In a decisive step toward modernizing its global infrastructure, Western Union has initiated a broad AI-driven transformation of its operations. This move reflects a growing trend among financial institutions to re-engineer legacy processes, improve agility, and embed intelligence into their daily workflows. As the demand for real-time responsiveness, operational resilience, and cost-efficiency continues to grow, Western Union’s upgrade signals a strategic shift in how established fintech players adapt to a data-intensive, automation-first world. Curious how this could work in your environment? Let’s explore it↗.

Key Facts from the Initiative

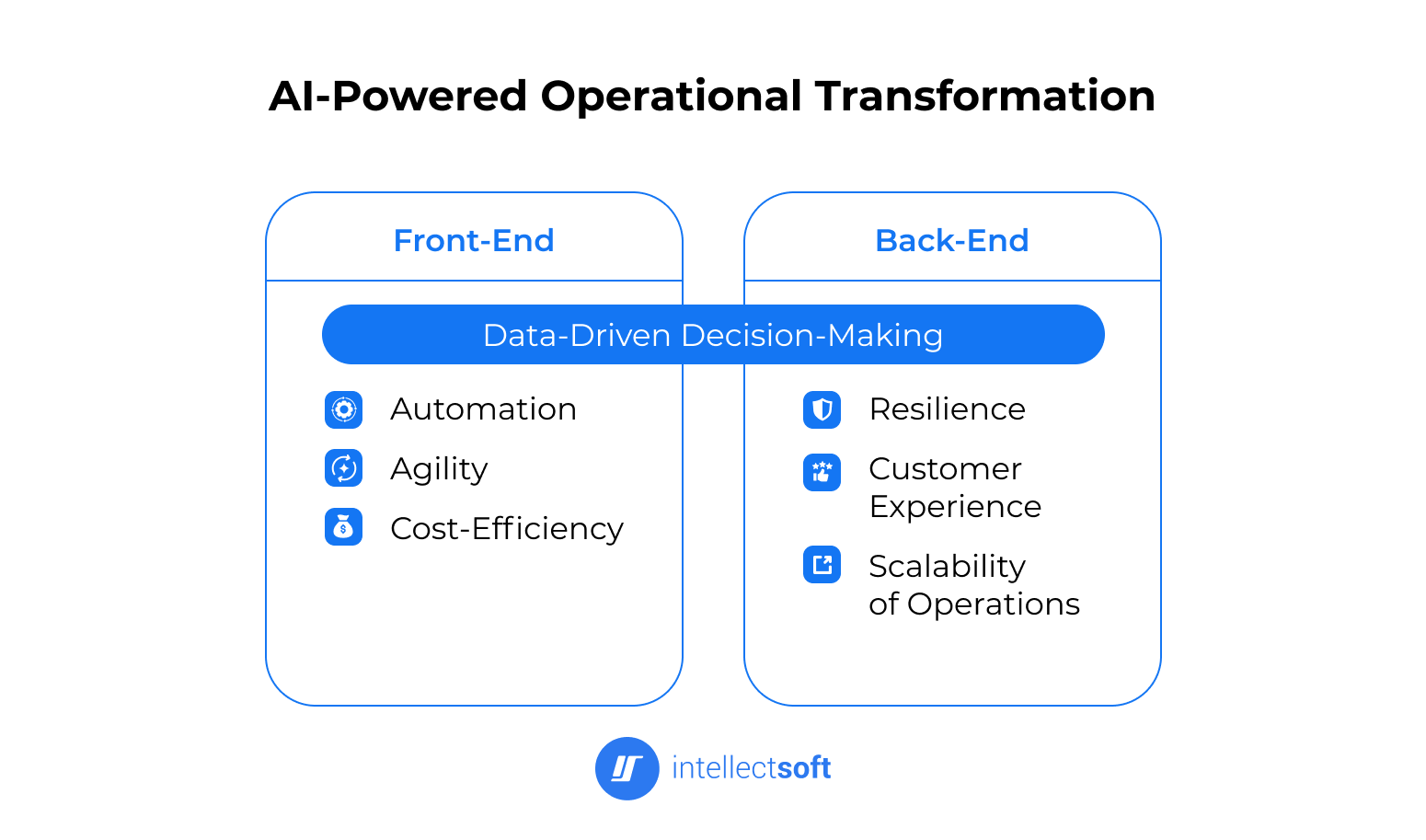

Western Union’s transformation focuses on implementing AI across both front-end and back-end operational layers. The initiative aims to enhance user experiences, reduce manual overhead, and infuse intelligence into decision-making processes across the organization. With AI increasingly becoming a foundational layer in financial services, this upgrade positions Western Union to deliver faster, more responsive services while strengthening internal systems for scalability and efficiency.

Scope of the Transformation

The initiative spans the entire operational spectrum—from consumer-facing interfaces to back-office systems. On the front end, AI supports improvements in digital onboarding, service personalization, and customer support automation. On the back end, the focus shifts to intelligent workflow orchestration, data processing, and enhanced compliance. At its core, this transformation is about enabling real-time, data-driven decision-making that drives consistent, adaptive, and measurable outcomes across the business.

Why This Move Matters in Fintech

Western Union’s investment in AI-driven operations is emblematic of a larger imperative across the financial technology sector: evolve or fall behind. Today’s fintech ecosystem is defined by accelerating complexity—greater regulatory scrutiny, rising customer expectations, and a constant influx of new digital competitors. To maintain relevance and scale efficiently, operational modernization has become non-negotiable.

Modern fintechs are expected to deliver seamless digital experiences while maintaining rigorous compliance and security standards. The traditional trade-off between speed and control is no longer viable. AI and machine learning offer a path forward—enabling firms to design operations that are not only efficient but also adaptive and intelligent.

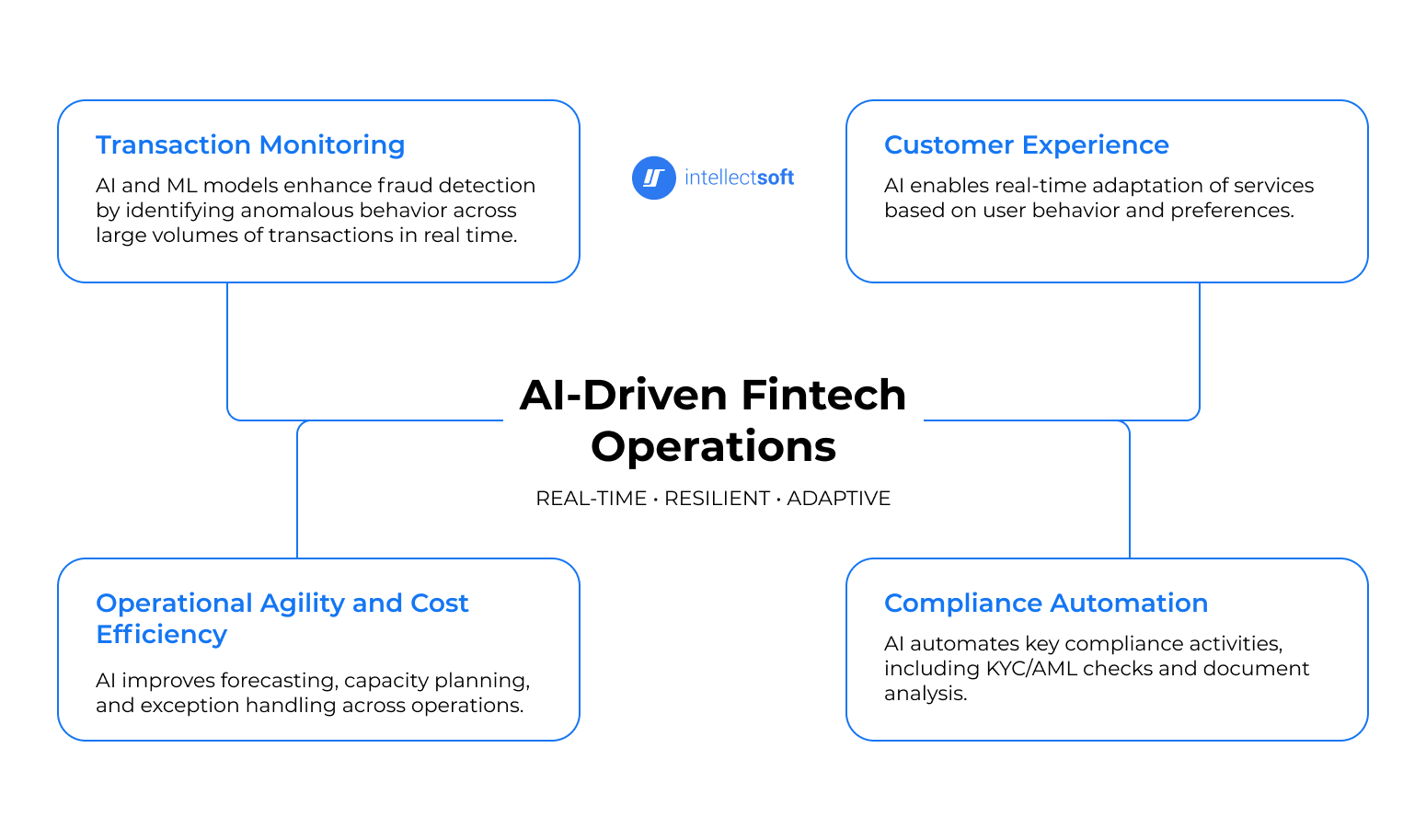

AI’s growing footprint in fintech operations spans several high-impact domains:

Transaction Monitoring

AI and ML models enhance fraud detection by identifying anomalous behavior across massive transaction volumes in real time. These models continuously learn and improve, reducing false positives while catching increasingly sophisticated threats. Automated workflows allow immediate escalation or blocking of suspicious activity without human delay.

Customer Experience

From personalized onboarding flows to AI-powered support agents, AI enables real-time adaptation of services to user behavior and preferences. Natural language processing (NLP) allows for more intuitive interfaces, while recommendation engines tailor financial products to individual needs—raising both satisfaction and engagement.

Compliance Automation

Regulatory requirements are dynamic and region-specific, making manual compliance a bottleneck. AI automates key compliance activities such as KYC/AML checks, documentation analysis, and audit trail generation. These systems ensure audit readiness and reduce the risk of oversight, even as frameworks evolve.

Operational Agility and Cost Efficiency

AI enhances forecasting, capacity planning, and exception handling—enabling operations to flex with market shifts. Whether it’s reallocating resources or rerouting workloads, AI helps reduce fixed costs and improves responsiveness.

The throughline across all these domains is the shift to real-time, resilient, and adaptive operations. This isn’t about automating the old way of doing things—it’s about redefining how fintechs operate at their core. For a company like Western Union, embedding AI into operational DNA is a foundational step toward long-term scalability and relevance.

When we talk about AI in ops, people often expect flashy automation. But real value lies in systems that can suppress noise, detect operational drift early, and route exceptions based on context—not rules. That’s where cost and risk drop at scale.

Yevhen Kulinichenko, CTO at Intellectsoft

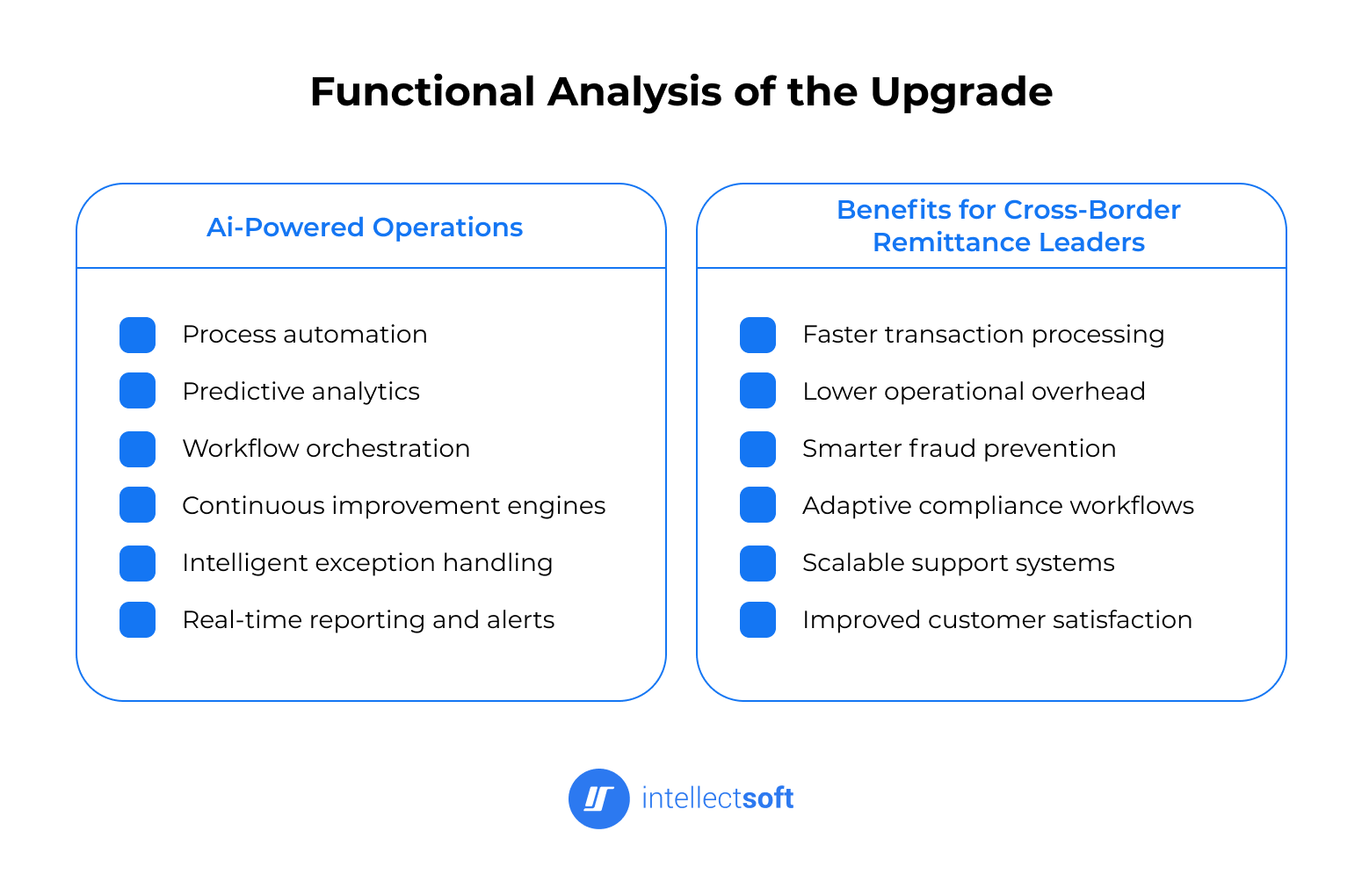

Functional Analysis of the Upgrade

When Western Union speaks of AI-powered operations, it suggests a fundamental shift from traditional workflow optimization to deeply integrated, intelligence-driven processes. These aren’t standalone automations or isolated ML models—they’re systems that observe, learn, adapt, and execute across a wide spectrum of operational tasks.

At the core, this means using AI not just to accelerate what already exists, but to rethink how work is done. Manual checkpoints are replaced with smart triggers. Processes are dynamically routed. Decisions are informed by data patterns rather than static rules. Over time, the system improves itself through continuous feedback loops and performance data.

For cross-border remittance leaders like Western Union, the implications are substantial. Global money movement involves high transaction volumes, compliance with regional regulations, and the need for real-time responsiveness. These demands make traditional operations brittle and expensive.

With AI in place, Western Union can move toward a model where operational scale doesn’t require a linear increase in human resources. Instead, systems handle complexity autonomously, escalating only the most nuanced exceptions. This shift not only reduces cost but improves speed, accuracy, and customer experience.

This kind of transformation is especially critical for institutions with global reach and legacy infrastructure. By embedding AI into the operational core, Western Union is not just modernizing its stack—it’s fundamentally changing how the organization scales, responds to risk, and delivers value. The ability to route decisions intelligently, act in real time, and continuously optimize execution gives the company a strategic edge in a market where latency, error, and inefficiency are no longer tolerable. In a sense, AI becomes the new operational operating system—one that’s built for volatility, growth, and constant reinvention.

How to Develop and Deploy Such Solutions

Building AI-powered operations at the scale and complexity of an institution like Western Union is not a plug-and-play endeavor. It requires a structured, multi-stage approach that blends strategic planning with deep technical execution. The goal isn’t just to implement AI—but to integrate it meaningfully into the heart of operational systems, with all the scalability, governance, and resilience that financial services demand.

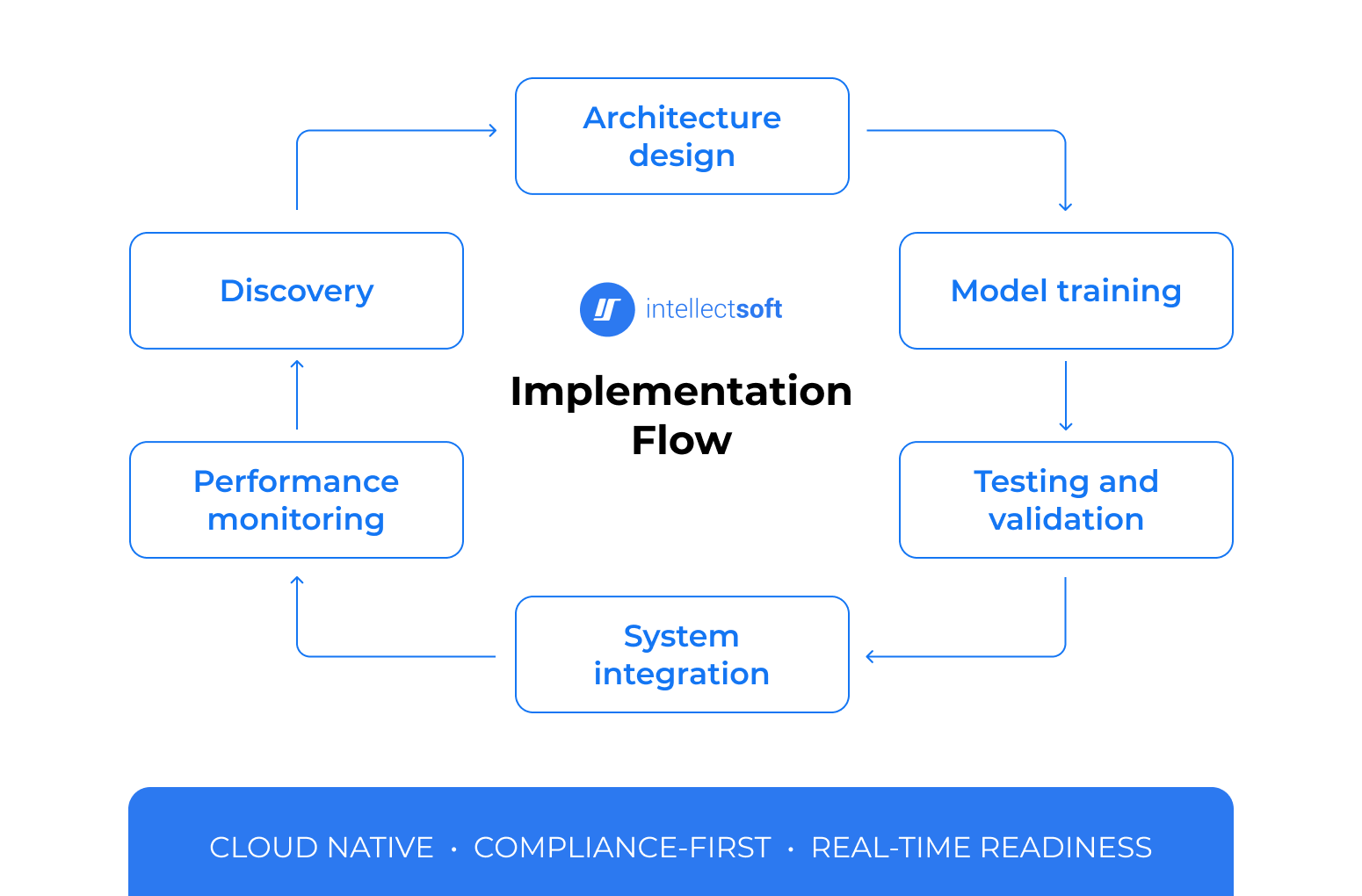

The journey typically begins with discovery, where business objectives are translated into actionable use cases. This stage involves mapping existing workflows, identifying inefficiencies, and defining success metrics. From there, architecture design follows—where data pipelines, model environments, and integration layers are planned to align with enterprise systems.

Next comes model training, where datasets are cleaned, labeled, and used to develop algorithms that match the defined use cases. This is followed by rigorous testing and validation, ensuring the model performs accurately, reliably, and ethically across scenarios. Once models pass quality gates, they move into integration, connecting seamlessly with production environments via APIs, orchestration platforms, or middleware.

This cycle is supported by a robust technical backbone. Cloud infrastructure—often hybrid or multi-cloud—is essential to deliver the elasticity and compute power required for model training and real-time processing. Additionally, data infrastructure must support secure ingestion, governance, and lineage to ensure that AI outputs are trusted and explainable.

Equally critical is compliance and security. In a financial context, every AI decision must be auditable, every model explainable, and every dataset protected. Adherence to GDPR, SOC 2, and local regulatory frameworks is not optional—it’s foundational. Encryption, anonymization, access control, and incident response protocols must be embedded into every layer of the AI deployment stack.

What Makes an AI-Driven Ops Model Effective

Building and deploying AI within operations is only the first step. True effectiveness comes from how well the system continues to evolve, adapt, and align with the broader goals of the organization. An AI-driven operational model must not only work technically—it must deliver sustained business value, operate within complex legacy environments, and improve over time.

The foundation of any effective model is alignment between AI capabilities and business objectives. It’s not enough to implement intelligent automation for its own sake—each AI initiative must be tied to a measurable outcome: reducing operational cost, improving customer resolution time, increasing transaction visibility, or enhancing compliance accuracy. AI systems should be designed around these targets from the outset, with performance tracked and tuned accordingly.

Equally important is continuous model retraining and feedback integration. Operational environments are dynamic: user behavior shifts, fraud patterns evolve, regulatory demands change. A static model will become obsolete. The most resilient AI ops architectures incorporate ongoing feedback loops—where system performance, exception handling, and user outcomes are fed back into the model pipeline. This creates a self-improving system that adapts without requiring constant manual intervention.

Another critical success factor is interoperability with existing systems. Large financial institutions like Western Union don’t operate on a greenfield stack—they have legacy systems, hybrid cloud deployments, and regional infrastructure constraints. Effective AI models must be modular, API-driven, and designed to function across environments that include both modern platforms and decades-old core systems. Seamless integration, not wholesale replacement, is often the path to scalable, real-world adoption.

Core Pillars of an Effective AI-Driven Ops Model

- Every AI application should be designed around clear business goals and linked to operational KPIs from day one.

Models must support retraining, feedback ingestion, and performance monitoring to remain effective in changing environments.

AI workloads require elastic compute, reliable data flow, and robust orchestration across cloud and hybrid platforms. - Models must plug into existing architectures with minimal disruption, supporting legacy systems and modern APIs alike.

- Effective models offer explainability, audit trails, and compliance reporting to satisfy regulatory and internal requirements.

When these elements are in place, AI transforms from an isolated innovation into a sustainable foundation for operational resilience.

Lessons for Financial Institutions and Fintechs

Western Union’s transformation offers a strong signal to the broader financial services industry: AI is no longer a future-facing experiment—it’s an operational imperative. For institutions still reliant on manual workflows, legacy architecture, or siloed data systems, the question is not if to modernize, but when and how. Triggers often emerge in the form of mounting operational costs, increasing compliance complexity, or growing customer demand for personalized, instant service.

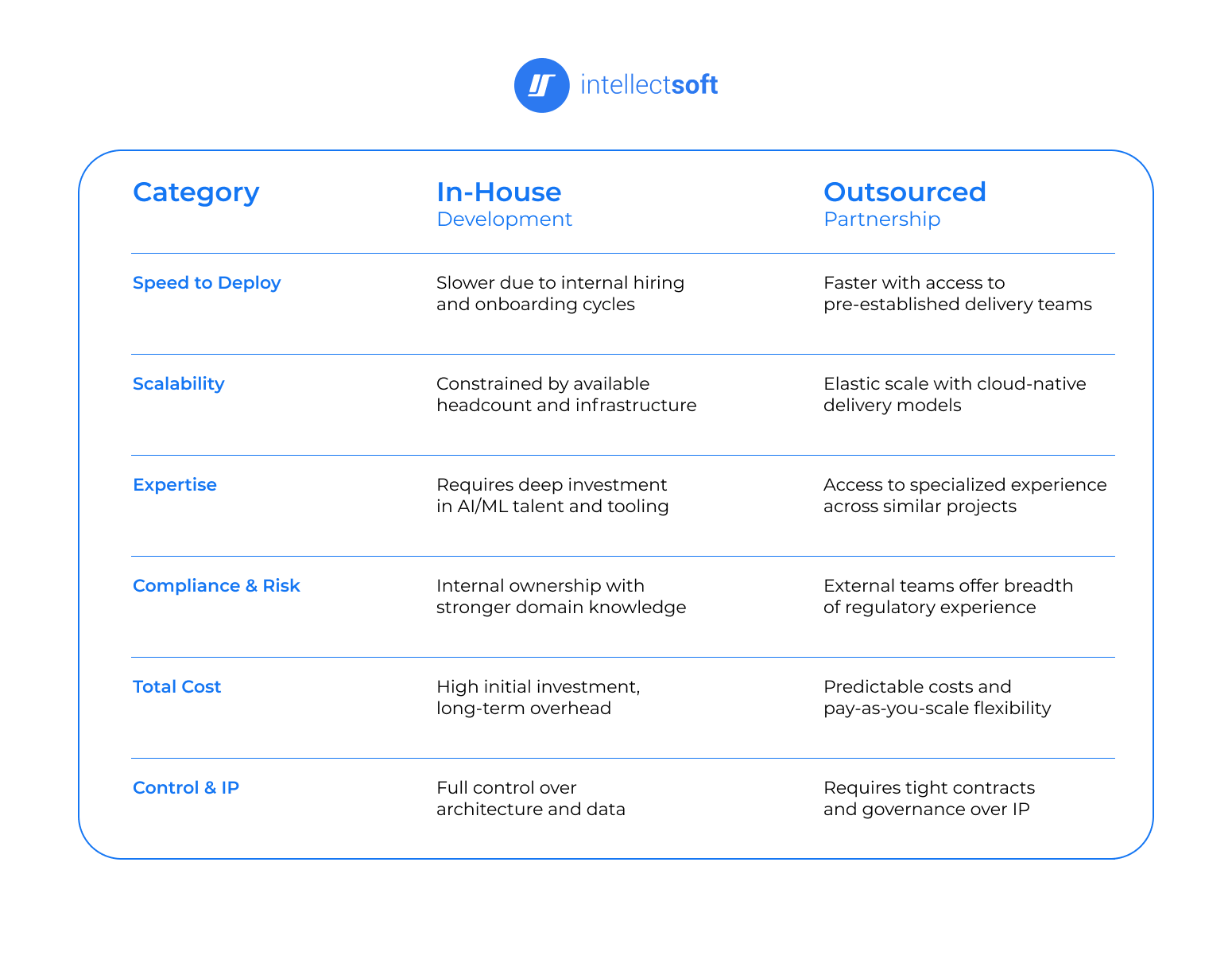

For organizations looking to make this shift, a critical decision lies in the approach—whether to develop solutions internally or bring in external expertise. While building in-house offers full control, it often comes at the cost of time and access to niche capabilities. On the other hand, outsourcing can accelerate results by leveraging pre-built frameworks, specialized talent, and cross-industry insights.

You can own the stack or rent velocity—but rarely both. What we’ve seen work best is a hybrid approach: keep architectural control, but partner for acceleration in areas like ML engineering, tooling, and observability.

Yevhen Kulinichenko, CTO at Intellectsoft

ROI Benchmarks and Success Indicators

For financial institutions, understanding the return on investment from AI-powered operations requires a shift in how value is measured. Traditional IT metrics like deployment time or system uptime must be augmented with outcome-oriented indicators that reflect operational and strategic value.

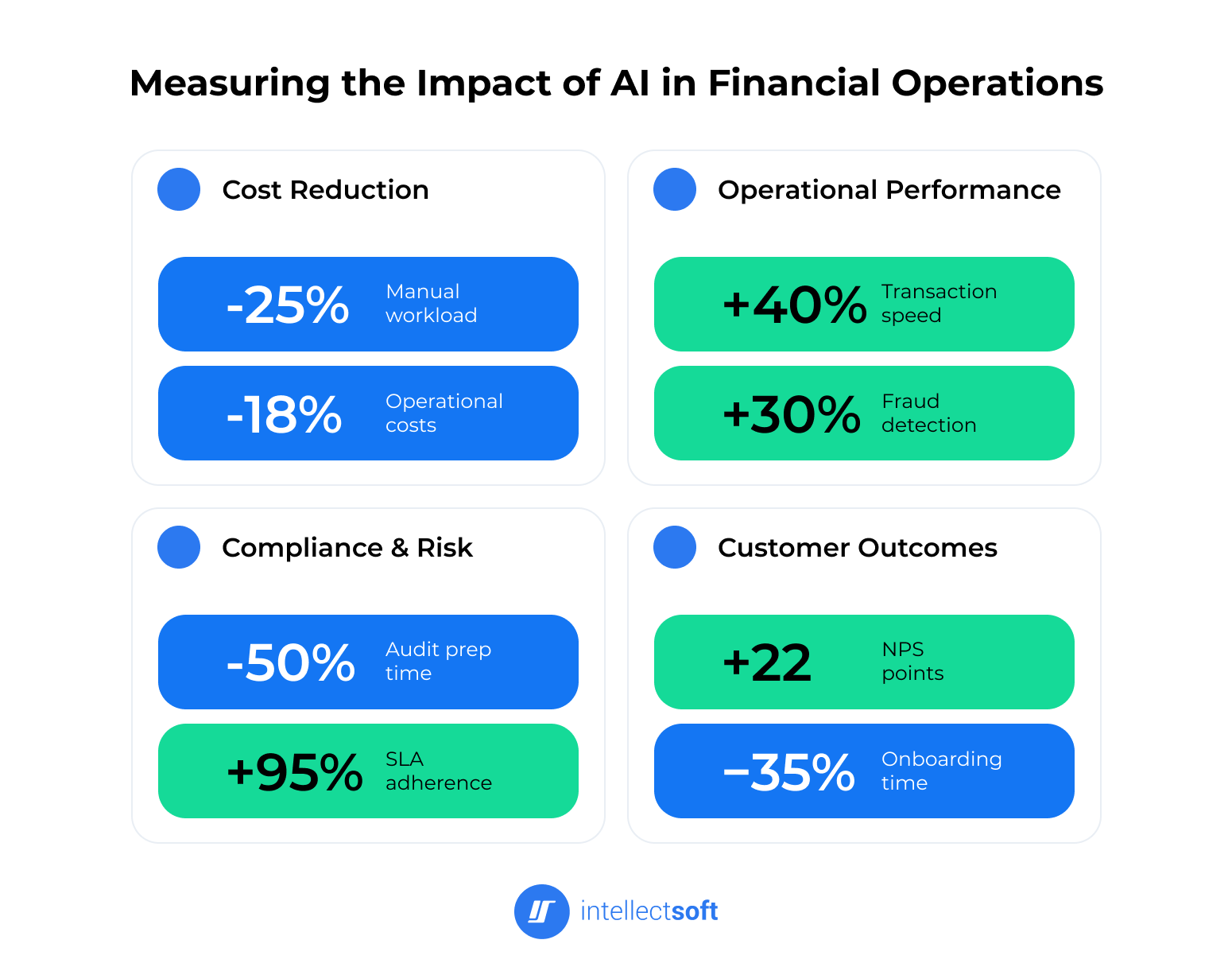

ROI benchmarks for AI in operations often begin with cost reduction—such as decreasing manual processing time, lowering headcount in repetitive workflows, or improving infrastructure efficiency through automation. But equally important are performance gains that compound over time: improved fraud detection accuracy, faster transaction resolution, or higher compliance pass rates in audits.

Organizations should also monitor success indicators tied to responsiveness and quality. These include improvements in customer support SLAs, turnaround time for onboarding or verifications, and reduced error rates in exception handling. Over time, more mature AI deployments begin to impact broader KPIs—like net promoter score, time-to-market for new services, and regulatory risk exposure.

Ultimately, the most meaningful success indicators align closely with business goals. If AI is used to streamline cross-border payment operations, then its impact should show in transaction throughput, time per transfer, and issue resolution metrics. If used to enhance compliance, the value should be visible in audit efficiency and reduction in regulatory penalties.

By setting clear benchmarks and monitoring both short-term wins and long-term strategic outcomes, financial institutions can ensure their AI investments drive not only efficiency—but competitive advantage.

Our Perspective: How We Help Build the Future of Fintech Operations

Having worked with financial institutions navigating complex transformation challenges, we’ve seen firsthand what it takes to make AI operational at scale. It’s not just about models and data pipelines—it’s about aligning strategy, architecture, and governance to deliver systems that can run continuously, adapt intelligently, and meet the rigorous standards of modern financial environments.

Our experience spans the full lifecycle of AI and ML implementation in fintech—from early discovery and business case validation to full-scale deployment and post-launch optimization. We’ve supported platforms that process millions of transactions per day, integrating intelligent automation into everything from KYC workflows to fraud detection engines. Each engagement is tailored to our client’s operating environment, technology stack, and regulatory obligations.

What sets our approach apart is the ability to work across layers—business logic, cloud infrastructure, data governance, and user-facing systems—while ensuring every solution is production-ready, auditable, and scalable. Our teams combine domain-specific expertise with technical depth, delivering through agile delivery models that prioritize fast iteration and continuous alignment with client goals.

We also bring the benefit of deep compliance and risk management experience. Whether it’s adhering to GDPR, PCI DSS, or regional banking regulations, we build with security and auditability in mind—embedding safeguards and explainability into every layer of the system.

Through strategic partnerships, we stay on the edge of what’s possible—advising not only on how to use AI effectively, but how to design operational ecosystems that are ready for what’s next. Our role isn’t just technical enablement—it’s helping institutions turn operational transformation into long-term competitive advantage. Happy to chat about what’s realistic, not just what’s possible↗.

Subscribe to updates

Source link