Financial intelligence isn’t something we’re born with, but it might be the most important skill we need to develop by the time we become adults and can make informed decisions. We’re incredibly fortunate to live in a world where information flows at the speed of light, giving us access to the knowledge of the best minds out there.

Stock trading has changed the way people think about earning money. No longer tied to a paycheck, anyone can trade without a math degree or a spot on the trading floor. Thanks to the internet and advanced technology, stock trading is now accessible to everyone.

At its core, stock trading is a strategic discipline. It takes dedication, a system, and financial knowledge to succeed and avoid beginner’s mistakes.To make trading easier, brokers and financial institutions offer apps that empower users to learn about trading, trade anytime, anywhere. Eventually, helping them become less dependent on a salary.

If you’re here, you’re probably looking to create a stock trading platform. In this article, we’ll cover everything you need to know about trading app development — how it works, how to profit from it, and the steps involved. We’ll also look at the top apps on the market and what makes them successful, so you can learn from their functionalities and technology.

Let’s dive in!

How does trading apps work?

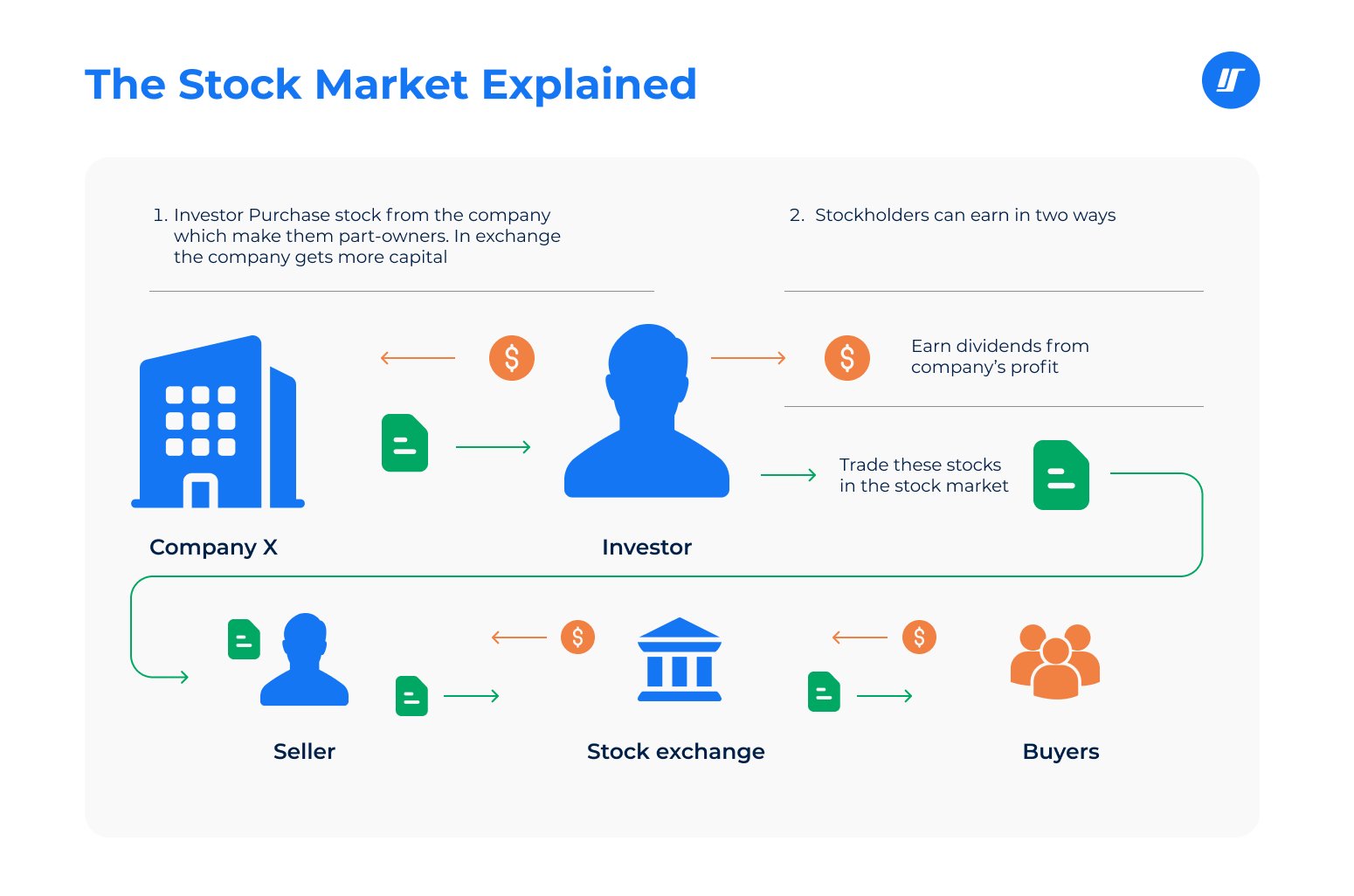

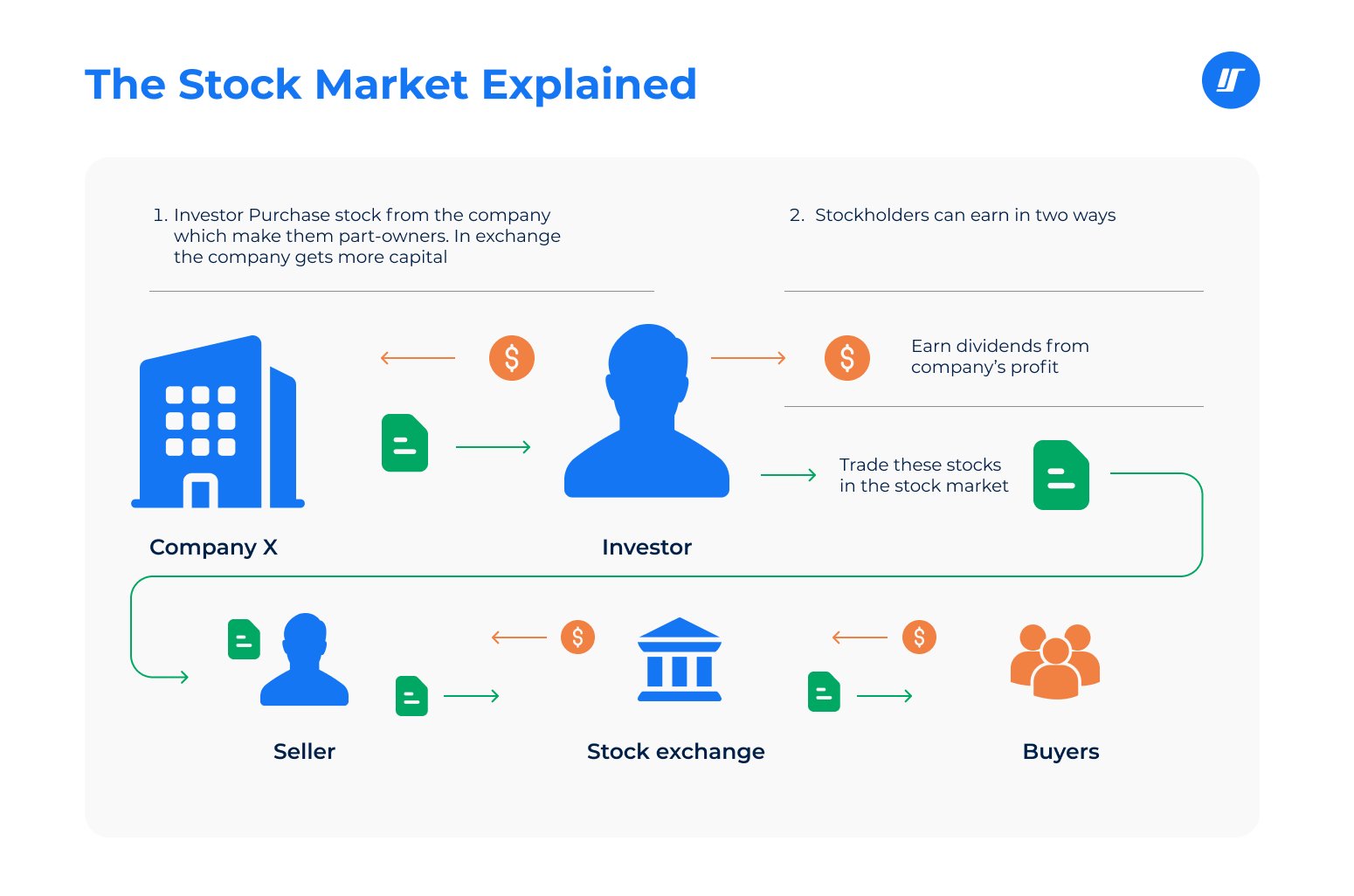

The terms “stock trading app” and “trading platform” are often used interchangeably, and we’ll do the same here. A trading platform is essentially a software application that lets users place trades and manage market positions through brokers or financial institutions.

The first step is to open an account with a broker like Robinhood or Interactive Brokers. Once set up, users can select the type of account they need — such as a registered account, discretionary account (where a manager makes decisions), margin account, or cash account — and choose the products to trade, like stocks, bonds, options, or futures.

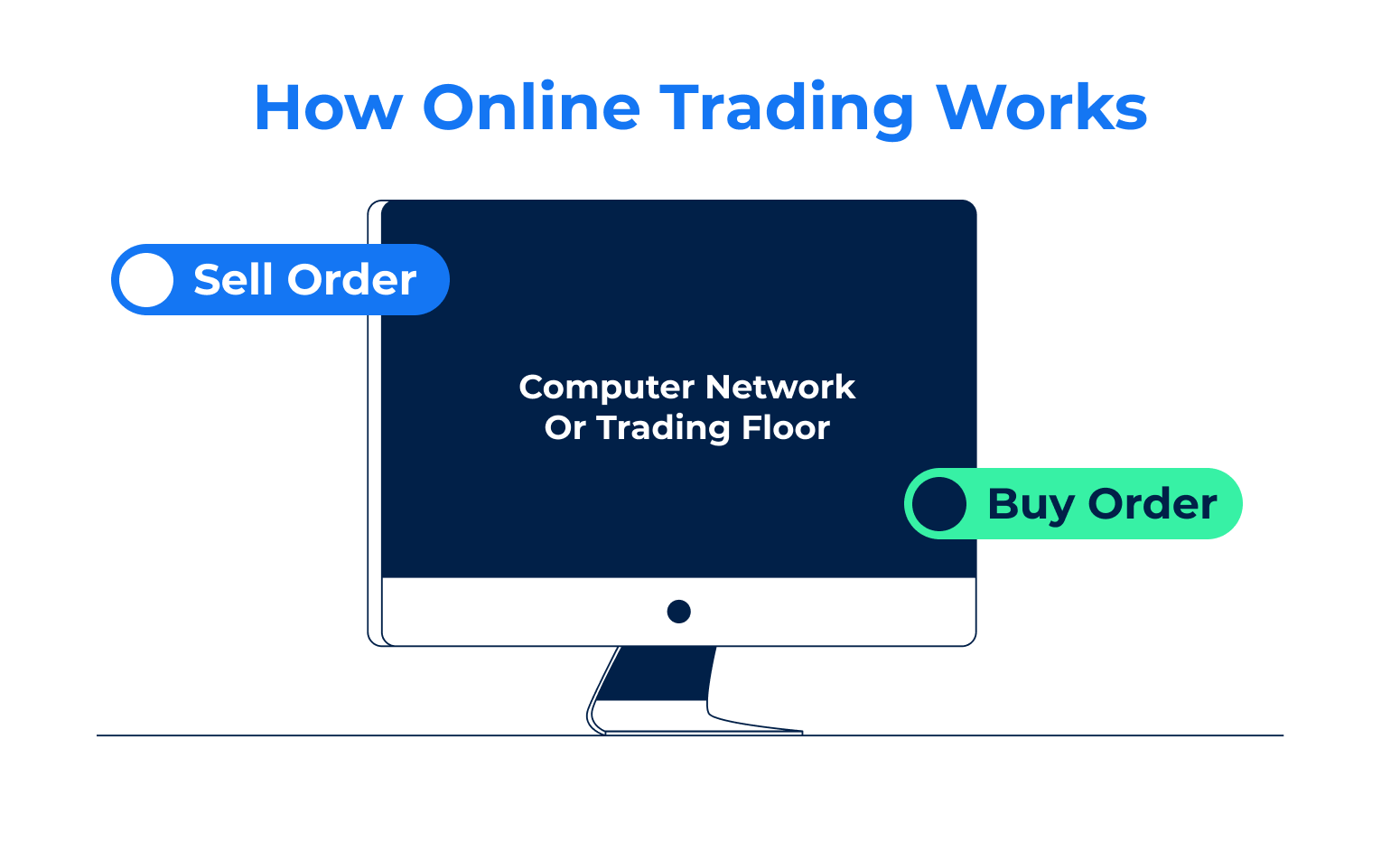

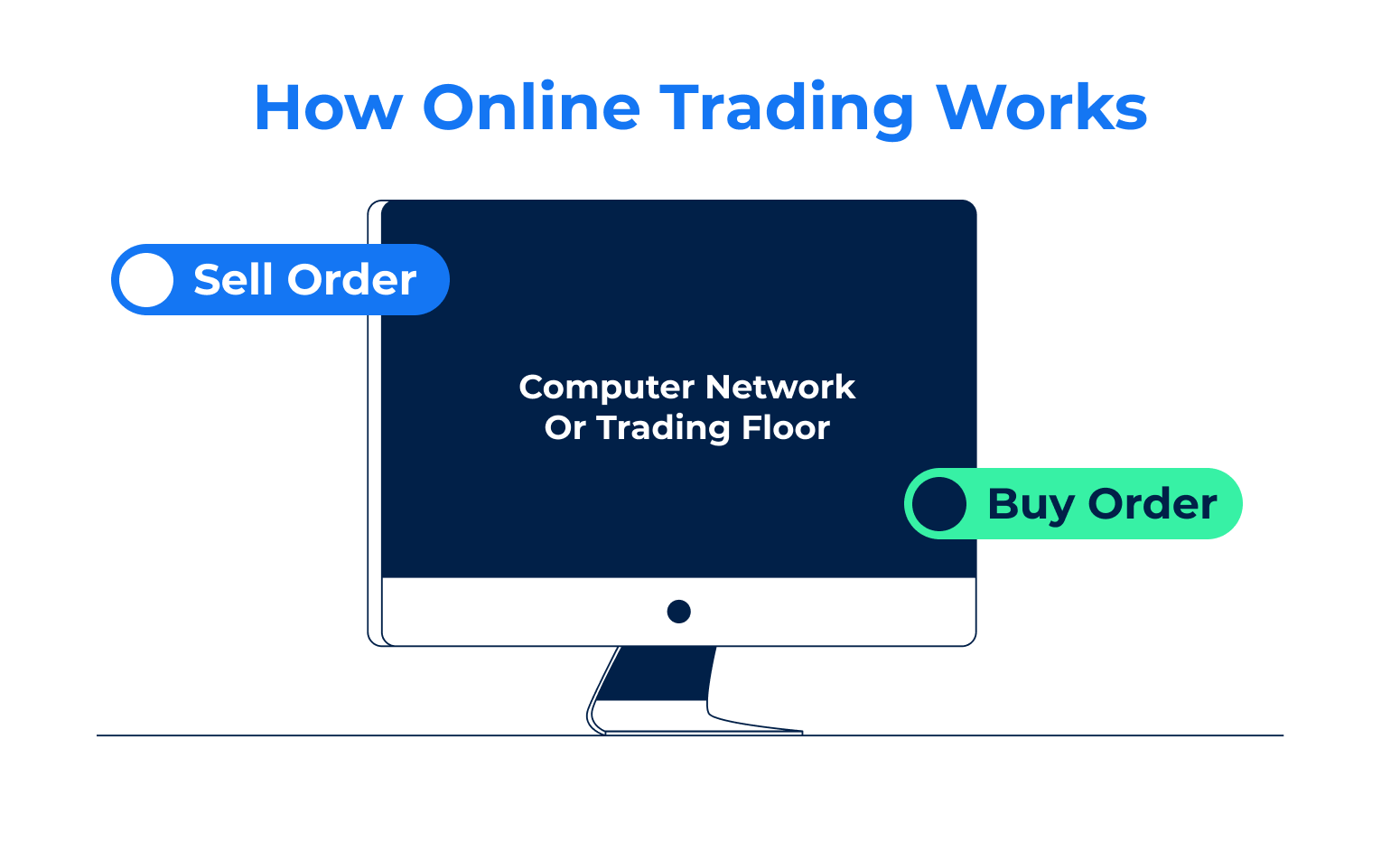

Trading apps function like any other fintech apps, linking a bank account to deposit funds. Then, they’re used to buy and sell financial assets. These apps connect users to major exchanges where they can trade stocks, options, ETFs, and cryptocurrencies.

There are two main types of exchanges: traditional ones like the New York Stock Exchange (NYSE) and NASDAQ, where you can trade stocks and ETFs. And crypto exchanges for trading cryptocurrencies like Bitcoin and Ethereum.

When a user places an order, the app sends it to the exchange, and matches it with a seller. The process can take anywhere from minutes to days depending on trading volume. Most apps charge a fee per trade, either as a flat rate or a percentage. Once completed, the assets or proceeds are added to the user’s portfolio. The funds can be withdrawn anytime.

Main Target Users of Stock Trading Apps

Just like with any product, knowing your audience is key when designing a trading app. The potential user base is diverse, and you can segment them in various ways. Whether it’s their level of experience with trading, the type of investments they prefer (short-term vs. long-term), their profession, or even their wealth — it’s all about understanding who you’re targeting. This depends on your goals, unique offerings, and, of course, the competition. To simplify things, here are the main groups of investors you might want to focus on:

Main Target Users:

Individual Investors / Retail Investors

Retail investors are everyday people managing their own portfolios, ranging from complete beginners to experienced traders. They use these apps to buy, sell, and track stocks, bonds, ETFs, and more. Some may prefer an app with basic features, while others will appreciate advanced tools like charts and reports to guide their investments.

Institutional Investors

Though smaller in number, institutional investors — such as banks, credit unions, and hedge funds—use trading apps to manage client portfolios or trade on the go. They typically look for sophisticated algorithms and detailed charting features to support their work. This group includes banks, mutual funds, venture capital funds, pension funds, and insurance companies.

Additional Audience Segments:

Day Traders

Day traders are fast movers, buying and selling stocks throughout the day to profit from short-term market fluctuations. They need apps with real-time data, quick transactions, and tools for rapid market analysis.

Passive Investors

Passive investors are hands-off users who rely on automated features, AI, or robo-advisors to manage their portfolios. They seek simplicity, with the app handling most of the work for them.

You can also further segment your audience by age, behavior, or comfort with technology. Each group has unique needs and expectations, so understanding your audience is the first step toward building a successful app.

How Trading app make money

Trading apps have some clever ways to generate revenue. Whether through transaction fees, premium upgrades, or other strategies, these apps find multiple avenues to profit while offering valuable services to their users.

Transaction Fees: One of the most straightforward ways trading apps make money is by charging a small fee for each trade. This could be a flat rate or a percentage of the trade value.

Premium Features: Many apps are free to use, but they offer premium upgrades that come with additional offerings like expert advice, advanced research tools, detailed reports, and advanced charting options. These premium features are often available through subscriptions or in-app purchases, giving users the option to level up their trading strategy.

Advertisements and Promotions: Some trading apps bring in extra cash by displaying ads or offering promotions within the app. This is a win-win for the app founders and advertisers who want to reach a specific audience of investors.

Payment for Order Flow: Apps like Robinhood make money by routing customers’ trades through specific market makers, who then pay the app a fee for the business. This allows the app to offer commission-free trading while still generating revenue.

Additional Services:

- Research Tools: Users can dig deeper into the market with access to in-depth analysis and research reports.

- Expert Advice: Some apps offer access to financial experts and analysts who can provide personalized investment advice and insights.

- Advanced Reporting and Charts: For those who love data, advanced reporting tools and sophisticated charts are available to help track and analyze market trends.

- Trading Bots: Some apps offer automated trading bots that execute trades based on pre-set strategies.

- Analyst Ratings: Users can also access analyst ratings and recommendations, giving them a peek into what the professionals think about specific stocks and assets.

In short, trading apps have a variety of smart ways to make money, from transaction fees and premium subscriptions to ads and payment for order flow. They offer a mix of free and paid features, catering to different user needs while ensuring they stay profitable.

Best Stock Trading Apps on the market

We believe it’s always better to learn from someone else’s mistakes rather than our own. Why reinvent the wheel when you can benefit from others’ experiences?

To give you a head start, we’ve pulled together an overview of the top five brokerage stock trading apps. This way, you can get the lay of the land, seeing both the strengths and weaknesses, as well as the targeting strategies used by competitors.

Robinhood

Robinhood is one of the most popular U.S. brokerages, thanks to its easy-to-use app. It offers flexibility with no account minimums, no fees, cryptocurrency trading, fractional shares, and instant access to deposited cash.

Users on Reddit share mixed reviews — many praise its variety of products and convenience, while some experienced traders feel it lacks features like foreign stocks and mutual funds.

Platforms: Web and mobile (iOS and Android)

Interactive Brokers (IBKR)

One of the oldest brokerages, IBKR caters to both casual and experienced traders with three apps, two web portals, and two desktop platforms. IBKR Lite offers commission-free trades on U.S. stocks and ETFs. IBKR Pro provides more advanced tools and access to foreign markets. Some investors may find IBKR’s platform complex for beginners.

Platforms: IBKR Mobile, Client Portal, Trader Workstation

Mobile app: IBKR Mobile (iOS and Android)

TD Ameritrade’s thinkorswim

Thinkorswim remains a top choice, offering access on mobile, desktop, and web. It supports OTC stocks, options, futures, and margin trading, with real-time market data and educational resources. Forbes Advisors named it the Best Investment App for Experienced Investors.

Platforms: TD Ameritrade web and thinkorswim (desktop)

Mobile app: TD Ameritrade and TDA thinkorswim (iOS and Android)

Fidelity

A go-to for beginners and frequent traders, Fidelity offers commission-free trading, no account fees, and extensive research tools. It’s known for its mutual funds, especially its Fidelity Zero index funds, which come with no fees or minimums. Users appreciate the educational resources for both retirement and active traders.

Platforms: Fidelity.com and Active Trader Pro

Mobile app: iOS and Android

E*Trade by Morgan Stanley

E*TRADE is praised for its user-friendly interface and access to educational resources. Beginners benefit from free financial consultations, while experienced traders enjoy Power E*TRADE’s advanced charting tools and options strategies. However, some professional traders feel the lack of a trading journal is a drawback.

Platforms: E*TRADE Web and Power E*TRADE

Mobile app: E*TRADE and Power E*TRADE (iOS and Android)

Stages of Stock Trading app development

We know there’s no one-size-fits-all solution for every client. But over the years of practice, most tech providers have developed solid processes that work for a wide range of needs.

As a tech partner, we offer the following steps to our clients to ensure a seamless and successful app development process — from defining your app’s goals to the final rollout.

Planning

Creating a successful stock trading app starts with defining clear objectives. It’s important to make sure they align with your overall business goals.

Important things to consider:

- Defining objectives

- Correctly segmenting and targeting the right audience

- Conducting competitor analysis

- Highlighting USPs (Unique Selling Points)

- Budget planning (this will help us determine the technology we use and the number of developers we engage in the process)

- Setting a timeline

Here, it’s important to mention that at Intellectsoft, we don’t conduct market research. However, during the planning (discovery) stage, we can assist with analyzing the current state of your software (if you’re looking to modernize or re-engineer existing solutions) and building a roadmap for a new product to kick off your development journey.

Designing

Once we completed the discovery stage, our team creates detailed designs and documentation, making sure the app’s architecture and technology stack are right for your trading platform. We also focus on creating a user-friendly interface that delivers a smooth and enjoyable experience.

Defining

When we receive the documentation and requirements, we’ll define and document the app’s features and functionalities. This step ensures everyone is on the same page and sets the project up for success.

Building

Our experienced developers then get to work, writing code using the selected programming languages, techniques, and methodologies. At this stage, they’ll transform the designs into a high-quality, functional stock trading platform.

Testing

Next, your app goes through testing to ensure it meets all quality standards. We’ll sort out any bugs or issues, ensuring a smooth and secure experience for your users. This stage will give you confidence that the app performs reliably and securely.

Deployment

Once your app is ready, we’ll handle the deployment, releasing it on your chosen platforms (App Store, Google Play). We make sure everything runs smoothly, addressing any potential issues for a successful launch.

Maintenance

After launch, we continue to support your app to ensure it meets your needs and runs flawlessly. We stick to the service level agreement we set at the beginning, keeping your app up to date, secure, and ready for any future improvements or challenges.

Main Features

The world of finance is highly competitive, and financial institutions and brokers are always trying to offer the best to attract new audiences. You may find a wide range of features and functionalities that can be added to your app. It all depends on your budget, timeline, and goals. Some features are simple and quick to implement, while others are more advanced and take more time and integration.

By researching and analyzing what key players are doing, we can highlight the key features you may want to consider. These features can be divided into two categories:

Basic Features:

- Portfolio Management: Easy tracking and management of investments.

- Buy and Sell Stocks: Efficient execution of trades.

- Search Stock: Simple search functionality for finding stocks.

- Easy and Secure Authorization: Secure, hassle-free login process.

- KYC/AML: Ensures compliance with regulatory bodies.

- Onboarding: Smooth process for onboarding new traders.

- Personal Profile: Customizable profiles for users.

- Dashboard: Centralized view of key metrics and performance.

- Payment Options: Secure options for payment processing.

- Sorting and Filtering Tools: Easy tools to filter and sort stocks.

- Push Notifications: Alerts for stock price changes.

Advanced Features:

- Real-time Market Data: Live data feeds to stay updated.

- Stock Scanners: Tools to scan for stocks based on criteria.

- Probability Indicator: Insights into stock movements and probabilities.

- Third-party Integrations: Integration with stock exchanges like NASDAQ and NYSE or market data providers like Bloomberg.

- Newsfeed: Updates with the latest market news.

- Personalized Watch-List: Tracks favorite stocks.

- Journal Trading: Records and reviews trades for future reference.

- Analytic Reports and Research: Detailed reports to analyze performance.

- Expert Consultations: Access to advice from industry experts.

Main Challenges

Here, we want to point out a few important things that any founder should take into consideration. After working with our clients on their fintech products, we’ve identified some key takeaways that may help you plan ahead to overcome challenges or avoid them altogether.

Security

For fintech products, security is the backbone of success. Handling sensitive data like user information, financial details, and trades requires strong encryption, multi-factor authentication, and compliance with regulations like KYC/AML. A security breach can hit hard, leading to financial and reputational damage that’s tough to recover from. That’s why it’s crucial to discuss security with your tech partner early in the process.

Compliance with Regulations

Compliance goes hand in hand with security. Meeting financial regulations and legal requirements across countries, such as KYC, AML, and GDPR, can feel daunting, but it’s essential. Staying compliant helps you avoid legal risks and penalties.

Real-time Data

Delivering real-time stock prices, market data, and news feeds is key for a trading execution. This requires a complex data streaming infrastructure. Delays or inaccuracies can frustrate users and lead to financial losses.

Scalability

Your app needs to handle traffic surges, especially during market swings. Making sure it scales seamlessly without crashing is essential for keeping investors happy.

User Experience (UX)

A user-friendly interface is a game-changer. It’s important to work closely with your tech partner to design an app that meets the needs of your target audience — whether they’re beginners, intermediate traders, or experts. The app should be intuitive, easy to navigate, and packed with useful features. Many users may experience frustration with overly complex UX, so simplicity is key.

Latency

Fast trade execution is what investors value most. Often, lags happen on the server side, not on user devices. Minimizing latency is a challenge, but trades need to be executed in milliseconds to stay competitive. This requires optimized server infrastructure and low-latency data streams.

Cross-platform Compatibility

The app needs to work smoothly across different devices. Balancing consistency and performance across platforms like iOS, Android, and web can be tricky. You’ll need to decide whether to go for native mobile apps (longer and more expensive) or cross-platform solutions (quicker to market and more affordable). Your tech partner will guide you through the solutions that should work best for you.

Testing and Quality Assurance

Thorough testing is key to catching bugs and avoiding crashes, especially during busy trading times. It’s important to check core features like order execution, data streaming, and overall performance to make sure everything runs smoothly before the app goes live.

These challenges might seem obvious, but many apps still struggle with them. Understanding and addressing these issues will bring you closer to building a robust, secure, and high-performing trading app.

Intellectsoft Case Study

Seamless, On-the-Go Trading app

A renowned financial company, with deep roots in capital markets, called for a solution. They needed a platform that allowed their investors to trade fast and provided the tools to stay connected and informed on the go.

We developed an app that tracks real-time stock prices and financial data. With push notifications, users get timely updates so they can make quick, informed decisions. The app also includes a stock finder, personal watch lists, and alerts for price changes to keep investors in the loop.

Our goal in building your stock trading app is to strengthen your ability to deliver excellent services while scaling your business operations. To achieve this, we follow an end-to-end app development roadmap that begins with discovery workshops, progresses to actual implementation, and continues with maintenance and support.

At Intellectsoft, we’ve had over ten years of experience developing high-quality fintech solutions, including platforms and apps for stock trading.

From complex banking platforms to AI and blockchain integrations, and digital wallets – we enable financial institutions to navigate the complexities of modern environments with cutting-edge technology that’s as unique as your Fintech business.

We invite you to take a look at our diverse client and case study portfolios and discover how Intellectsoft can revolutionize your fintech operations.

Get in touch today and speak with one of our experts about your next fintech and stock trading platform.

Subscribe to updates

Source link