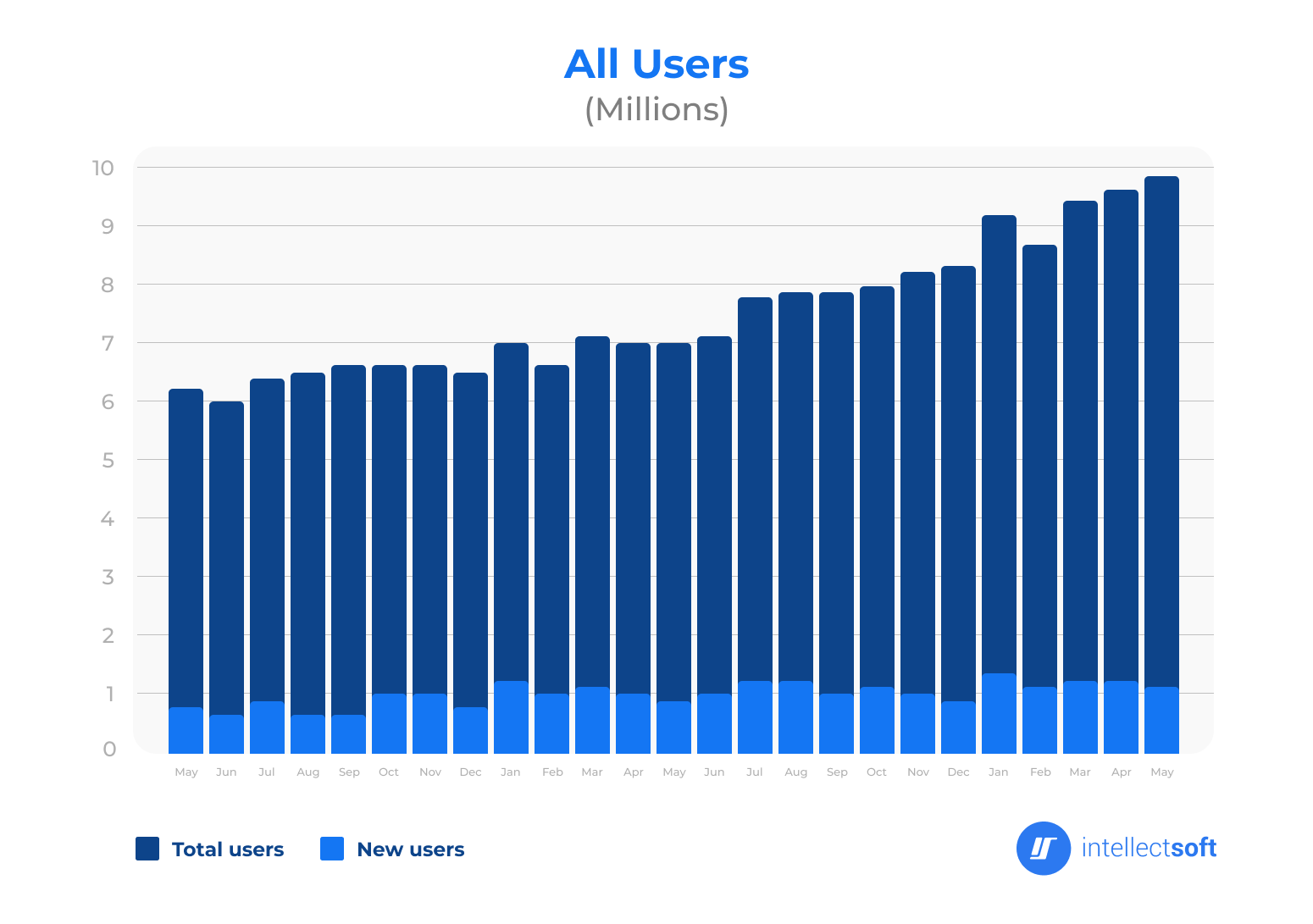

Fintech’s adoption of Open Banking API infrastructure has steadily risen over the past few years. As of the time of writing, openbanking.org.uk, which monitors Open Banking API performance indicates that over 1.5 billion successful API calls have been made in May alone.

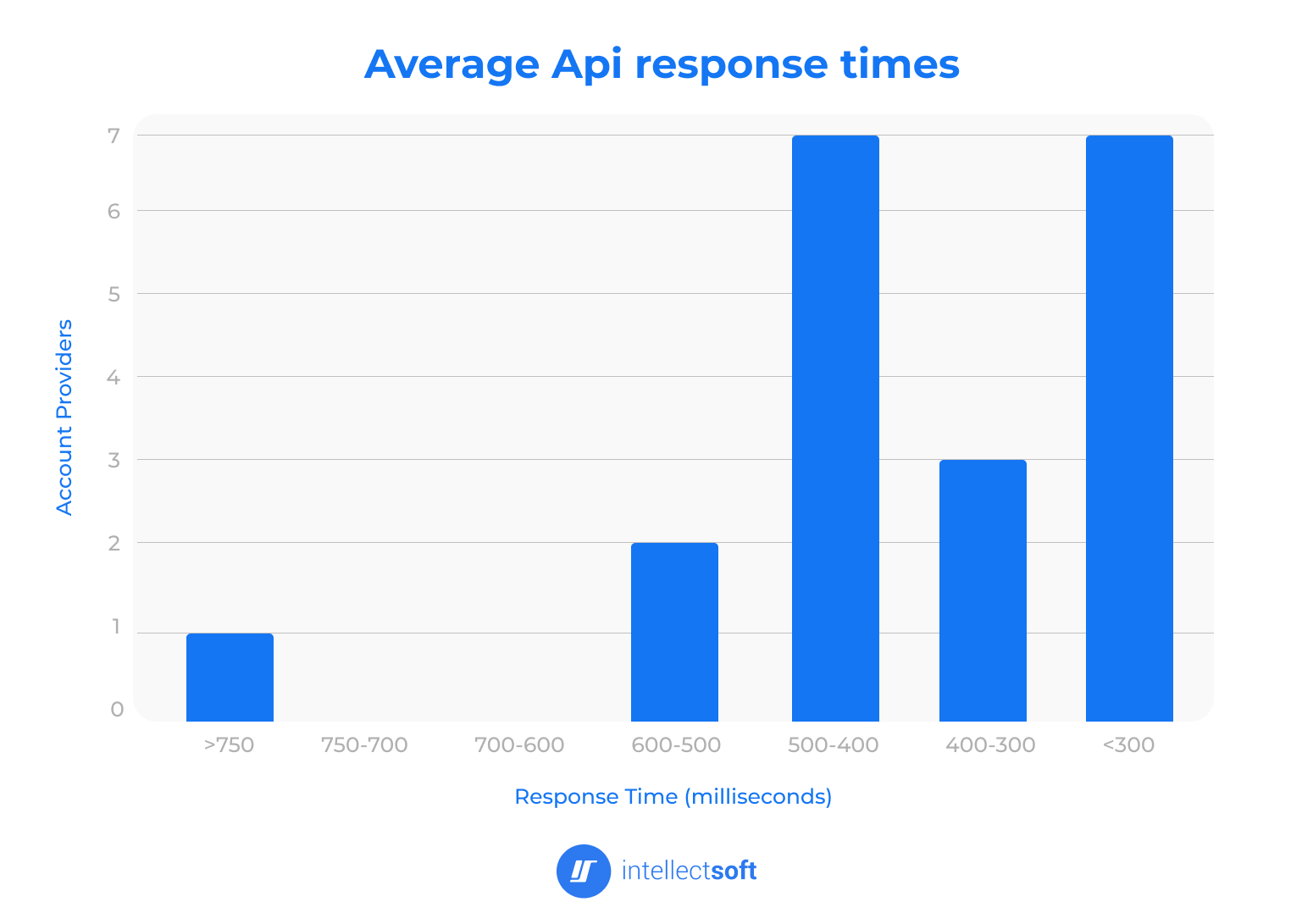

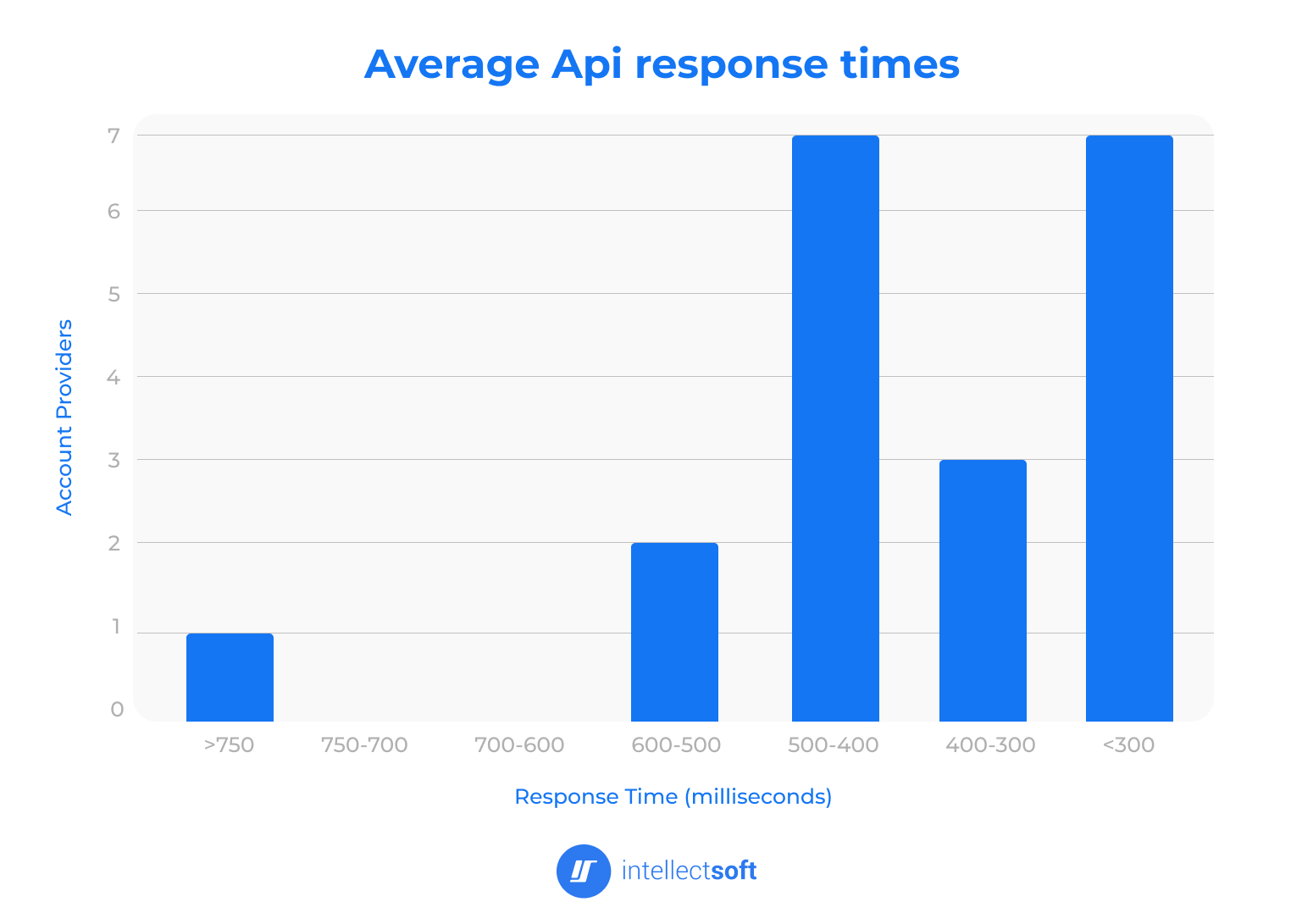

The API call latency is blisteringly fast, coming in at an average of 375 milliseconds. It’s also reliable with an impressive availability rate of 99.45%.

With almost ten million active users now using Open Banking APIs, it’s clear that this democratizing banking infrastructure is now allowing fintech companies to develop more adaptable and fairer solutions for all.

What is Open Banking API?

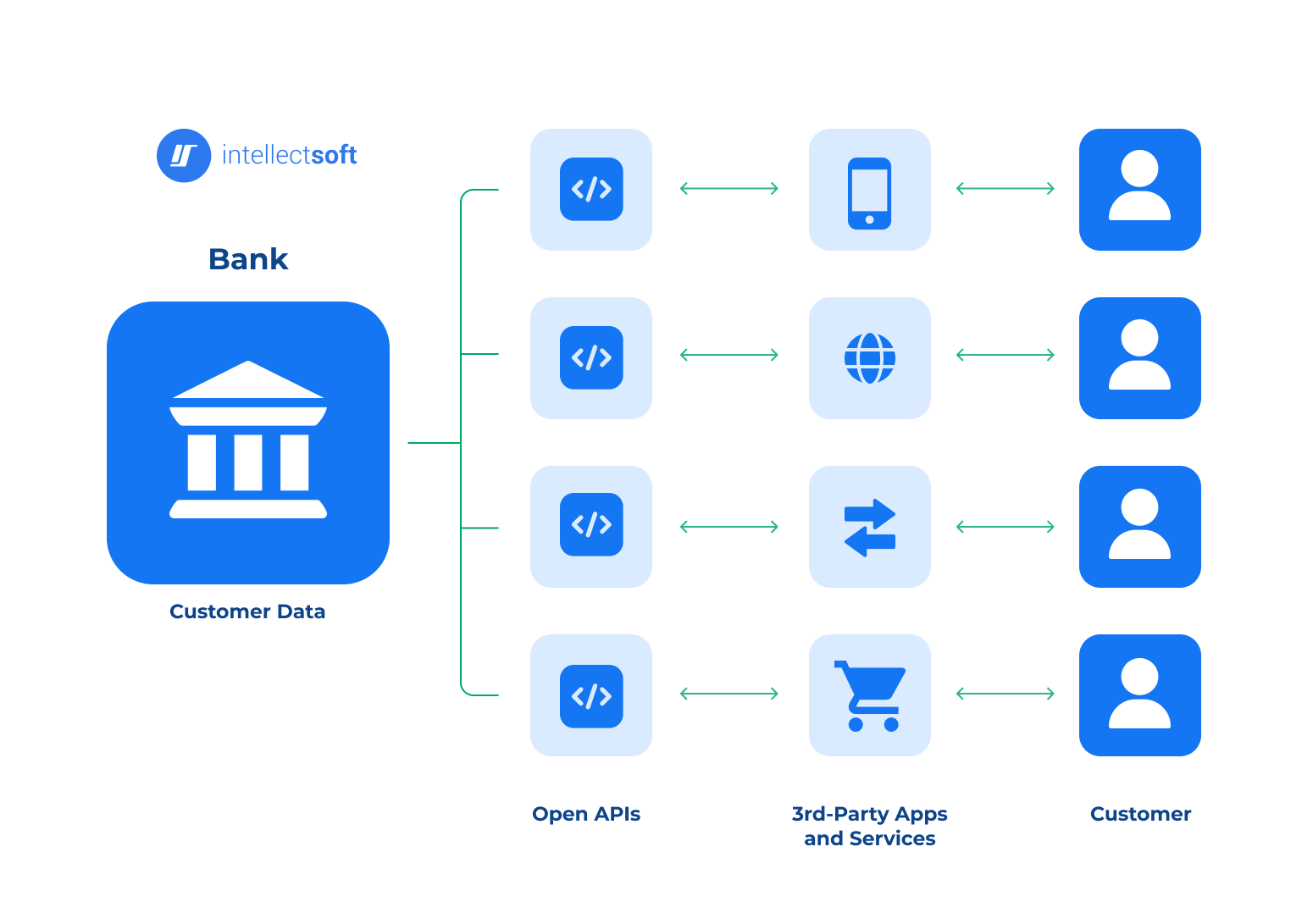

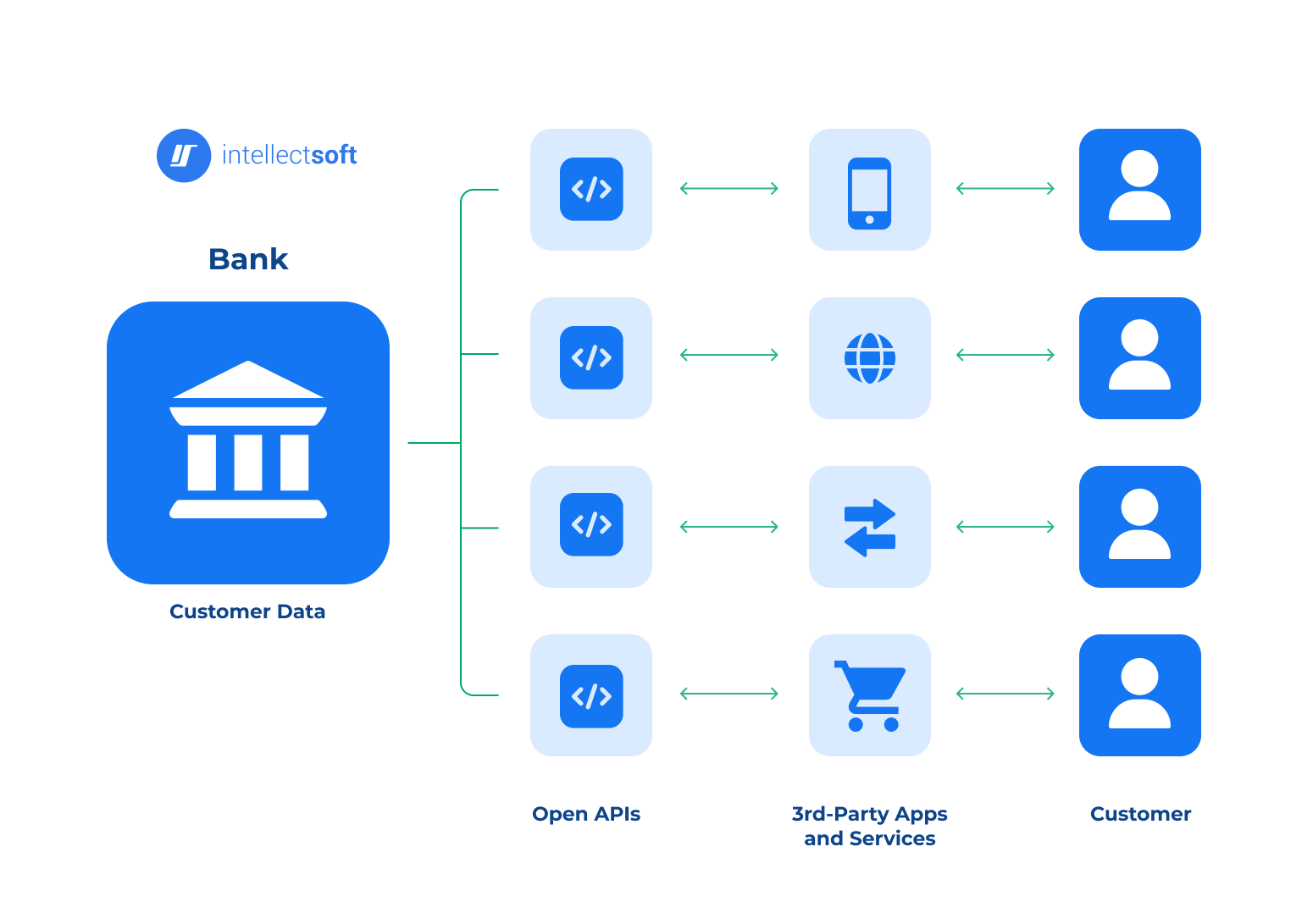

So, what is an Open Banking API? While it may sound like a complex term, it’s essentially about making your financial life easier and more connected. Think of Open Banking APIs as secure pathways that let trusted financial apps and services talk directly to your bank with your permission.

This means you can get a fuller, clearer picture of your finances all in one place.

What is an API in Open Banking?

It acts much like an interpreter assisting two people who speak different languages to understand each other. In the world of finance, these “people” are actually your bank’s database and the applications you use to manage money.

With APIs setting the rules for this interaction, third-parties can develop helpful tools—like budgeting apps or payment platforms—that utilize your financial information securely.

The beauty of Open Banking is how it encourages smarter finance management by offering tailored insights based on individual data such as spending habits.

For consumers, this level of customization means not only improved service from their providers but also access to innovative products they never had before—making managing money less stressful and more intuitive.

Applications in Fintech

Open Banking APIs allow fintech firms to create user-friendly tools that help people manage their money better and make smarter decisions. These might include budgeting apps or systems that automate investing.

Ensuring these innovations work smoothly, providers of the Open Banking API offer essential support. Think of them as the backbone, ensuring everything runs securely and complies with regulations. Their role is crucial in keeping our financial data safe while we benefit from these advanced services.

Main Benefits of Open Banking API for Fintech

Open Banking APIs have become saviors for FinTech startups that are struggling to overcome the resistance provided by traditional banking institutions.

For fintech, Open Banking APIs completely improve how these businesses work, connect with their clients, and stand out from their competitors.

With over 30,000 Fintech companies currently in operation, these APIs make things easier by allowing different systems to talk to each other without any barriers, resulting in four key advantages:

- Operational Efficiency

- Improved Customer Experience

- Competitive Advantage

- Standardization of Transactions

Increased Operational Efficiency

By adopting Open Banking APIs, day-to-day operations get a lot simpler. These tools connect the dots between banks and your services automatically, meaning less manual work for you and your team.

Fewer hours spent inputting data means fewer mistakes and more savings on operational expenses. Plus, with instant access to financial information, you can make swift decisions that keep you ahead in a fast-paced market.

This leaves Fintech companies free to pour energy into creative solutions and build strong relationships with customers without getting tangled up in technical details behind the scenes.

Improved Customer Experience

The Open Banking API is a real boon for FinTech startups, primarily because they can make life easier and better for their customers. By tapping into these technologies, startups can access detailed financial information quickly and safely.

This means they can give each customer advice that fits just right, whether it’s helping them understand where their money goes each month or finding smart ways to save.

Plus, Open Banking makes the whole process of getting started with a financial service much smoother and more streamlined, meaning it’s an easy start, one that helps build confidence between the customer and the company from day one.

Enhanced Competitive Advantage

Open Banking empowers businesses to create services that deeply connect with customer needs, often surpassing what traditional banks can offer.

By leveraging these APIs, startups can access a wealth of data that facilitates innovations such as investment forecasts, personalized advice, and custom-made products tailored to specific customer segments.

Additionally, this integration provides startups with agility, enabling them to adapt to market changes while effortlessly adhering to evolving regulations.

Transaction Standardization

Having a common ground for financial transactions allows various banking systems and software to work together seamlessly.

This makes life easier for startups who are looking to grow and move into new areas, as they don’t have to worry about the usual obstacles of making sure everything works together or meets specific rules.

Open Banking API Use Cases in FinTech

From simplifying audits to facilitating payment systems, the Open Banking API has become a transformative force across many sectors of the financial industry.

Here are a few real-world case studies detailing how the Open Banking framework has been harnessed to create successful fintech enterprises.

Case Study 1: Enhancing Audit Efficiency with Circit

Circit has aimed to make the auditing process easier. By embracing Open Banking technology, this audit evidence platform allows faster verification of financial information.

In the past, audits could be slow and filled with manual tasks that took a lot of time to complete. Now, thanks to Circit’s use of cutting-edge Open Banking APIs, auditors can quickly check financial assets straight from banks as they happen—meaning more accurate results and lower chances for mistakes or fraud.

This modern approach has made a real difference. With Circit’s system, what used to take weeks now only takes days, slashing the amount of work involved by half. It’s a smarter way of doing things that’s helping everyone involved in auditing breathe a little easier.

Case Study 2: Improving Donation Processes with Wonderful’s Direct Payment System

Wonderful Payments, originally a platform aiding charity fundraising efforts, confronted the issue of steep card processing fees.

They sought to alleviate this financial burden by adopting a direct bank transfer method known as account-to-account (A2A) payments. This strategic move allowed charities to collect contributions without enduring hefty charges, thus fostering greater openness in handling funds.

Embracing Open Banking principles aligns perfectly with Wonderful’s commitment to not charge charities any fees and offers small enterprises an economical payment alternative that cuts down on expenses and quickens the pace of transactions.

Case Study 3: Expanding Loan Access with AperiData’s Credit Console

HEY Credit Union has revamped its loan approval process by leveraging banking APIs in partnership with AperiData.

The innovative Credit Console, by AperiData utilizes the Open Banking APIs to deliver time insights. The integration means the credit union can expedite and enhance the accuracy of its lending decisions.

This collaboration has notably boosted the approval rates of loans for amounts as it offers a more holistic view of an applicant’s financial status compared to traditional credit assessments.

By identifying risks and spending trends, the system ensures that loans are extended responsibly and better understands the borrower’s financial circumstances.

Case Study 4: Little Birdie’s App Simplifies Subscription Management for Consumers

Little Birdie, a subscription management app, has smartly leveraged the benefits of an Open Banking payment API to tackle the issue many UK consumers face with managing their subscriptions.

This platform allows individuals to easily keep an eye on, handle, and even cancel various subscriptions from one central place. It effectively addresses the common problem where people forget about ongoing payments that can quietly drain their finances.

By linking directly with users’ bank accounts through Open Banking technology, Little Birdie swiftly spots recurring expenses.

This feature is particularly helpful at a time when every penny counts due to rising living costs.

Users who find themselves paying for services they no longer need or use can cut these out or swap them for more affordable alternatives which could lead to significant savings each year.

Technical Aspects of Open Banking: How Does It Work?

As we’ve discussed, Open Banking relies on an Application Programming Interface (API). These act like bridges that allow different financial services and apps to talk to each other.

Think of it as a secure postal service for your financial data: It delivers information where it needs to go, but only after checking the right levels of permission are in place.

The technical backbone of these connections is known as RESTful APIs. These are built specifically for the web so they can seamlessly handle requests, whether you’re asking for data (that’s a GET), sending new details (a POST), updating existing info (with PUT), or removing data (using DELETE).

It all operates under strict Open Banking standards which make sure everyone speaks the same language when sharing and accessing this kind of sensitive information.

This is essential if we want our various financial tools to work together smoothly. For instance, managing bank accounts through a single app without any hiccups along the way.

Security and Compliance

As with any banking, ensuring security is critical, and Opening Banking is no exception.

Open Banking API security measures are comprehensive – they include OAuth to confirm identities, HTTPS to establish secure channels of communication, and end-to-end encryption to safeguard data privacy.

To further strengthen these defenses, strict access guidelines are in place alongside vigilant monitoring to preempt any potential threats. Matching steps with stringent international regulations like GDPR and PSD2 in the European Union underscores this commitment to rigorously protecting user information.

Blueprint of an Open Banking API

The Open Banking API specification serves as the framework that establishes Open Banking API standards and operational guidelines crucial for collaboration between different entities in this ecosystem.

It explicitly defines the data formats to be utilized, provides definitions for each API endpoint interaction, and standardizes error resolution approaches across platforms.

These measures are essentially put in place to facilitate productive cooperation, among all parties involved.

First Steps to Open API Banking: What You Need to Know?

Starting the process of embracing Open Banking APIs can lead to positive changes for FinTech firms.

Understanding the initial steps is essential. Below is a roadmap to kick off and tactically organize for an incorporation.

Getting Started

The first thing to do when getting started with Open API Banking is to grasp the tech and regulatory landscape.

This involves getting familiar with the standards for Open Banking APIs established by bodies that are in place to ensure security and data privacy.

Choose an Open Banking Provider

The next important step is choosing the Open Banking API providers. It’s crucial to opt for providers that do not adhere to these standards but cater to your specific business requirements. Seek out regulated providers known for their security protocols, uptime, and reliable support systems.

Making sure you comply with global regulations like GDPR in Europe or CCPA in California is also vital. This compliance plays a role in fostering trust with your users by protecting their information.

Strategic Planning

Once you have laid down the groundwork it’s essential to engage in planning for incorporating an Open Banking API.

Begin by outlining the scope of API integration in your services. Determine which features you want to improve or introduce using banking data. Consider conducting a feasibility study to evaluate the financial aspects of the integration.

Create a phased rollout strategy that involves testing with a group of users to gather feedback and make adjustments before launching on a larger scale. This step-by-step approach helps in reducing risks and ensures an efficient integration process.

Maintenance

Lastly, be prepared for maintenance and updates as Open Banking environments are constantly evolving. Regular updates to APIs and compliance standards are typical, so it’s essential to stay informed and adaptable.

Summing Up

The Open Banking API is a great equalizer in an industry that has for too long been at the mercy of traditional financial institutions.

Open Banking represents a much-needed change and a huge opportunity for fintech companies to boost their operational efficiencies, standardize their technology, and as a result become more competitive in a rapidly growing industry.

Getting started with Open Banking does require some groundwork, but the rewards are worth the effort. With Open Banking, your fintech enterprise stands to pioneer innovative solutions in a world where dynamic and inclusive financial ecosystems stand ready to propel the industry forward and democratize banking once and for all.

Join the Open Banking Phenomenon with Intellectsoft at your Side

At Intellectsoft, we’ve had over ten years of experience developing high-quality fintech solutions, including platforms utilizing the Open Banking API.

From online banking platforms to blockchain integrations, and digital wallets – we enable financial institutions to navigate the complexities of modern financial environments with cutting-edge technology that’s as unique as your Fintech business.

We invite you to take a look at our diverse client and case study portfolios and discover how Intellectsoft can revolutionize your fintech operations.

Get in touch today and speak with one of our experts about your next fintech and Open Banking project.

FAQs

Q: What is involved in Open Banking API integration for a new FinTech startup?

Integrating an Open Banking API means linking your FinTech platform to banks using APIs.

This connection allows for real-time sharing of data and transactions enhancing your services by offering loan approvals, personalized guidance, and safe payment procedures.

Visit our fintech services page to learn more and get started today.

Q: What challenges are addressed by custom Open Banking API development?

Working with Open Banking APIs and a custom software development company can tackle issues such as ensuring data security meeting requirements and enabling seamless interactions among diverse financial platforms.

Crafting APIs can streamline operations. Improve user satisfaction ultimately boosting your service competitiveness and adherence to regulations.

Discover how our tailored solutions can transform your financial services by checking out our development solutions page.

Q: How do Open Banking APIs enhance financial transaction security?

Open Banking application programming interfaces (APIs) improve security by implementing authentication procedures, encryption methods, and ongoing supervision.

These APIs adhere to security regulations, guaranteeing the safety of customer information, from entry and data breaches.

At Intellectsoft, we’ve helped many fintech companies develop safe and secure platforms. Take a look at our case studies to understand how we can help.

Subscribe to updates

Source link