Financial technology, or fintech, has revolutionized the way we interact with money. By enabling seamless integration of technology into what we think of as traditional financial services, fintech applications are moving closer to a future where cash might be rendered obsolete.

Fintech banking apps play a crucial role in providing comprehensive online financial solutions, including account creation, loan applications, and other banking services.

The digitization of the financial sector is surging and has created an immense opportunity for tech entrepreneurs and businesses to exploit.

But what does it take to bring these innovative digital services to market? The focus of this guide is to shed light on and break down the costs of building a fintech application.

Understanding FinTech App Development

FinTech app development is a multifaceted process that involves several stages, from conceptualization to deployment. Understanding the intricacies of fintech app development is crucial for businesses and individuals looking to create a successful fintech app. The development process is influenced by various factors, each playing a significant role in determining the overall fintech app development costs.

Factors Affecting the Cost to Develop a FinTech App

So, how much does it cost to build a fintech app? It’s important to be aware that it is not a flat-rate venture, as numerous factors play their part in determining the final cost.

The scope and complexity of the project, regulatory compliances, and secure payment gateway integration all play a significant role.

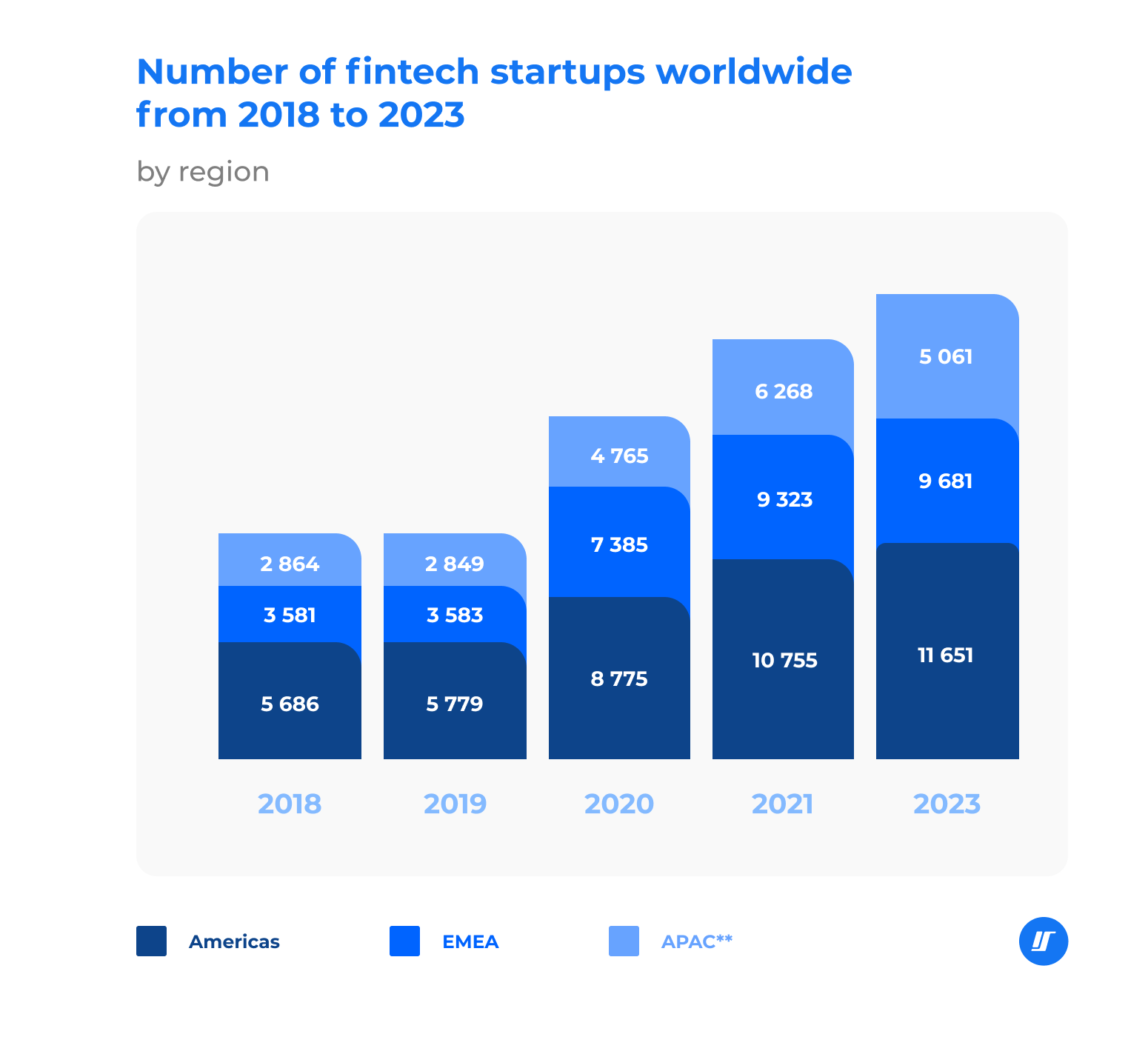

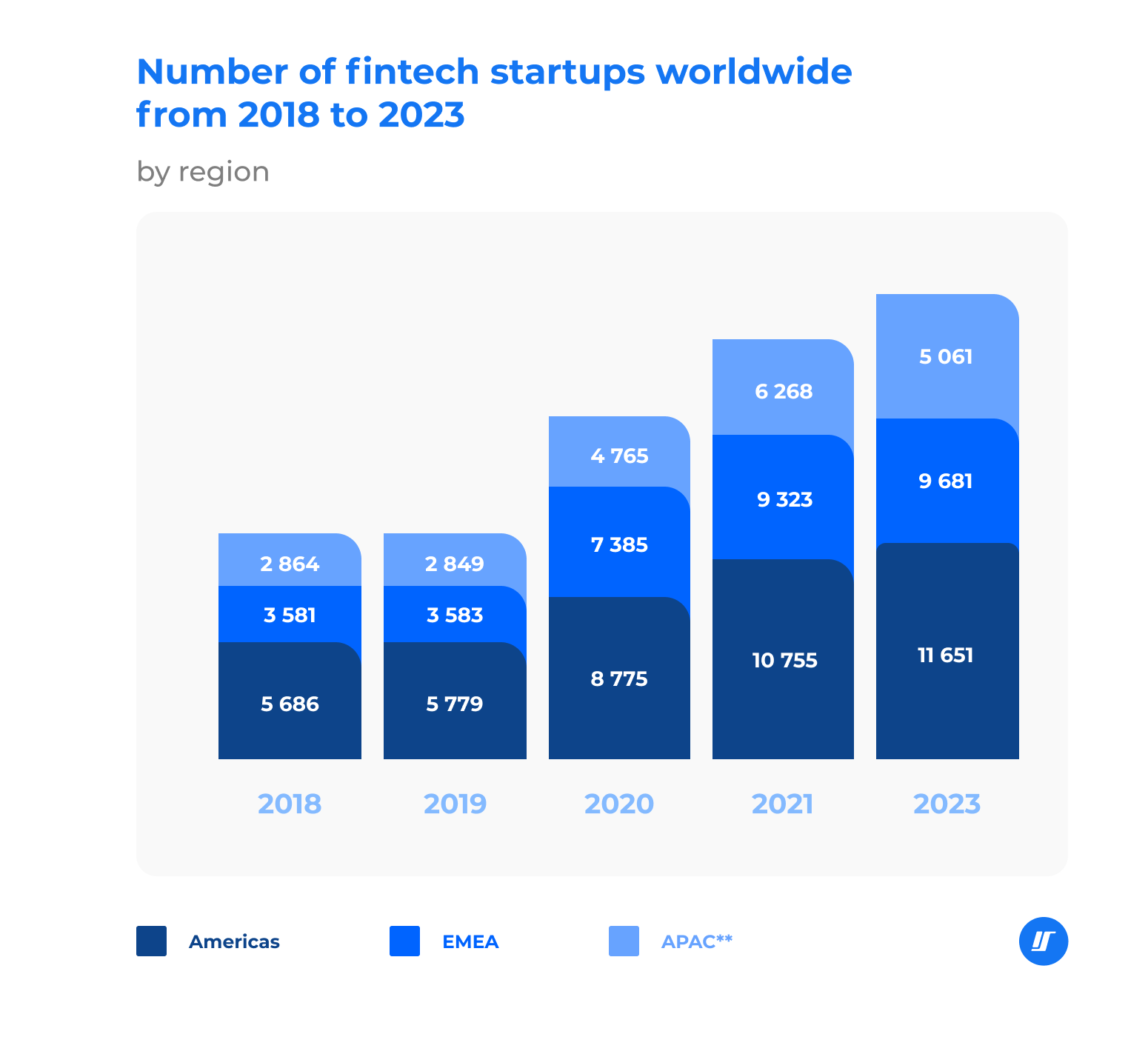

In 2023, a global surge in fintech startups with North America and the EMEA leading the charge has created an intensely competitive environment. In this landscape, it is essential to build an app that not only stands out but fulfills a unique requirement. Often this comes at an extra cost.

In addition to increased competition and the need to create a niche market, numerous factors also come into play when it comes to development expenses, such as thorough testing, custom UI/UX design, and implementing multiple payment integrations.

Features and Functionality

Fintech apps often come with complex features such as payment gateway integration, real-time analytics, security protocols, and more. More advanced features will inevitably escalate development costs. Effective time management in fintech mobile app development is crucial, as delivery time can significantly influence the overall cost of developing a financial application.

App Complexity: Exploring how the complexity of the app influences development costs.

The complexity of a fintech app is a significant factor in determining its development costs. A simple app with basic features will cost less to develop than a complex app with advanced functionalities. The complexity of an app can be measured by the number of features, the type of features, and the level of customization required.

For instance, a basic banking app that allows users to check their account balance and transfer funds may cost between $30,000 to $50,000 to develop. On the other hand, a complex investment app that provides real-time market data, portfolio management, and AI-driven investment advice may cost between $100,000 to $200,000 or more to develop. The more intricate the features and the higher the level of customization, the greater the development costs.

Platform Compatibility: Discussing the impact of developing for multiple platforms on costs.

Developing a fintech app for multiple platforms, such as iOS and Android, can significantly increase development costs. Each platform has its own set of development tools, languages, and requirements, necessitating more resources, time, and expertise. This can drive up costs as developers need to create and maintain separate codebases for each platform.

However, developing a cross-platform app using frameworks like React Native or Flutter can help reduce costs. These frameworks allow developers to create a single codebase that can be used across multiple platforms, reducing the need for duplicate code and minimizing development time. This approach not only saves on development costs but also ensures a consistent user experience across different devices.

UX/UI Design

User interface and user experience design is crucial in fintech applications. An aesthetically pleasing and intuitive design not only enhances user satisfaction but also boosts product functionality.

Security Measures

Given that fintech apps handle sensitive financial data, they require robust security measures to protect this information. The implementation of such measures, including encryption and secure payment gateway integration, adds to the development cost.

Location and Structure of the Development Team

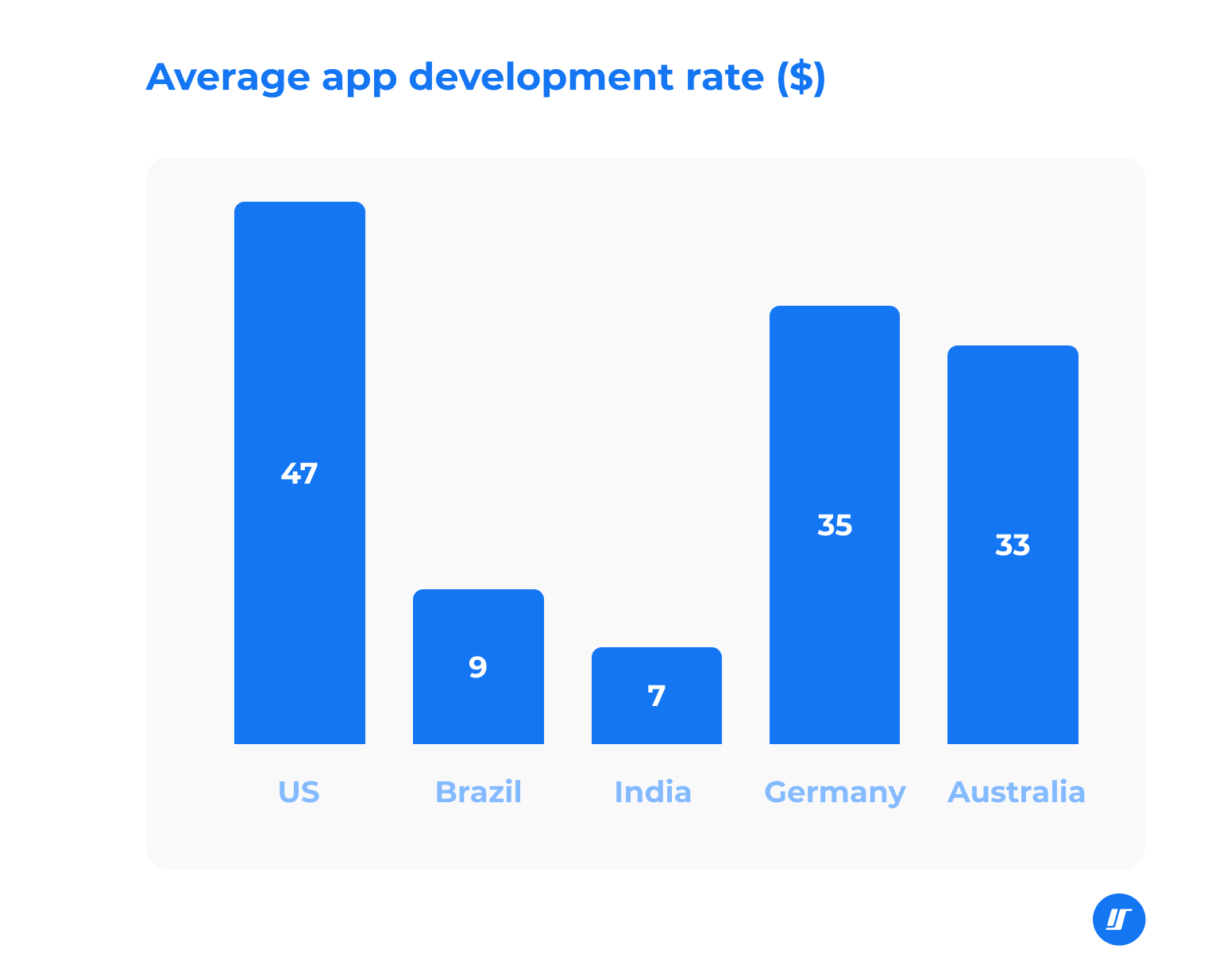

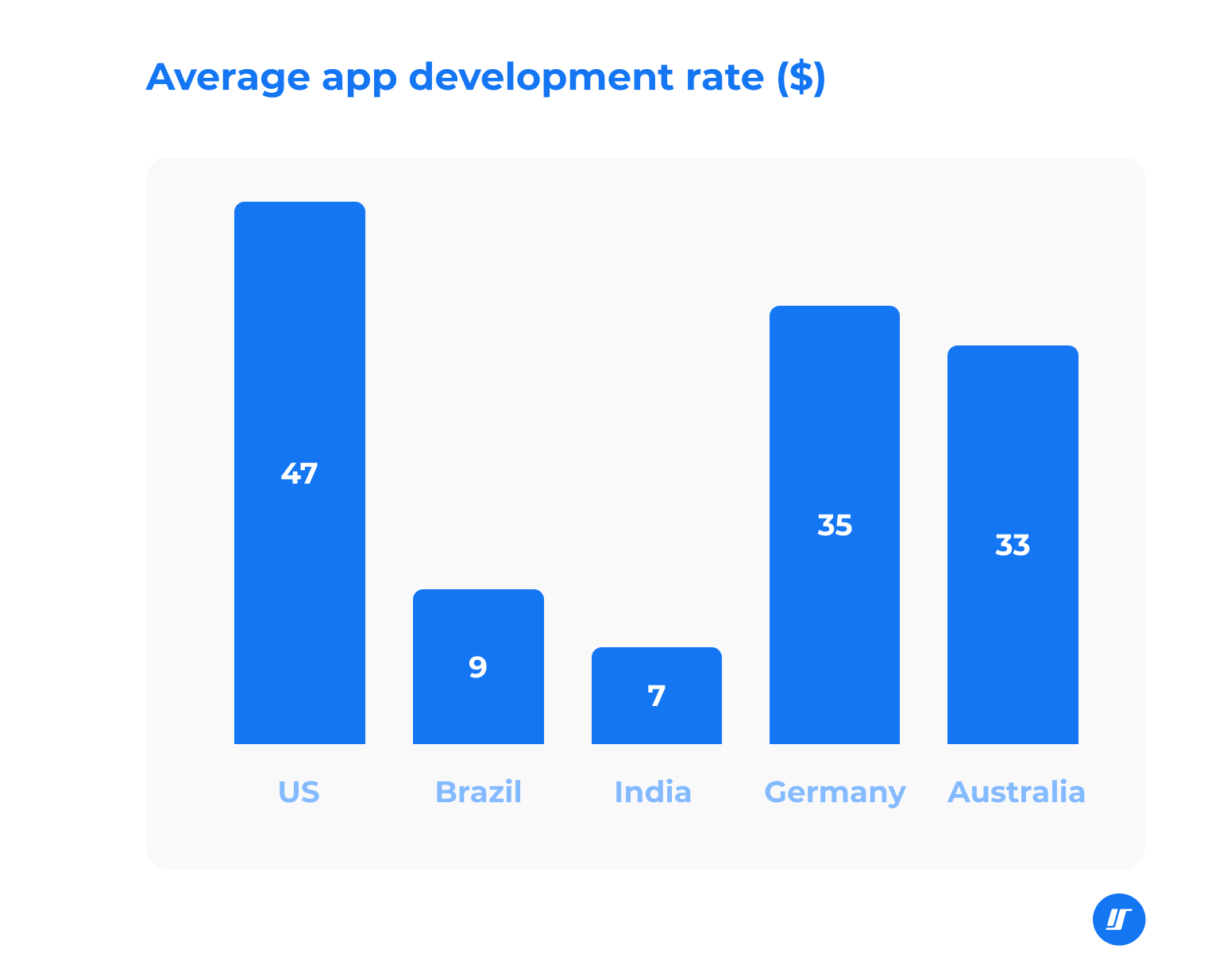

Whether you choose in-house development or outsourcing, the expertise and geographical location of your app development team can significantly impact your budget. Developers in North America and Western Europe, for instance, typically charge higher rates than those in Eastern Europe or Asia.

Development Team Expertise: Highlighting the role of team expertise in cost determination.

The expertise of the development team is a critical factor in determining fintech app development costs. A team with extensive experience in fintech app development, particularly in areas like security, compliance, and regulatory requirements, can help reduce costs by minimizing errors and bugs, ensuring compliance with regulatory requirements, implementing robust security measures, and optimizing app performance and user experience.

A team with expertise in fintech app development can also help businesses and individuals create a more effective and efficient app, which can lead to increased user adoption and revenue. Their knowledge and experience can streamline the development process, ensuring that the app meets industry standards and user expectations.

Maintenance and Updates

Post-development apps require regular updates and maintenance to keep up with changing user needs, regulatory demands, and technology trends. This is an ongoing cost that must be factored into the overall budget.

Types of FinTech Apps and Their Development Costs

FinTech apps can be broadly categorized into several types, each with its own set of features, functionalities, and development costs. Here are some of the most common types of fintech apps and their estimated development costs:

- Banking Apps: $30,000 to $100,000

- Lending Apps: $50,000 to $150,000

- Investment Apps: $100,000 to $250,000

- Insurance Apps: $80,000 to $200,000

- Personal Finance Apps: $50,000 to $150,000

These estimates are rough and can vary depending on the complexity of the app, the development team, and the technology used. However, they provide a general idea of the development costs associated with each type of fintech app.

In conclusion, fintech app development is a complex process that requires careful consideration of several factors, including app complexity, platform compatibility, and development team expertise. By understanding these factors, businesses and individuals can create a successful fintech app that meets their needs and budget.

Outsourcing vs. In-House Development

A vital aspect of the fintech app development journey involves navigating the decision between outsourcing and in-house development. The preference for either approach will ultimately shape the trajectory of the project and impact both the overall cost and the quality.

The decision is contingent on various parameters, including cost, control, expertise, and scalability.

In-House Development

Owing to having direct control over project aspects from conception to the final product, in-house development might seem like an appealing choice. This control allows for real-time monitoring, immediate feedback, and actionable quick iterations – giving you an intrinsic sense of involvement and ownership of the process.

The approach, however, comes with a unique set of challenges. Training, hiring, and retention of talent all contribute to the costs associated with building a highly skilled development team. In addition to these factors, the costs of maintaining infrastructure workspace and advanced software tools can quickly add up.

Outsourcing

Outsourcing opens the door to a global pool of seasoned professionals all with the required skills, experience, and tools to turn your fintech vision into reality.

Financial institutions are utilizing technology to enhance their services, but they face challenges such as data breaches and complexities in interacting with various financial systems in the evolving fintech landscape.

Outsourcing alleviates the burden of hiring and training costs, and the requirement for constant infrastructure and software tool updates, patching, and maintenance.

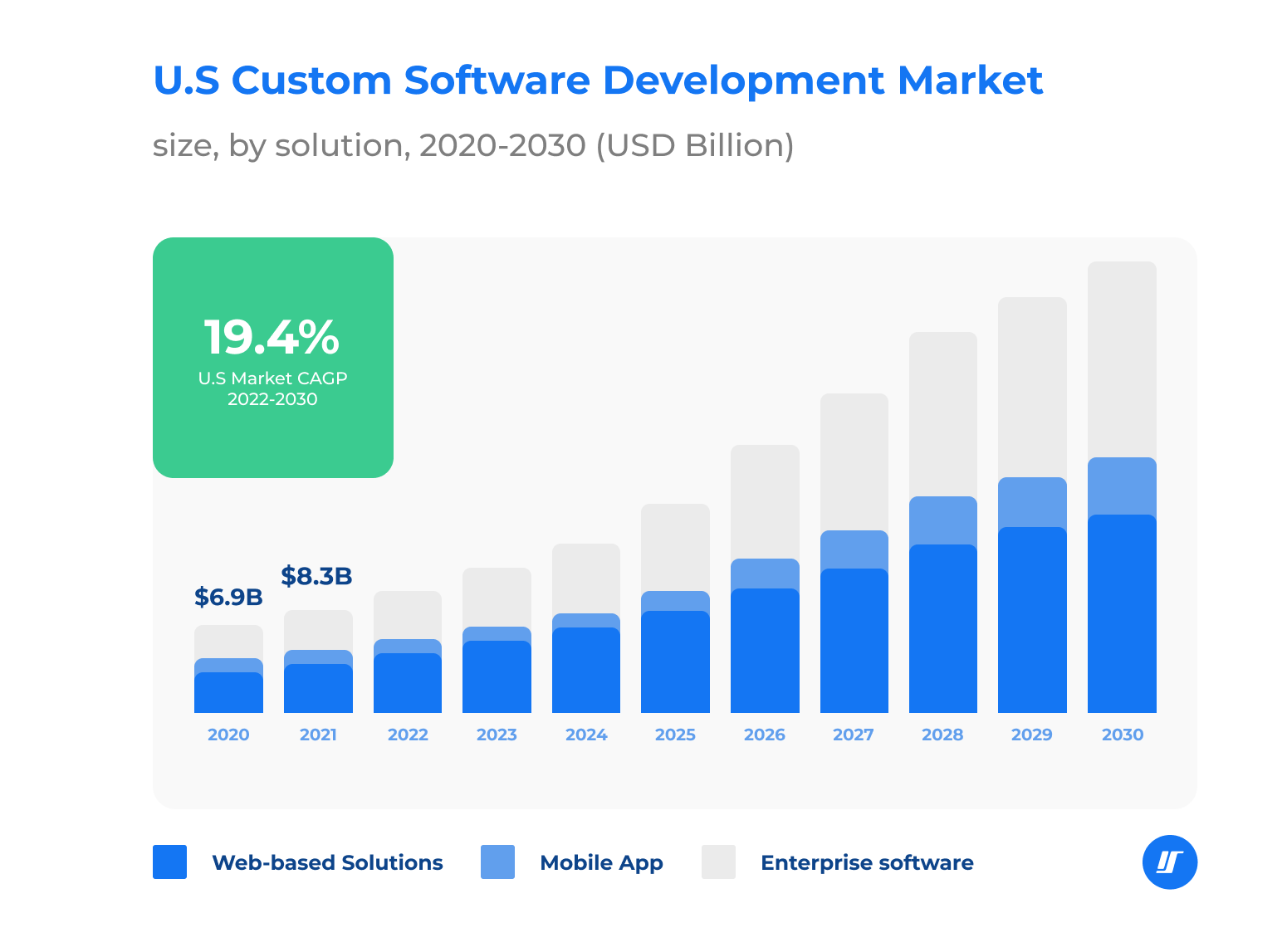

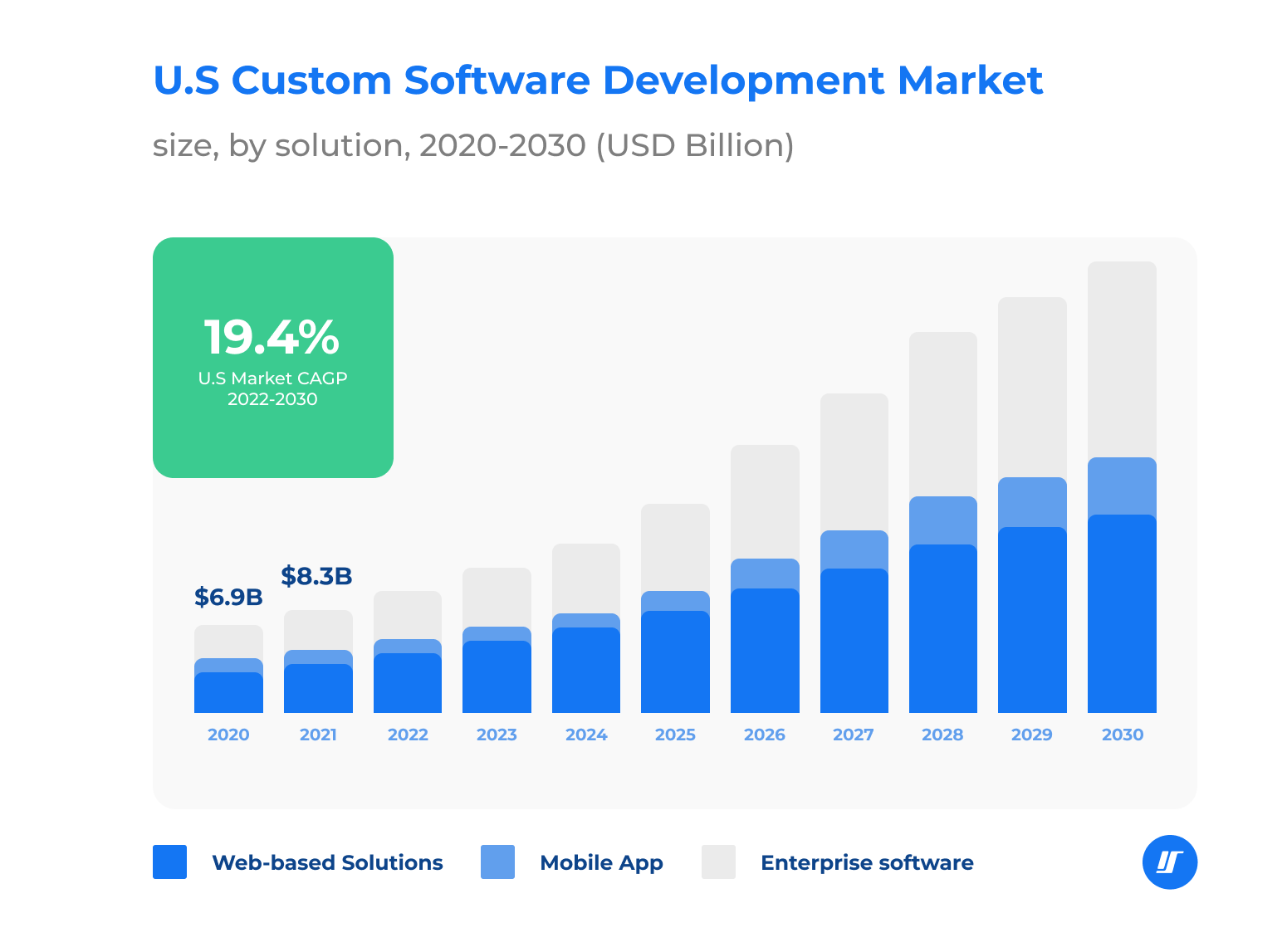

Interestingly, a growing trend within the United States hints at the increasing popularity of this approach. According to Grand View Research, the custom software development market has witnessed a steady climb, with a projected growth rate of 22.3% by 2030.

This surge in outsourcing application development suggests that businesses are beginning to recognize the value and convenience of external expertise.

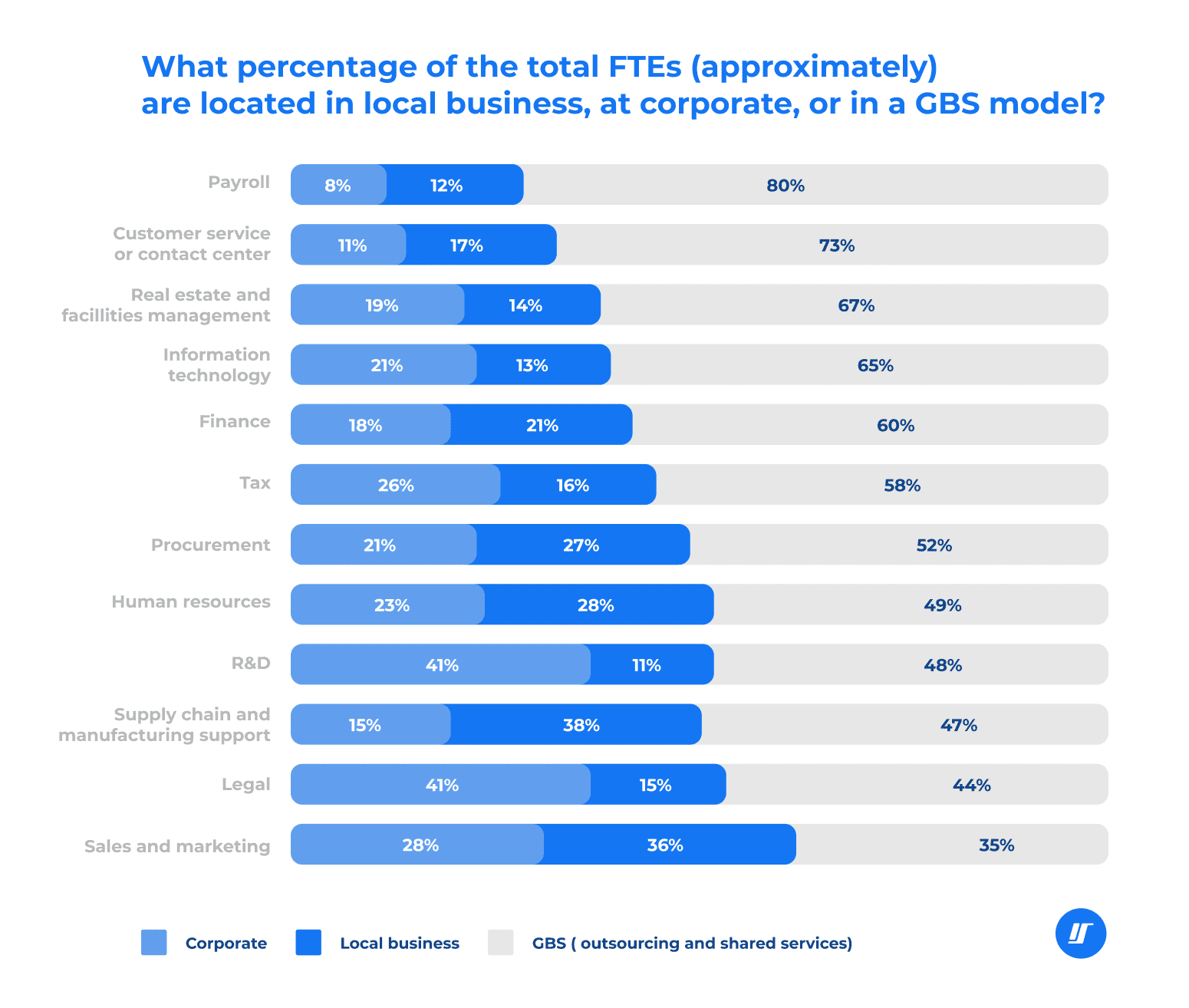

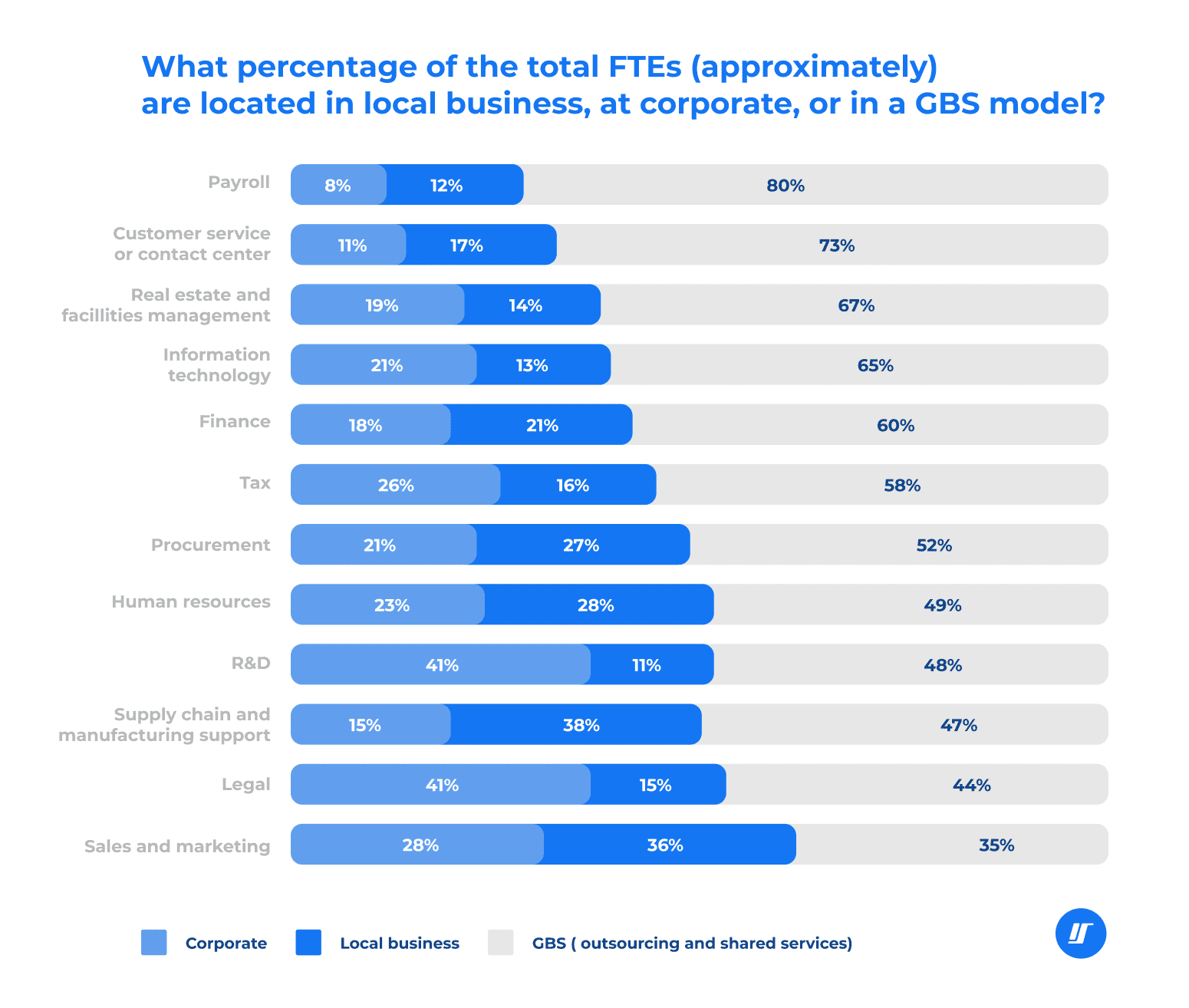

In a 2021 report titled “Global Shared Services and Outsourcing Survey Report,” Deloitte reveals that 65% of information technology is currently being outsourced.

Again, this significant figure underscores the trust businesses have placed in outsourcing, appreciating both its cost efficiency and the readily available access to specialized expertise.

While outsourcing may seem promising, it is not without its challenges, and diligence is required when choosing the right partner. Careful evaluation of their portfolio, reputation, communication skills, transparency in cost estimation, and – most importantly – specific experience in fintech should constitute a large part of the selection process.

This meticulous approach ensures you reap the benefits of outsourcing without compromising on quality, security, or functionality.

The Hidden Costs in FinTech App Development

The costs associated with fintech application development don’t stop with the completion of the development project itself. One must not overlook the additional ongoing costs that arise post-development.

Understanding these costs is key to efficient budgeting and ensuring the longevity of the app. Here we’ll devolve into these essential aspects and discuss strategies for cost optimization.

Marketing & User Acquisition: The Gateway to Success

As discussed earlier, the marketplace of fintech apps is rapidly becoming overcrowded, and standing out is no easy feat. Investing in a comprehensive marketing strategy and user acquisition is non-negotiable.

Whether leveraging social media, search engine optimization, or paid advertising, every marketing strategy entails additional costs. Additionally, attracting and retaining users necessitates a budget for customer relationship management tools, promotional offers, and loyalty programs.

Operational Costs: The Steady Stream of Expenditure

Running a successful fintech app goes beyond the realm of technology. It involves the day-to-day administrative costs, employee salaries, office rent, and utility bills.

These operational costs, while seemingly mundane, are critical to the smooth functioning of your business and must be factored into the overall budget.

Legal & Compliance Costs: The Price of Integrity

The financial industry operates within a web of regulations. Staying compliant is not an option but a necessity to avoid heavy penalties and maintain user trust.

Whether it’s data privacy laws, anti-money laundering regulations, sanctions, or banking standards, compliance involves costs for legal counsel, audits, and implementation of necessary security measures.

App Store Fees: The Unavoidable Expense

Hosting your app on platforms like the Apple App Store and Google Play is unavoidable and comes at a price. Apple charges a developer fee paid annually of $99, and Google Play requires a one-time fee of $25.

In addition to these upfront costs, both platforms claim a percentage of every single transaction performed within the app.

These expenses can add up significantly over time and must be incorporated into your financial strategy.

Strategies to Reduce FinTech App Development Costs: Making Every Penny Count

Despite the mounting costs, there are strategic approaches to managing your budget effectively. Here are the two main approaches:

1. Prioritizing Features: The Minimalist Approach

Starting out straight away with a full-fledged app can quickly become an expensive venture. Instead, focus on developing core features that solve a specific problem.

This Minimal Viable Product (MVP) approach allows you to launch your fintech app fast while gathering valuable user feedback.

Based on these user preferences, future updates can be rolled out, ensuring that every feature added contributes to functionality and user satisfaction – avoiding unnecessary expenditure and lowering costs.

2. Choosing the Right Development Partner: The Path to Quality and Efficiency

Choosing the right development partner is vital for cost-effective, quality fintech app development.

An experienced company prevents issues like poor-quality code or security vulnerabilities. But expertise should also extend to emerging technologies such as blockchain and smart contracts, crucial for enhanced security and streamlined transactions in fintech.

The right partner thus not only saves costs in the long run but also ensures a high-quality and technologically advanced app. Paving the way for success in your project and the dynamic fintech industry.

Conclusion: Deciphering the True FinTech App Development Cost

Understanding the fintech app development cost is crucial, as building a fintech app is a multi-faceted approach with expenses depending on many factors. Understanding these variables is essential in estimating the budget accurately.

Amidst all the number crunching and cost optimization, the quality of the application should never be compromised.

A well-built fintech app can be an absolute game changer, especially when designed to facilitate a niche market. It offers seamless services to customers and disruptive competition to traditional financial market players.

Trends indicate a bright future for fintech apps, making it a worthwhile investment.

When considering the potential costs involved, it’s crucial to consider all aspects – the development strategy, ongoing and post-development costs, selecting the right vendors, and keeping up with emerging technologies.

When equipped with this knowledge, you can venture into the fintech world prepared and confident.

Why Choose Intellectsoft for Financial Software Development Services?

Discover why Intellectsoft is the ideal choice for your financial software development needs. As a leading software development company, we specialize in creating secure and user-centric fintech applications across various industries.

With our extensive expertise, we offer the perfect guidance and services for your fintech app development journey.

From inception to implementation, Intellectsoft delivers end-to-end solutions that guarantee a seamless and successful fintech experience.

Embrace the opportunity to explore our cutting-edge financial software development services today and transform your fintech idea into a groundbreaking app that reshapes the digital financial landscape. Let’s work together to drive innovation and elevate the financial industry to new heights.

Subscribe to updates

Source link