If you’re a part of the fast-evolving world of Finance Technology (FinTech), you will already know that keeping up with legal and regulatory requirements is essential. One critical aspect is the Know Your Customer (KYC) compliance. This approach is integral across sectors requiring customer identity validation, like healthcare, telecommunications, professional consulting, and online marketplaces.

Legislation such as the Bank Secrecy Act (BSA), General Data Protection Regulation (GDPR), Financial Action Task Force (FATF) guidelines, and EU Directive 2018/843 require FinTech organizations to integrate comprehensive KYC and anti-money laundering (AML) compliance measures within their operational frameworks. The goal is to prevent the use of financial systems for money laundering or terrorist financing.

When it comes to choosing the right KYC solution for your business, you have two options: Custom software development and ready-to-buy systems. In this guide, we’ll explore the key differences between the two and help you make an informed choice.

What is KYC?

KYC is the process that enables financial institutions and various businesses to authenticate the identities of their clientele through digital identity solutions. This stringent mechanism serves as a shield against financial malfeasance, including fraud and money laundering. KYC ensures that the true identity of each customer is accurately established.

However, don’t think of it as merely a regulatory hoop to jump through. KYC is a practice that fortifies trust, underpins legal and regulatory conformity, and plays a crucial role in safeguarding the financial ecosystem from illicit activities. By implementing advanced KYC procedures, your business can significantly mitigate its exposure to financial risks and cultivate a safer, more reliable operating environment for your customers.

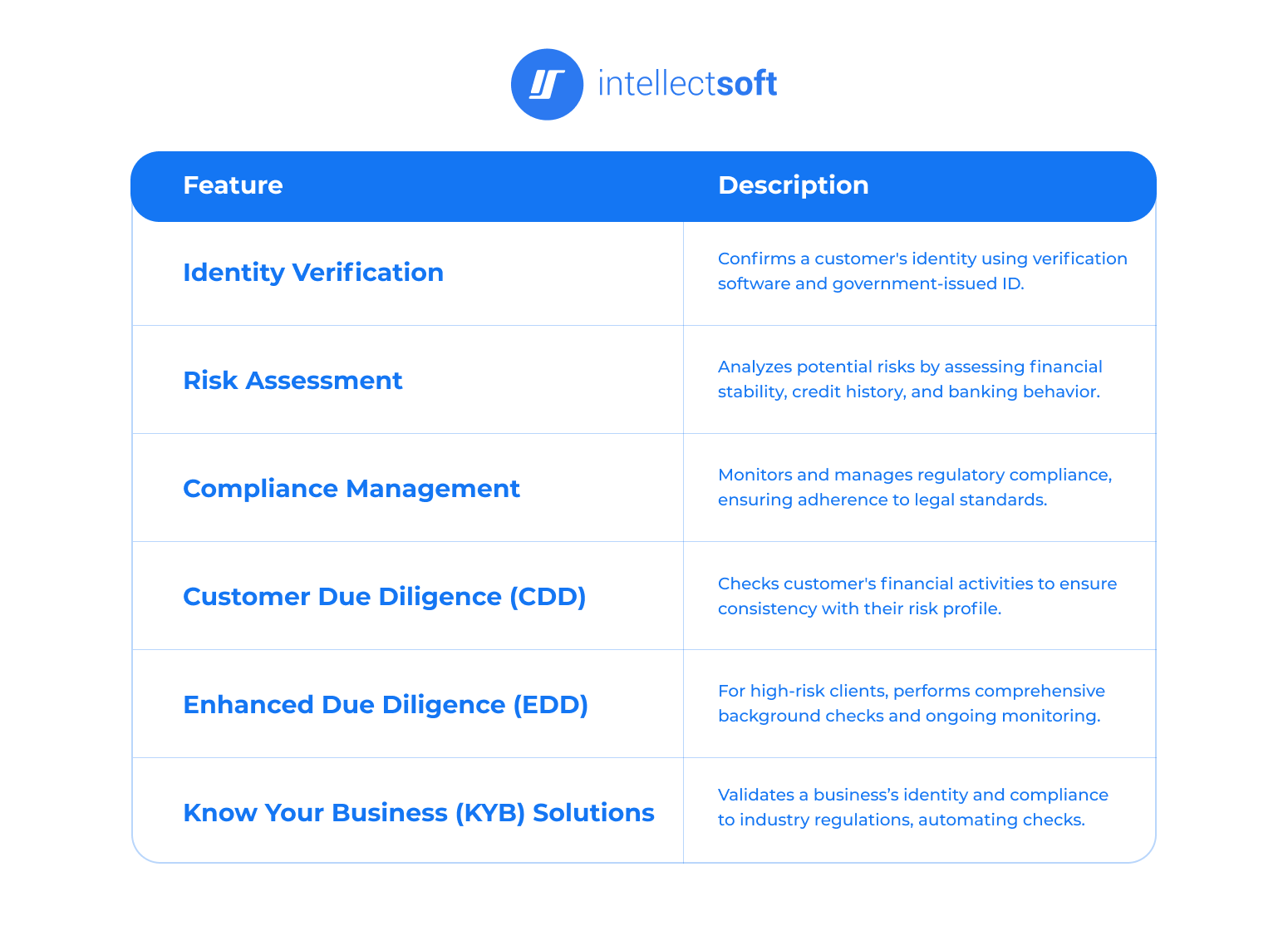

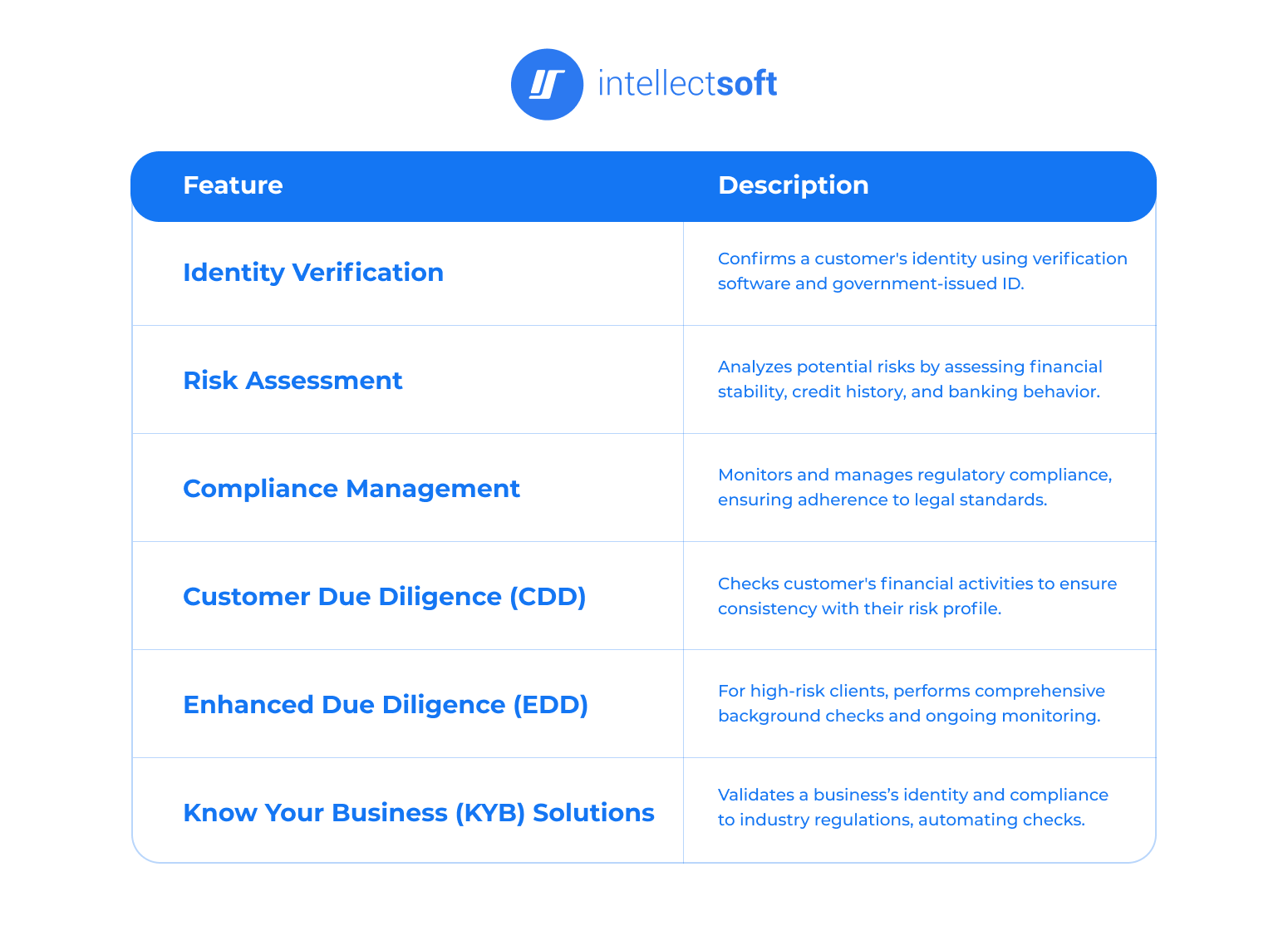

As a financial regulatory technology, KYC is ingeniously designed to incorporate essential features and functionalities, such as:

Identity Verification

Using identity verification software, KYC establishes and confirms a customer’s identity when they provide their full name, date of birth, and residential address. Upon gathering this vital information, it is incumbent upon a financial entity to authenticate it, often by a government-issued ID or document.

Risk Assessment

The system automatically conducts an in-depth analysis of potential risks that each customer could bring to your business by assessing their financial stability, credit history, and previous banking behavior.

Compliance Management

Some integral parts of the KYC tech stack are the compliance management tools, which effectively monitor, manage, and uphold regulatory compliance. By tracking changes in local and global regulations, these tools ensure that your business adheres to all necessary legal standards and avoids potential financial penalties.

Customer Due Diligence (CDD)

This refers to a series of checks conducted by a business to understand the customer’s finance-related activities and to ascertain whether those undertakings are consistent with their known financial behavior and risk profile. It often includes source(s) of funds, nature of transactions, and other ventures that might be considered high risk. KYC software can automate these processes for you, making them seamless and efficient.

Enhanced Due Diligence (EDD)

This is designated for clients deemed as high-risk, such as politically exposed persons (PEPs), affluent entities, and individuals linked to sectors or regions known for elevated risk levels. It involves comprehensive background scrutiny of the customer, focusing on verifying the origins of their wealth and any connections with potentially risky parties. This process demands ongoing monitoring in order to swiftly detect any dubious actions.

Know Your Business (KYB) Solutions

This complementary process to KYC focuses on a company’s identity and legality. It includes validating and assessing a business’s registration, ownership structure, risk levels, and compliance to industry regulations like AML. By automating these checks, FinTech organizations can do away with manual procedures like biometric verification methods.

Importance of KYC in Financial Technology (FinTech) Compliance in 2024

As we venture into the second half of 2024, the stringent emphasis on compliance makes KYC a prerequisite for any business within the FinTech sector. Here are two legal and regulatory requirements in addition to the various legislation of agencies and institutions mentioned at the beginning of this article:

Customer Identification Program (CIP)

The Patriot Act mandates that financial services firms implement a CIP to ensure they have verified the true identities of their customers. Compliance with this directive entails collecting the four essential identifying data from new clients: Full name, date of birth, address, and identification number (for example, Social Security Number or Taxpayer Identification Number).

Perpetual KYC (pKYC)

Also referred to as Continuous Monitoring, pKYC is the ongoing observation of customers’ transactions to identify signs of potential financial crimes. This initiative includes periodic reevaluation of their risk profiles to guarantee a robust defense mechanism is maintained against illicit undertakings.

Beyond its foundational role of identity verification, KYC risk management solutions ensure legal adherence, provide customers with data privacy and security, and establish a fortified barrier against the financial delinquencies that are rampant in the digital age.

The implementation of sophisticated KYC processes is no longer a matter of choice but a strategic move that aligns with the global push towards more transparent, secure, and accountable financial services. As regulations become more intricate and encompassing, the role of KYC becomes even more critical.

This heightened significance is further amplified by the dual benefits it offers—shielding you from reputational damage and financial penalties of non-compliance and enhancing operational efficiency through a streamlined customer onboarding process and risk assessment protocols.

Moreover, KYC serves as a key enabler for FinTech companies to innovate responsibly. Through AI-powered machine learning in KYC, you can leverage emerging technologies to offer safer, more reliable services to your customers.

Ready-to-Buy KYC Solutions

If you are a business owner too busy to build your own regulatory compliance software, off-the-shelf packages are a convenient option. Engineered with precision to cater to a spectrum of FinTech security solutions, they feature seamless identity verification, meticulous compliance management, and proactive risk assessment straight out of the box.

IDology from Acuant, Jumio, Onfido, and Trulioo are some of the best examples of these KYC solutions. They offer robust frameworks that integrate effortlessly into existing systems to streamline the intricate processes of CDD and pKYC.

Benefits of Ready-to-Buy KYC Solutions

The advantages of ready-to-use user authentication systems cater to the pressing needs of businesses aiming for agility and efficiency without the gestational period typical of bespoke software development.

Quick Deployment

With the clock ticking on compliance deadlines and the pace of digital transformation accelerating, ready-to-buy solutions are practical and enable you to navigate the regulatory landscape with unprecedented speed. This attribute is especially important for organizations planning rapid market entry.

Lower Initial Costs

Avoiding hefty upfront development costs is a significant draw for ventures keen on optimizing their initial outlay on compliance infrastructure. These cost-effective options promise regulatory adherence without the daunting financial commitment to tailor-made software. Aside from alleviating initial financial pressures, they allow for the reallocation of resources towards other strategic areas of operation.

Vendor Support

With a safety net of expert guidance and technical assistance, you can balance compliance with commercial agility. This support system ensures that KYC solutions are not just deployed but also maintained and updated according to current regulatory standards and technological advancements.

Challenges of Ready-to-Buy KYC Solutions

While marked by convenience, ready-to-buy KYC solutions also come with certain complexities that you should meticulously weigh against the bespoke fit and flexibility of custom solutions.

Limited Customization

Off-the-shelf solutions are designed to cater to a broad market and come with this inherent limitation, which might not align perfectly with the nuanced requirements of your operation. Such constraints can lead to a mismatch between the functionalities offered and the specific needs your business aims to address, potentially leaving gaps in your KYC process.

Potential Integration Issues

The architecture of ready-to-buy solutions may not seamlessly mesh with your existing digital infrastructure. This misalignment may result in operational friction, additional technical hurdles, and unforeseen costs as you strive to achieve a harmonious integration for efficient workflows and data coherence.

Dependency on Vendor

Your reliance on vendor support could extend to critical aspects such as updates, troubleshooting, and the introduction of new features. While these are invaluable, it also places your business in a position where timely adaptations to regulatory changes or technological advancements are at the mercy of an external party’s timeline and priorities.

When weighing between custom KYC software development and ready-to-buy solutions, you should focus on your unique business requirements. Below are the factors to consider.

Cost Analysis

On the financial front, a custom KYC design generally demands a higher upfront investment. However, it offers the potential for a bespoke solution that can evolve alongside your business, possibly reducing costs over time.

In contrast, ready-to-buy solutions offer a lower initial cost, though potential future expenses for upgrades and customizations should not be overlooked.

Time to Implementation and Development

A custom KYC solution necessitates a significant development window before deployment, a period during which market and regulatory dynamics may shift.

Meanwhile, ready-to-buy options shine in their rapid deployment capabilities, allowing businesses to meet immediate regulatory demands. However, they may fall short when faced with the need for adaptability and customization.

Customization and Flexibility

In these areas, customized KYC distinctly outpaces off-the-shelf solutions, providing tailored features and scalability to meet future needs. Conversely, the latter may offer a fast and effective start but can limit strategic flexibility due to their generic design.

Security and Compliance

Both options can meet high standards of financial technology (FinTech) compliance as well as data privacy and security, but custom solutions allow for a tailored security posture that aligns closely with specific business risks and regulatory requirements.

Support and Maintenance

While vendor support is a strong advantage of ready-to-buy solutions, custom development offers the opportunity to build and maintain a solution with dedicated in-house or contracted support teams. This approach offers a deeper understanding of and responsiveness to your business’s unique ecosystem.

Choosing the Right Regulatory Compliance Software for Your Business

You need to take a deliberate and nuanced approach when selecting the optimal KYC solution for your business. One crucial aspect is to engage in a holistic assessment of your operational, regulatory, and strategic needs.

Here’s a simple 3-step process to follow:

1. Assess Your Business Needs

Begin by candidly evaluating your business’s scale, the complexity of your customer interactions, and the regulatory environment in which you operate. Budgetary constraints and the urgency of deployment timelines also play pivotal roles in shaping your decision.

2. Questions to Ask Before Deciding

Asking probing questions is key: What level of customization will truly align with your long-term business objectives? How will the choice between a custom-developed or a ready-to-buy solution impact your ability to scale and adapt in a rapidly evolving FinTech ecosystem? This process should not be a solitary exercise— ensure you have a collaborative dialogue with stakeholders across your organization.

3. Consulting with Experts

Finally, the wisdom of external expertise and years of experience cannot be overstated. Seasoned professionals like the Intellectsoft team, who bring both insights and foresight, can illuminate paths and possibilities that may not be immediately apparent.

From fraud detection systems to automated KYC processes to blockchain for KYC, our guidance can help you navigate the complex decision-making landscape with confidence and strategic acuity.

Moving Forward with Your KYC System

The complex world of KYC solutions requires a thoughtful and strategic approach in order to balance regulatory compliance with the demands of your business operations. Choosing between custom KYC software development and ready-to-buy solutions is not merely a financial decision; It is a pivotal step that can define the agility and resilience of your financial operations.

On the one hand, a custom KYC solution is higher priced and takes time to implement, though it offers the flexibility to be designed according to your specifics and to scale as your business grows. On the other hand, ready-to-buy solutions may be more affordable and quicker to deploy, but their customization is limited.

You should engage deeply with the selection process and consider both the immediate implications as well as the long-term impact on innovation and adaptation. It is also crucial to have a mindset geared towards understanding that the right KYC solution is a vital component in the broader quest to provide secure, compliant, and user-centric financial services.

At Intellectsoft, we offer bespoke software development solutions in FinTech through industry-standard methodologies and state-of-the-art technology. Your KYC and KYB systems will be in the good company of Fortune 500 companies like Walt Disney, Jaguar, Guinness, Audi, Harley Davidson, and Eurostar.

Protect your business from bad financial actors while delivering a satisfactory customer journey without missing any compliance requirements. We’ll do all that for you so you can focus on growing your enterprise. Reach out now for a consultation.

FAQs

What are the essential features integral to KYC software?

These are the pillars of a robust KYC framework:

- Identity verification

- Compliance management

- Risk assessment

- Customer due diligence

They collectively contribute to a system’s efficiency in mitigating risks and ensuring compliance.

What should I look for in a custom KYC software provider?

Hire a vendor with a proven track record in the following aspects:

- KYC compliance and regulations

- Scalability

- Competitive pricing

- Comprehensive integration capabilities

- Data privacy and security

- Customer support

Does your business require separate KYC and KYB software?

No. KYC is an integral part of KYB in terms of the verification of identities that make up the company being vetted. However, if you intend to conduct both, you should inform your provider at the outset so that both processes will be embedded in your single system.

Subscribe to updates

Source link